India’s rising renewable power capacity could render the country’s 33GW of coal-fired power plants under construction unviable.

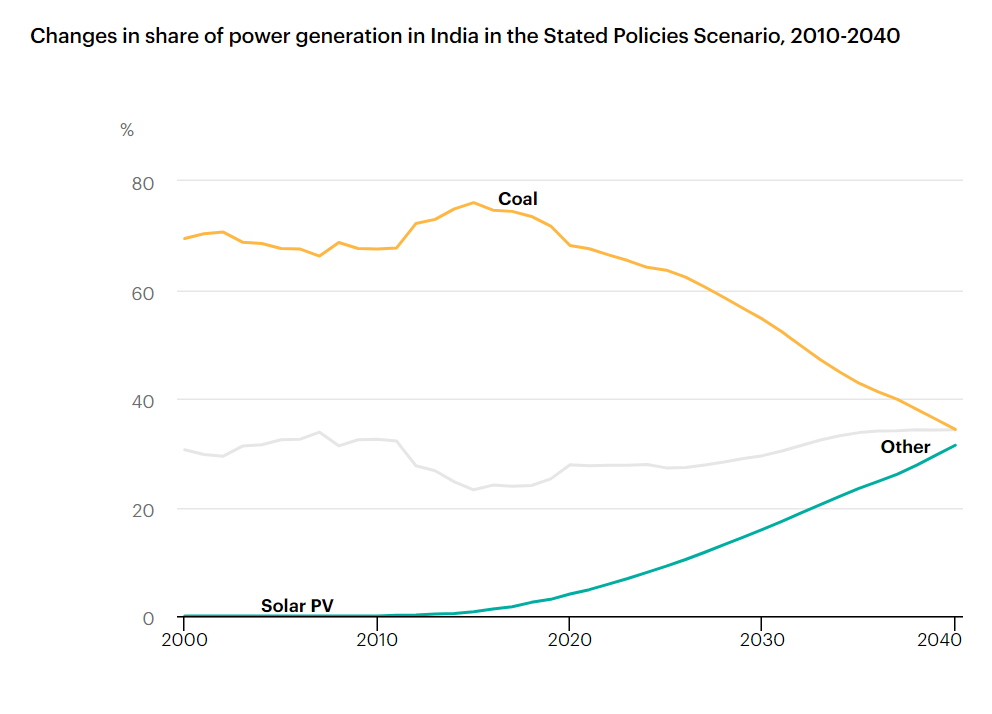

That’s according to new research from the Institute for Energy Economics and Financial Analysis (IEEFA), which states that coal’s current 68% share of India’s power mix will fall to 34% by 2040, while solar’s share will rise to 31% compared with just 4% today.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The institution said there is currently a lack of financing available for new coal-fired power plants in India, which has led to no new plants being announced in the past year, and those that are under development are largely state-owned. IEEFA’s briefing notes that almost half (49%) of the 33GW of coal plants under construction are funded by state power companies, while just 16% of plants are privately funded. Government-owned groups NTPC and NLC India Ltd each own 29% respectively. Additionally, IEEFA states that NTPC has started to focus more on renewable power assets, setting a target of 32GW of clean energy capacity by 2032.

The issue has been exacerbated by the construction delays of the past year. India installed just over 2GW of solar in the first quarter of 2021, up 88% compared with the same period last year and driven by a rush of previous project that had to be delayed, but there has been far less progress in breaking ground on the 29.3GW of pre-construction coal plants, according to IEEFA. On top of this, data from Global Energy Monitor notes that more than 601GW of Indian coal projects have been scrapped in the last decade, while several projects that are under construction have been delayed by COVID-19.

Kashish Shah, research analyst at IEEFA and author of the report, said that future predictions on how India’s power mix will look should take into consideration that new coal-fired power plants “are likely to become stranded assets”.

“The new capacity would only be economically viable if it replaced end-of-life, polluting power plants with outdated combustion technology and locations remote to coal mines.

“Even then, there would need to be sufficient coal plant flexibility to deliver power into periods of peak demand, and the time-of-day pricing would need to be high enough to justify the low over the day utilisation rates.”

India’s Central Electricity Authority (CEA) predicts that the country will reach 267GW of coal-fired capacity by 2030, but IEEFA states this is “highly improbable” given the current challenges the fossil fuel sector faces. The research group expects Indian coal-fired power capacity to peak at between 220GW and 230GW within the next four years.