The co-location of renewable generation and energy storage demands new contractual arrangements to make such projects commercially viable. Jack Rankin, Miguel Valderrama and Brian Knowles of Pexapark explore how hybrid PPAs are becoming a favoured solution for structuring deals that capture the full value of both assets.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In the world of power infrastructure, we may broadly define “co-located” assets as those that share a single connection to the grid. Although various co-location schemes could be devised in this context, there is one which has gained great relevance in recent times: the co-location of renewable energy generation (RES) – especially solar PV – and battery energy storage systems (BESS). Indeed, the combination of two asset classes traditionally viewed as stand-alone may offer a plethora of advantages, for example optimising output and minimising losses through complementary dispatch profiles, slashing project costs thanks to equipment sharing, or simplifying administrative procedures by amalgamating permit applications.

However, for all the potential benefits that co-location can bring, trying to combine two complex assets in a way that is both technically and commercially viable poses a wide array of challenges: What is the optimal use case of the hybrid set-up? What’s the optimal revenue stream strategy when there are competing interests between the two assets? How does the industry model a cost-benefit analysis to evaluate an investment decision?

Such questions demand sophisticated support and Pexapark, as a specialised advisory and enterprise software provider for the energy transition, has been at the forefront of raising awareness, generating knowledge [1], and facilitating watershed deals in this space. Notoriously, in June of 2023, the UK’s first unsubsidised and bankable solar-plus-storage off-take agreement was signed.

In this transaction, Pexapark advised DIF Capital Partners (asset owner and seller) in analysing, structuring, and executing a deal with Engie (acting as buyer and storage optimiser) combining a power purchase agreement (PPA) and a battery optimisation agreement for a co-located 55MW solar farm and 40 MW/80 MWh BESS in Leighton Buzzard, Bedfordshire, providing clean energy and secured revenue across the solar and BESS over a 10-year term [2].

Following such landmark, we continue helping our clients in a number of ongoing transactions that explore diverse contracting models and continue pushing the boundaries of renewable-plus-storage co-location. Drawing on all this experience, this article will attempt to give readers a high-level explanation of what hybrid PPAs are and how they can be arranged and priced in practice. We also include some important notes on risks associated with PPAs, technical aspects of co-location, and markets of interest.

Notes on risks and renewable energy PPAs

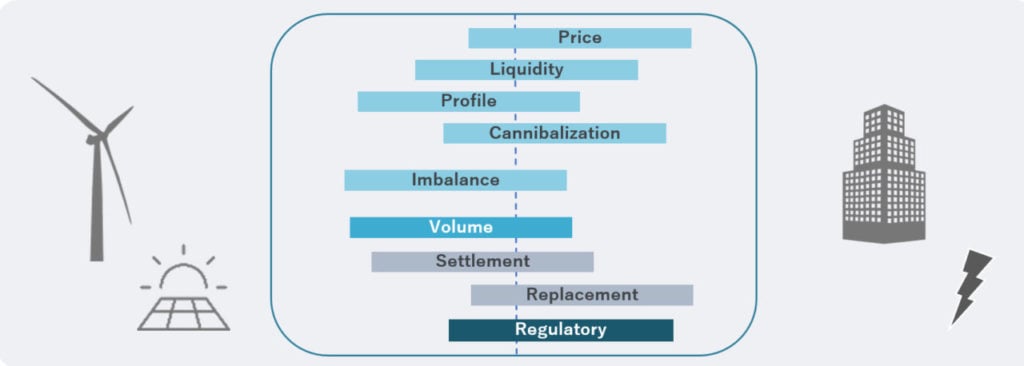

As the subsidy mechanisms that were initially put in place by governments to spur the growth of RES generation become less ubiquitous, and RES technologies have themselves matured, experienced significant cost reductions and ultimately become more competitive, PPAs have turned into a commonplace market mechanism to address different actors’ needs: developers’ and lenders’ wish for higher long-term revenue certainty allowing projects to become bankable, consumers’ desire to procure clean energy and certificates that satisfy their sustainability goals, and so on. How these needs are effectively addressed by a PPA will come down to the way in which the parties agree to distribute risks. Without going into detail about each specific concept, Figure 1 lays out the main risks that parties in a PPA would typically want to consider and assign.

As it is well known, non-conventional RES generation such as solar and wind is intermittent and thus its output cannot be managed to respond to market signals.

For a merchant RES asset, there is a risk that when the sun is shining or the wind is blowing and the asset is injecting power into the grid, market prices may be low due to an abundance of generation (broadly speaking, this is known as the profile cost). This risk could be hedged through a PPA under a classic pay-as-produced (PaP) volume structure, in which the buyer takes over the risk of the intermittent generation profile and commits to purchasing all or part of the seller’s output (regardless of when it is produced) for a fixed long-term price.

But what if the buyer demands higher certainty around the profile and associated volumes of energy they will commit to purchase or applies a significant risk discount to take this profile cost and cannibalisation risks associated with it? Then the seller might consider offering a baseload structure where the profile is fixed for a given period. Although a baseload PPA may command a price premium over a PaP structure, it exposes the seller to uncertain market prices in times when its generation output is higher or lower than the baseload hedge.

All in all, contractual hedges are a tried-and-tested mechanism to manage risk in the post-subsidy RES world. Nevertheless, contracts can only go so far. When RES generation owners consider further ways to optimise the performance of their assets, BESS is now more present than ever not only as a stand-alone asset with an independent business model, but as the complementary physical hedge that can fill in some of the missing pieces left by traditional PPA structures.

Technical renewable-plus-storage setups

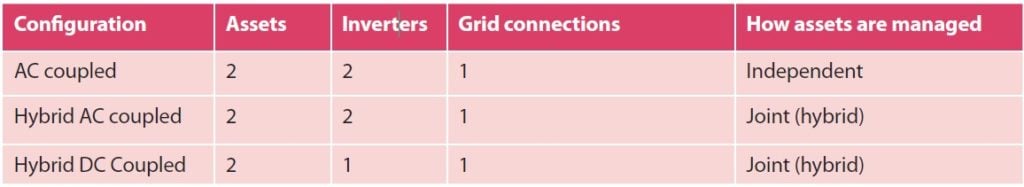

Putting two assets on the same site does not necessarily mean that there’s a single way of operating them. In the case of renewable generation co-located with a battery, Pexapark’s research suggests there are generally three setups found in the market today, as set out in Table 1.

The key point to keep in mind here is that the chosen configuration is likely to impact the contractual structures that the co-located project may adopt. Therefore, selecting one of these setups should be a process that analyses them from multiple angles, not just a technical perspective. It is fair to say that Pexapark’s early-stage quantitative and contractual support has proven critical for the design and future commercial viability of our clients’ projects.

What are hybrid PPAs?

The value of flexibility, not only for individual assets, but for the entire electricity system is widely recognised. On one hand, the ability to bid into the market and deliver grid services contributes to tangible ‘value creation’ for storage assets. On the other hand, ‘value capture’ is the tough job of tapping such value and converting it into realised revenue. This is where tools like optimisation agreements and hybrid PPAs fall into place.

From a traditional stand-alone perspective, BESS assets tend to focus on accessing grid-level revenue streams that a given market’s operator may offer, such as providing capacity, balancing energy, or ancillary services, as well as wholesale energy trading. As the stand-alone energy storage concept matured, market players started looking at such assets from a complementary angle, that of co-location.

Asset-level opportunities are centred around the idea that storage is primarily improving the performance, and therefore investment returns, of renewables through mitigating the risks deriving from their inherent intermittent nature. Profile shaping comprises a prime example, tackling the effects of cannibalisation in spot markets.

The latest mega trend in the renewables-plus-storage sphere is on hybrid PPAs, where several different contractual arrangements may be found. So, what is a hybrid PPA? For Pexapark, it is a contractual arrangement leveraging benefits both for the grid- and asset-level, only available to co-located assets. With a hybrid PPA, the idea is to get the best of the two worlds: potentially generate revenues through grid services, while improving the investment returns of the renewable asset.

The first financial-benefits touchpoint of considering co-locating a renewable asset with storage is the cost savings from the shared grid connection. Such cost savings, as well as saturation in the ancillary service markets, increased cannibalisation risk for renewables, and volatility in the wholesale markets incentivising profile shaping of intermittent renewables, comprise factors driving market players to explore the co-location model overall.

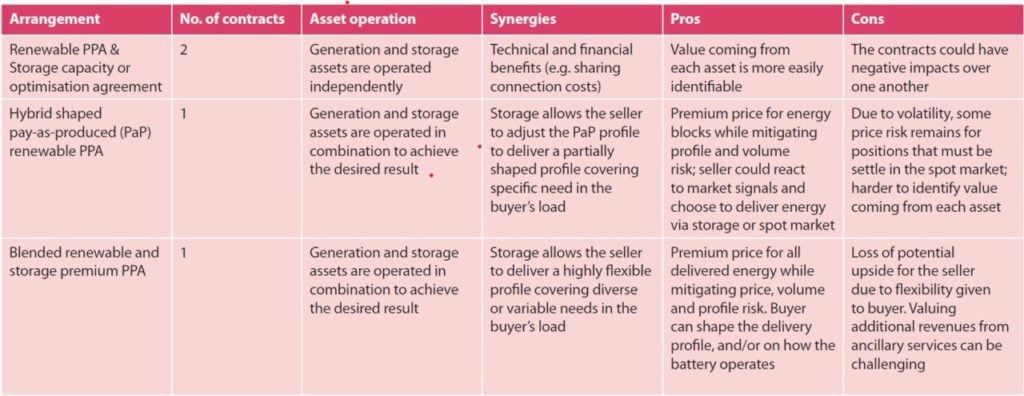

The maturity of tangible contractual arrangements and the emergence of hybrid PPAs make the co-location consideration even more attractive. How the two assets will communicate will be dependent on the contractual details. With a hybrid PPA, it’s possible to have a physical asset to manage the different types of PPA structures, practically turning storage into a physical hedge to complement the financial hedge of the renewable asset. At the same time, another option would be for the two assets to operate virtually independently, with a renewable PPA for the generation, and an optimisation agreement for storage. Or, adding a price premium to the energy produced from the renewable asset by valuing-in the flexibility which allows better risk management of the energy.

Bearing in mind the above, Pexapark’s view is that the arrangements set out in Table 2 are currently available.

At this point we should also mention certain potential costs of co-location: co-location could lead to the constraints of one part of the system, and, depending on the type of physical coupling, may reduce ancillary service revenues available to the BESS. Hence, understanding these interplays is key for making sound investment decisions in co-located assets and structuring the right contractual arrangement to satisfy the project’s goals.

Hybrid PPA pricing

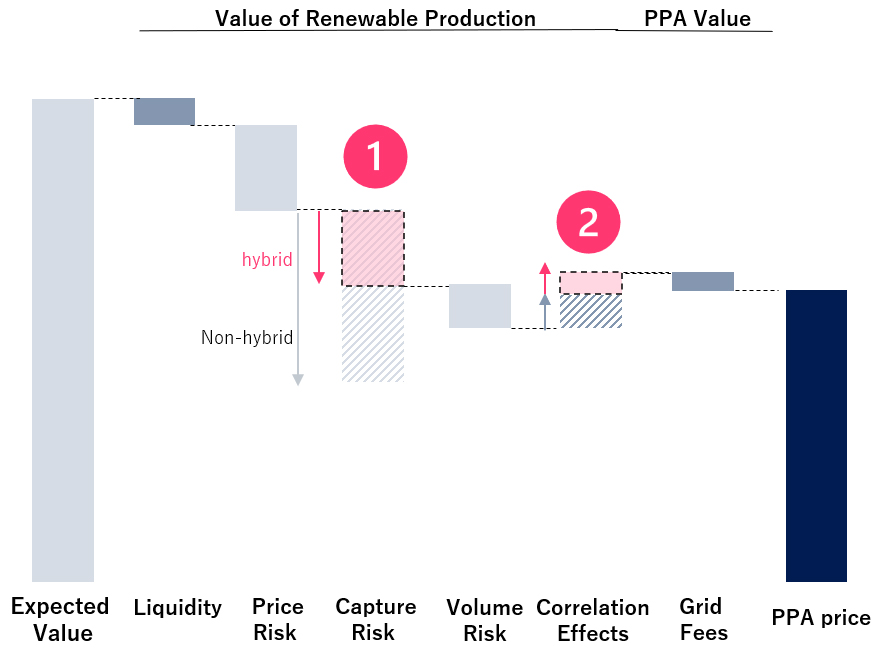

Pricing a hybrid PPA is usually less straightforward than pricing a conventional PPA. In this section, we illustrate this considering a hybrid shaped PPA (see the third type of arrangement in Table 2), for which we need appropriate granularity to understand how both assets’ complementarity will play out and subsequently estimate the value of profile shaping. Pexapark’s hybrid PPA pricing uses hourly forward curves, where we model the behaviour of how renewable generation and storage operate together and determine what is the value of that profile resulting in a premium PPA price. It’s a valuation tool to bring transparency into the hybrid project’s pricing after profile shaping.

Certainly, energy storage is among the prime physical tools to mitigate capture risk, because through profile shaping the storage element can shift the power delivery to slots when the energy is needed the most. Likewise, through the addition of a physical hedge, the timely reaction to daily pricing patterns not only results in reduced profile costs, but such costs could also become profile benefits.

Figure 2 illustrates the series of elements that go into the hybrid shaped PPA pricing process for a given renewable generation asset, highlighting how the addition of storage could reduce the negative price impact of capture risk and contribute a positive correlation effect between volume and price, ultimately leading to a higher PPA price than that which would be obtained from the stand-alone renewable asset.

In addition to the above, we should also keep in mind that the pricing impact on the hybrid PPA is not only limited to the energy generation level. After the impact of improved capture risk and reduced profile costs, additional revenue from ancillary services can become part of the PPA price or perform a separate valuation process.

Hybrid PPA markets

The British energy storage market is currently the largest and most sophisticated in Europe, largely owing to a welcoming environment for stand-alone BESS that can access a plethora of innovative regulated grid services, balancing services and the capacity market, as well as wholesale trading. Capital providers have gradually become more comfortable with financing batteries and many players are flocking towards these assets.

Hence, it is natural that the British market is leading innovation in the storage space, including co-location and hybrid PPAs. One signal is that the volume of hybrid solar projects seeking approval substantially outgrew that of stand-alone projects (according to Pexapark research, these figures stood at 3.4GW and 921MW respectively, as of Q1 2023).

Another signal is that the first hybrid PPA transactions in Europe have been closed here, with the latest publicly announced example being the DIF-Engie deal referenced in this article’s introduction, where Pexapark was DIF’s adviser. Outside of Britain, markets for co-location and hybrid PPAs are less advanced at the moment but we can find promising signals in several countries.

One of these signals is increasing cannibalisation in markets with high renewable penetration of renewable generation. This is something we are already seeing in countries such as Spain, Germany, and the Nordics [3].

Spain currently hosts more than 19GW of installed solar capacity, with several thousands more in the pipeline (especially after a recent government push to disentangle recurring permitting bottlenecks) and this has led to an already visible price cannibalisation effect. For instance, in April of 2023 Spanish solar capture factors reached all-time record lows at nearly 0.6. Likewise, in Germany the solar capture factor fell to 0.6 in May of 2023. In the Nordics the same issue is present, although rather than solar it is linked to the widely deployed onshore wind generation, whose captor factors have reached record-low levels (even to a point of 0.36 in Finland during September).

To add salt to the wound, many offshore wind projects in the Nordics sit on baseload PPAs, so their need to cover their contractual shortfalls with expensive energy in the market has led to numerous cases of serious financial distress. In all these markets, hybridisation is becoming a growing trend, with developers seeking to add co-location to both new and existing projects (retrofitting), as the physical hedge of storage can greatly help mitigate the impact of cannibalisation. It is only natural that with a larger co-located BESS deployment, more opportunities for hybrid PPAs will start to appear.

Finally, in addition to the cannibalisation factor we may find other drivers for co-location growth that could signal an uptick in hybrid PPA activity. One of these drivers is Germany’s innovation auctions. The country was the first to hold government-backed auctions for hybrid projects, with solar-plus-storage having swept more than 1GW of the awarded capacity. Due to the merchant element included in the partial subsidy scheme, such hybrid assets could be on the lookout for further contractual arrangements.

In conclusion, we expect that gradually more and more markets will continue to devise mechanisms to stimulate flexibility additions, as this is indispensable in grids with a growing share of intermittent renewables; this in turn will favour the deployment of storage co-location, leading also to a growth in hybrid PPA contracting.

References

[1] Visit www.pexapark.com to find our full report “Renewables-plus-Storage Co-location Trends: Hybrid PPAs and More” (on which the present article is largely based), as well as our upcoming academy sessions on energy storage, power purchase agreements, energy risk management, among others.

[2] For further information on this deal, see https://www.solarpowerportal.co.uk/dif_announces_uks_first_bankable_and_unsubsidised_hybrid_ppa_for_solar/

[3] Our market data and PPA pricing can be found on our platform PexaQuote. To open a freemium account, see https://pexapark.com/pexaquote-freemium/

Authors

Jack Rankin is the regional lead for Pexapark’s PPA Transaction Advisory business in the UK and Ireland, responsible for the origination, structuring and negotiation of a range of Pexapark’s co-located clients projects in GB. Previously, Jack worked as a utility and corporate PPA originator for SmartestEnergy and Centrica. Jack also has experience in M&A and in the energy markets team at a boutique investment bank, advising clients on their off-take arrangements alongside the raising of senior financing for client’s portfolios.

Miguel Valderrama is currently a senior PPA transactions associate at Pexapark. Previously, he was head of business development at CVC Energia, a utility, and associate at LQG Energy & Mining, a consulting firm. He is also a member of the World Energy Council’s Future Energy Leaders (FEL-100) group. Miguel holds an MBA from the University of Cambridge and a Law degree from Universidad del Pacifico (Peru).

Brian Knowles is director of energy storage and flexibility at Pexapark. He has over ten years of development and power markets experience.