Indian domestic solar module manufacturing capacity has exceeded 100GW, up from just 2.3GW in 2014, according to energy minister Pralhad Joshi.

All of this capacity is listed under the Approved List of Models and Manufacturers (ALMM), a list of largely Indian-based manufacturers whose solar products are eligible for use on government-supported projects.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The government has sought to expand Indian domestic manufacturing capacity in recent years – adding over 25GW of new module capacity alone in 2024 – and Joshi attributed this growth to policies such as the Production Linked Incentive (PLI) scheme, which incentivises industrial manufacturing in India.

“We are building a robust, self-reliant solar manufacturing ecosystem,” said Joshi. “This achievement strengthens our path towards Atmanirbhar Bharat [‘Self-reliant India’] and the target of 500GW non-fossil capacity by 2030.”

The ALMM was first introduced in 2019, and expanded to cover the solar module space in March 2021. In the last four years, the number of ALMM-registered manufacturers has grown from 21 to 100, operating 123 separate manufacturing facilities.

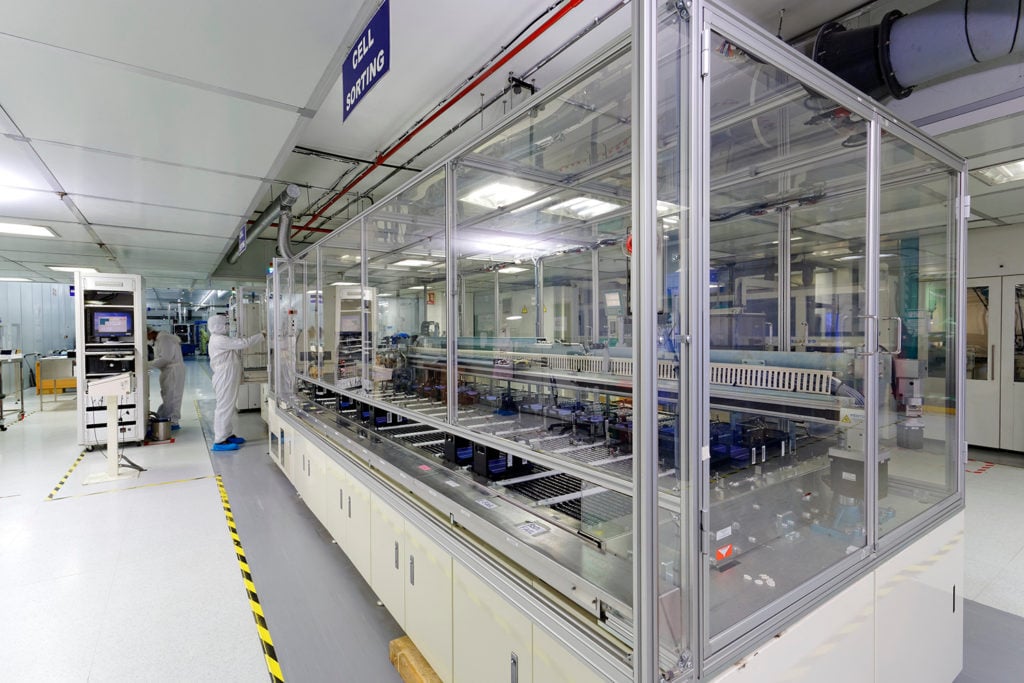

Despite this growth in module manufacturing capacity, upstream manufacturing capacity has lagged behind, leaving India reliant on imports of cells and wafers from overseas, most notably China. Cell and wafer manufacturing are more expensive and complicated processes, which take longer to establish.

This week, an Ember report found that, between January and June this year, India’s monthly imports of Chinese cells and wafers had increased.

Earlier this month, India updated its ALMM to include solar cell manufacturers, adding six companies with 13GW of annual cell manufacturing capacity. The country had already nearly trebled its cell manufacturing capacity in the 12 months to March 2025, and sustaining this growth through the support of the ALMM scheme will be vital if India is to onshore its solar supply chain.

Earlier this month, the US Department of Commerce launched a new antidumping and countervailing (AD/CVD) investigation into solar products from India, alongside Indonesia and Laos.