Market research firm IHS remains bullish on the global solar PV market in 2016, forecasting installations to reach 69GW in 2016.

IHS noted that global PV installations reached 59GW in 2015, a 35% increase over 2014, while growth in 2016 is expected to top a further 17%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Key markets in 2016 will include the US, India and China, which are forecast to increase by 5.6GW, 2.7GW and 0.9GW respectively, accounting for 9.3GW of the 10GW global increase.

Cumulative PV growth

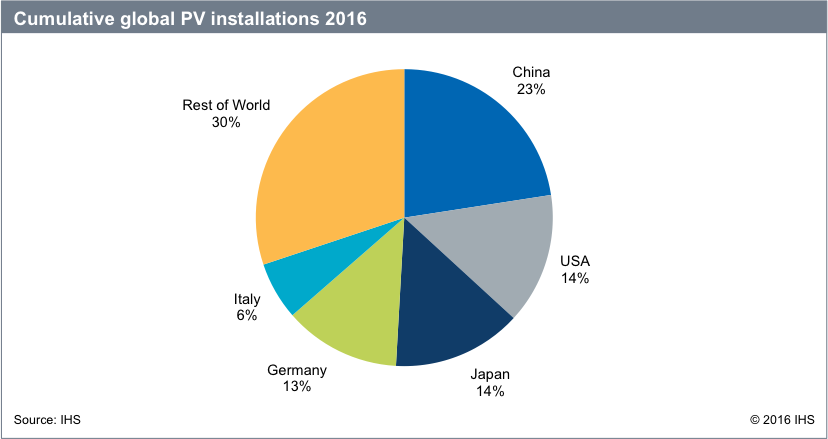

Due to the continued growth of major markets outside Europe, IHS said that it expected cumulative global PV installations to surpass 310GW by the end of 2016, with five countries (China, US, Japan, Germany and Italy) accounting for 70% of capacity.

IHS said it expected Germany to fall from second to fourth place in terms of total installed PV capacity as both the Japan and USA overtake it on the back of continued strong growth. Earlier this year Germany lost its number-one spot to China in the cumulative solar capacity leader board.

Market Dynamics

With continued strong PV demand expected in 2016, IHS said it expected more stable PV module pricing with ASPs declining less than 5%, the smallest year-over-year decline recorded by the market research firm.

The small ASP decline would also support higher industry average gross margins, which could reach 22% in 2016.

“A continued stagnation of major European PV markets due to weaker financial incentives has caused PV additions in Europe to slow dramatically in recent years, but global demand remains strong,” said Josefin Berg, senior analyst of solar demand for IHS Technology. “The supply chain continues to benefit from a period of relatively stable pricing, and there could be a new wave of capacity expansions.”

IHS's estimate of 2015 installs is in line with previous figures from GTM Research in the US. However, its 2016 forecast is a 5GW higher than GTM's 2016 forecast of 64GW.