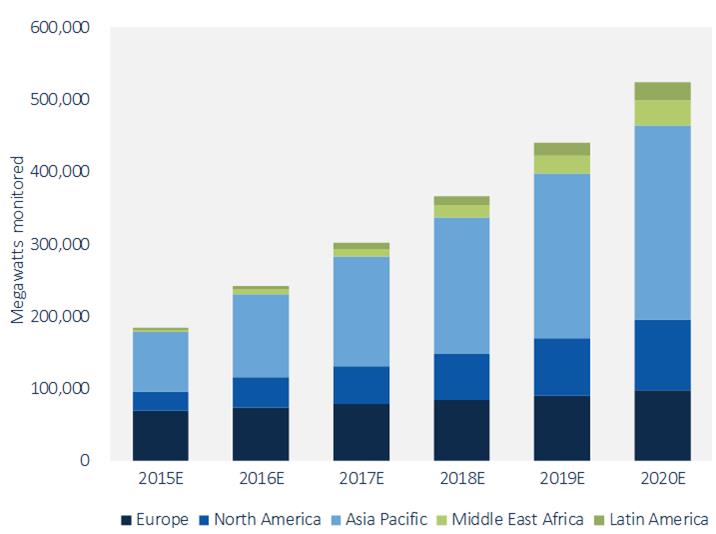

A new report from GTM Research and SoliChamba Consulting sheds new light on the global PV monitoring market.

According to the report, 58GW of monitored PV will be added to the sector in 2016 – bringing the total PV monitoring market to 242GW. In addition to the growing installation base, the PV monitoring market is in the middle of huge changes as it integrates itself into the larger PV software landscape, deals with additional regulatory and cybersecurity requirements and faces challengers from the energy management market.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Due in large part to China’s huge utility-scale segment and Japan’s feed-in tariff backed market, the Asia-Pacific region will make up 56% of the global total. North America stands as the second largest region at 27%, followed by Europe, the Middle East and North Africa and Latin America.

Monitoring vendors are diverse in terms of geography and business models. GTM’s report splits vendors into three segments – independent software vendors (ISVs), power electronics vendors, and downstream solar firms. Globally, of the top ten firms, six are ISVs, two are power electronics vendors and two ar downstream solar companies.

By 2020, GTM Research and SoliChamba Consulting expect the global monitoring market to surpass 524GW.