A new sales initiative from Maxeon Solar Technologies focused on the US commercial and industrial (C&I) solar market will see the company provide its interdigitated back contact (IBC) modules alongside a performance assurance product from Omnidian.

A provider of protection and performance assurance plans for solar systems, Omnidian will bundle one of its plans with commercial systems larger than 250kW sold by Maxeon as part of the tie-up that the pair say will increase bankability for project financing.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Seattle-based Omnidian, which has responsibility for the oversight of more than 1.8GW of US solar capacity, will also facilitate access for Maxeon to its existing US customer base to help expand the solar module manufacturer’s C&I market footprint.

Omnidian’s plan for Maxeon systems above 250kW will include system protection, preventive maintenance, monitoring and a cash-back performance guarantee on up to 95% of forecasted energy.

That guarantee transfers certain solar energy generation risks away from the solar asset owner, including weather risk, the company said.

The combination of Omnidian’s commercial performance guarantee with Maxeon’s solar panels “will enhance system bankability and improve our customers’ return on investment”, said Jeff Waters, CEO of Maxeon Solar Technologies.

The partnership follows Omnidian raising US$33 million in a Series B funding round in September, with the capital earmarked for supporting the company’s international expansion and growth into new asset classes such as energy storage and electric vehicle charging.

The manufacturer of both Maxeon and SunPower brand solar panels, Singapore-headquartered Maxeon missed its Q3 2021 module shipments guidance largely due to global shipping constraints.

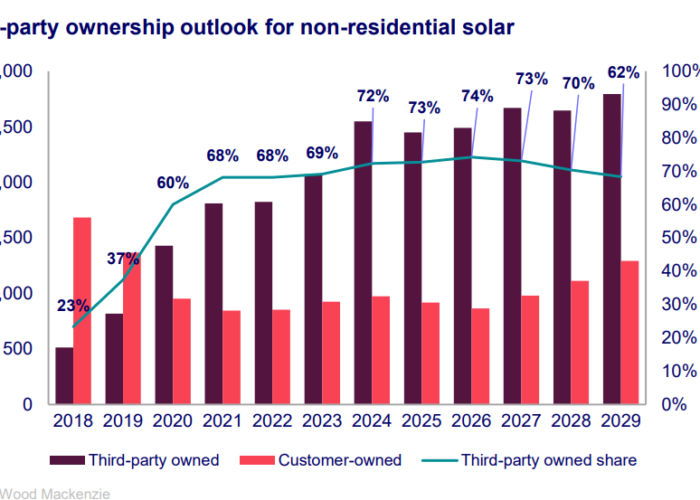

The company’s C&I solar push follows the US commercial solar industry posting a dip in Q3 installation figures compared with Q2, according to research from trade body the Solar Energy Industries Association (SEIA) and research firm Wood Mackenzie. However, they said that supply chain constraints during the third quarter that caused equipment delays mean 2022 and 2023 are expected to be higher growth years for the commercial segment.