‘Silicon Module Super League’ (SMSL) member Hanwha Q CELLS reported inline second quarter revenue but margins continued to be impacted by declining average selling prices (ASP).

Although Hanwha Q CELLS management had previously said that the company was attempting to broaden its sales and product mix to mitigate market risks of being overly dependent of sales generated from the US and China, its regional sales mix in the second quarter highlighted that US customers were stocking piling modules ahead of the looming ‘Section 201’ trading case.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Shipments to the US accounted for around 40% of total shipments in the second quarter, while China accounted for 25% of shipments. The company allocated more modules to the US, impacting shipments to Europe, which accounted for 15% of shipments. The company does not provide quarterly shipment figures or detailed geographical shipment breakout.

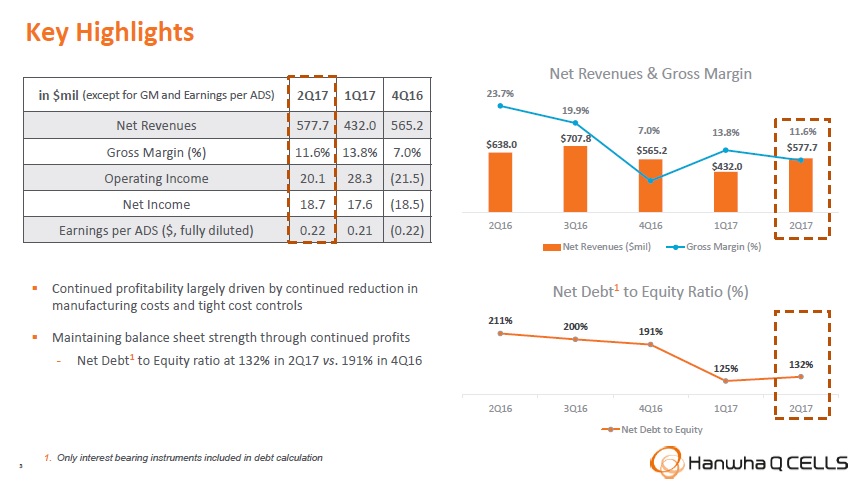

Hanwha Q CELLS reported net revenue in the second quarter of 2017 of US$577.7 million, compared with US$432.0 million in the first quarter of 2017.

Gross profit in the second quarter was US$67.2 million, compared with US$59.8 million in the previous quarter. Gross margin was down to 11.6%, compared with 13.8% in the first quarter of 2017 and 23.7% in the second quarter of 2016, due to continued ASP declines.

Operating income was US$20.1 million, compared with operating income of US$28.3 million in the previous quarter. Operating margin in the second quarter was 3.5%, compared with 6.6% in the first quarter of 2017.

“Our second quarter results were in-line with our guidance and we are pleased to report that we are continuing to realize profits despite uncertainties in some of the major solar markets around the world,” said Seong-woo Nam, Chairman and CEO of Hanwha Q CELLS. “We focused on expanding our footprint in markets with favorable conditions in response to the constantly changing market dynamics.”

“Our 60 cell mono-PERC module, Q.PEAK, with output up to 305 Wp, continues to be well received in the residential market worldwide and is continuing to strengthen our competitiveness throughout all market segments,” added Nam.

Guidance

Hanwha Q CELLS said it expected third quarter revenue to be in the range of US$540 to US560 million, slightly down from the second quarter of 2017.

However, Hanwha Q CELLS reiterated that it still expected total module shipments in 2017 to be in the range of 5,500MW to 5,700MW.

Management noted that it would launch a new 72-cell mono-PERC module with output up to 365Wp in the second half of the year.