An investment shortfall and government inaction are stymying the growth of green hydrogen globally, potentially creating a shortfall by 2030.

That is the key finding of a new report published by the Institute for Energy Economics and Financial Analysis (IEEFA), which has claimed the green hydrogen industry needs to significantly increase its pace in order to meet demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

IEEFA’s Yong Por, author of the ‘Great Expectations’ report, analysed the announcement of 50 new projects announced over the course of the last year to conclude that Europe, Australia and Asia were leading the hydrogen charge, backing the majority of new green hydrogen projects that have emerged.

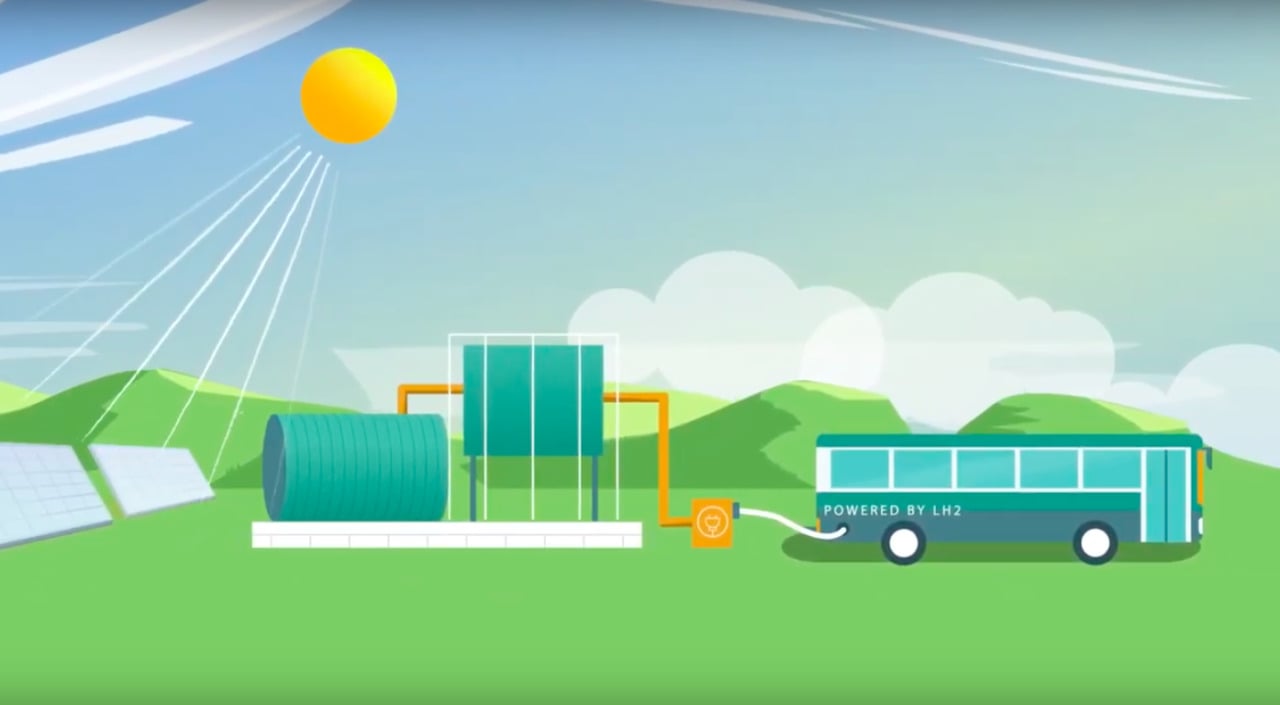

These projects are being supported by improving economics for hydrogen production, falling costs of renewable power and the presence of existing gas pipelines which can be used to transport produced hydrogen to meet more localised demand centres.

But these projects could face delays, Por said, due to ongoing uncertainties surrounding financing, amidst other issues, with the need for more public-private initiatives needed to overcome more specific hurdles. In addition, more significant scale in the manufacture of electrolysers and other associated equipment will be necessary.

“Governments will also need to get behind these new projects and work hand-in-hand with industry as the world transitions away from fossil fuels into cleaner renewable energies,” Por said, stating that green hydrogen stood to be a “key technology enabler” for integrating further renewable power onto worldwide grids.

But government initiatives around the globe have lacked ambition. The report concludes the European Union’s green hydrogen strategy – which wants 40GW of electrolysers to be deployed by 2030, with up to 120GW of new renewable capacity to power them – to be the most ambitious, being the only plan with a “key focus on the long game”.

Australia’s plans for green hydrogen, which is linked to a target of producing hydrogen at AU$2/kg or cheaper by 2030, contains the most ambitious export strategy.

But more is needed to be done, Por said.

“Governments need to urgently back this industry by developing policy settings encouraging private industry to invest the much needed capital, given the industry must ‘learn by doing’,” says Por.

“Until then, we are likely to see project delays as proponents struggle with still absent project viability, evidenced by only 14 of the 50 new projects having started construction with 34 at a study or memorandum of understanding stage.”

A conference session held as part of last week’s Green Hydrogen Virtual Summit, organised by PV Tech publisher Solar Media, reached similar conclusions, with the need for relaxed permitting rules highlighted by panellists as vital for paving the way for the significant quantities of new renewable generation required for Europe’s green hydrogen economy to take off.