The growth of floating PV gloablly and the increase in project sizes has led to the need for lenders to provide financing to support these projects. In such instances, experienced advisors are requested to provide due diligence and to ensure technical risks for the project are highlighted and can be mitigated.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

FPV market evolution

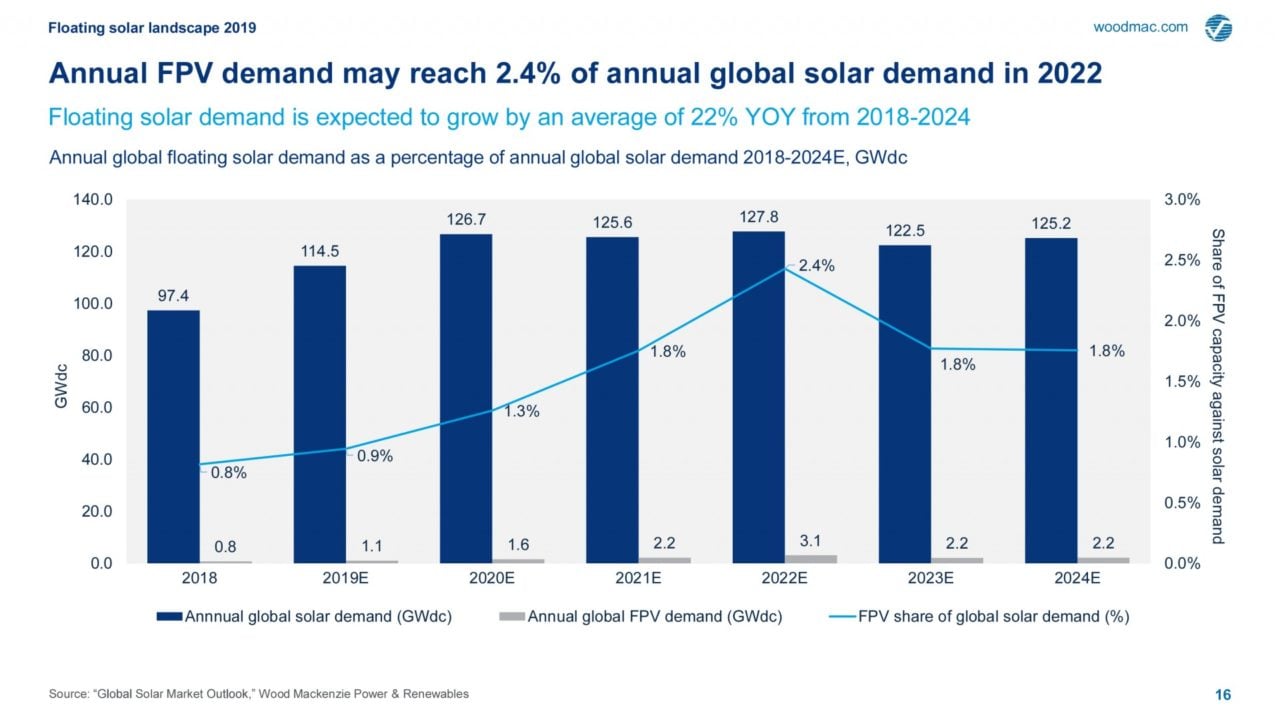

Floating PV as a nascent segment in solar has been gaining momentum globally in the last few years, particulalry in the APAC markets since 2014, and will satisfy just under 1% of annual global solar demand by the end of 2019, and 2% of global solar demand by 2022 [1].

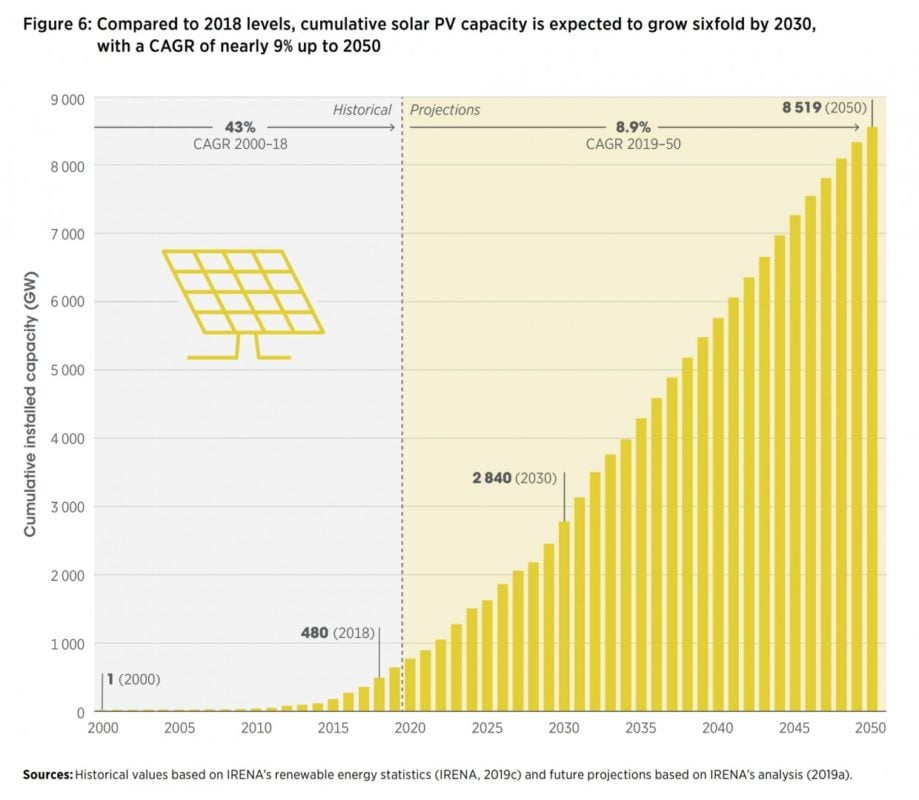

This follows the huge growth in the overall global solar PV market, which grew at CAGR 43% from 2000 to 2018 and will continue to increase at 8.9% CAGR to 2050 [2].

The world’s first floating PV project was a 20kWp system started in Achi, Japan in 2007. From there most FPV projects were small test prototypes of less than 100kWp until mid 2014. The Fukushima Tsunami disaster in 2011 resulted in the Japanese governement shutting down the country’s nuclear plants and creating a new policy and generous feed-in tariff of JPY42 for PV systems [3], and also stimulated the growth of floating PV in Japan [4]. The majority of these projects were smaller in scale at less than 2MWp, enabling developers to build them on equity and without requiring non-recourse project financing.

Therefore, many of these early floating PV projects built in Japan at that time will not have undergone a very rigorous due diligence. The other large market taking off was China nearly at the same time in a parallel trajectory but there the projects were not small but much larger in size of up to 40MW and these were developed and built mostly by the local floating system suppliers and then sold to the local utilities after construction and when operating. These projects were also built not with non-recourse project financing but fully on equity.

Interest in floating PV grew because the traditional areas where PV was built on land became more difficult and challenging; increasing land pricing, complexity of multiple land ownership, permitting and regulations on land use changes made floating PV on water bodies a more viable option to consider.

Growing need for project financing

With a growth of larger projects in the APAC region there becomes a need for developers to look at lenders to provide financing; with that, proper technical due diligence also becomes a neccessity from the lenders to help assess the technical risks associated in the technology, design, construction and operational aspects of the floating PV project.

Site assessment

An on-site assessment is critical to gain an appreciation of the actual site conditions. Having such in-situ measurements during the plant design phase will provide a more accurate forecast of the energy resource, good understanding of terrain conditions and identify key potential issues that can be mitigated early on. For a large floating PV project, where the majority of the PV plant will be on the water, one of the main challenges is to identify the conditions below the water surface, which is not possible with just a visual inspection.

Bathymetry and topography surveys

A bathymetry survey is performed to map out water depth variations across a project site and provide a perspective of the underwater terrain of the water bed. For a bathymetry survey at inland water bodies, a portable single beam echo sounder may be mounted over the side of a boat. For large water depths and extensive survey areas or nearshore/offshore, multi-beam echo sounders operated from a dedicated vessel are most suited. The bathymetry survey is complemented by a topography survey of the land area to cover locations for transmission facilities and any anchoring at the banks.

This is an extract of an article first published in Volume 24 of PV Tech Power. The full article can be read here, or in the full digital copy of PV Tech Power 24, which can be downloaded via the PV Tech Store here

References

[1] Cox, M., 2019. Floating Solar landscape 2019, s.l.: Wood Makenzie Power and Renewables & Cox, M., 2019. The State of Floating Solar: Bigger Projects, Climbing Capacity, New Markets.

Available at: https://www.greentechmedia.com/articles/read/the-state-of-floating-solar-bigger-projects-and-climbing-capacity

[2] International Renewable Energy Agency, 2019. Future of Solar Photovoltaic: Deployment, investment, technology, grid integration and socio-economic, Abu Dhabi: International Renewable Energy Agency.

[3] Anon., 2012. Japan Approves Feed-in Tariffs. Available at https://www.renewableenergyworld.com/2012/06/22/japan-approves-feed-in-tariffs/

[Accessed July 2020].

[4] Laboratory., D. R. E., 2019. Great potential for floating solar photovoltaics systems. Environmental Science & Technology, 8 January.

Authors

Jeremy Ong is DNV GL’s regional solar segment leader for APAC. He graduated with a B.Eng (Hons) in civil and environmental from the University of Edinburgh, Scotland. He has worked in the solar industry since the start of 2008 and has >6.5GWp of utility-scale PV and >2GW of FPV project experience, covering technology qualification, FPV supplier benchmarking, technical due diligence, preliminary designs, bankability reports and factory audits. He has strong technical and operational experience building the project execution and O&M teams in APAC in Singapore, China, Korea, India, Taiwan, Philippines, Thailand and Australia.

Ken Tay is a senior renewables analyst for DNV GL. He has been working in wind energy research for more than seven years, focusing on mesoscale and LES modelling of wind climate for offshore wind applications. He has a Bachelor degree in aerospace engineering and a PhD in sustainable earth from Nanyang Technological University (NTU), Singapore and has worked on a number projects in onshore/ offshore wind, including energy and production assessment, site conditions assessment, resource measurement and monitoring campaigns, project technical due diligence.

Harald Hammer is a solar consultant for DNV GL Renewables Advisory. He has been working in the solar industry for six years focusing on energy assessments, engineering and technical due diligence. He has eceived a Bachelor degree in renewable energy from the Norwegian University of Life Sciences and a MSc in renewable energy from Murdoch University in Perth, Australia. He has worked on several floating PV projects including technical due diligence, site conditions assessment, energy yield assessments and monitoring campaigns