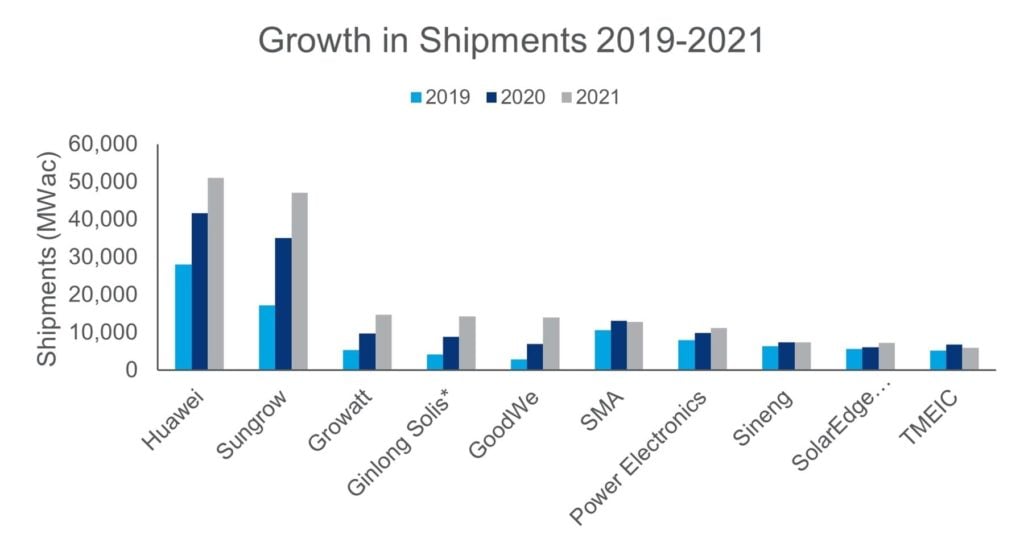

Huawei and Sungrow have maintained their leadership of the solar inverter market for the seventh year in a row, according to Wood Mackenzie.

Total inverter shipments reached 225,386MWac last year, Wood Mackenzie’s 2021 inverter market tracker has revealed, a 22% increase from 2020 which was primarily driven by strong growth in Europe, India and Latin America.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Chinese manufacturer Growatt finished third in WoodMac’s ranking, with the top three accounting for more than half of all solar inverter shipments last year. Huawei and Sungrow remain, by some distance, the largest suppliers accounting for 23% and 21% of shipments respectively, with Growatt a somewhat distant third with 7% market share.

Moreover, the 10 best sellers in 2021 increased their market share by two percentage points to 82% of the market last year.

Annie Rabi Bernard, research analyst at Wood Mackenzie, said: “Despite soaring raw material prices, supply chain challenges and delayed constructions, global PV inverter shipments continue to rise. Leading vendors have become bigger, and the top players continue to consolidate market share in 2021.”

Other notable changes in the top ten ranking include GoodWe gaining four positions to end 2021 in fifth place due to large shipments in the Asia Pacific region, notably in China and South Korea.

The company has registered the highest growth in shipments since pre-covid, with a near five-fold increase between 2019 and 2021.

SMA fell three positions to sixth last year as felt the effects of a shortage of electronic chips throughout the year, while SolarEdge entered the top 10 list, finishing ninth, due to its strong presence on the European market.

Region-wise, Asia Pacific accounted for more than half of solar PV inverter shipments in 2021, with 116,064 MWac as China, India and Australia accounted for the increase in demand.

Meanwhile Europe has increased its growth by 52% year-on-year, with 50,770MWac inverter shipments in 2021 and accounting for 23% of the global market.

Growth in demand from Germany, Italy, the Netherlands and Poland contributed to Europe’s significant increase between 2020 and 2021.

It was a different picture for the US, however, which saw a slight reduction of 360MWac in inverter shipments last year due to supply chain issues, increased cost of raw materials and rising costs for developers. Its global market share accounted for 14%.