India has issued a record 73GW of utility-scale renewable energy tenders in 2024, yet challenges have emerged.

This is according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics, which highlights three notable challenges for the execution of utility-scale renewable energy projects.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Despite last year seeing a record 73GW of renewable energy utility-scale tenders, it has also witnessed a rise in undersubscribed tenders. Nearly 8.5GW of capacity was undersubscribed in 2024, a fivefold increase from 2023. According to the report this could be attributed to several factors, including complex tender designs, aggressive bidding during reverse auctions, and delays in the readiness of Inter State Transmission System (ISTS) infrastructure.

Another issue for utility-scale projects is the delay in signing power sale agreements (PSAs) which has exceeded 40GW. State-owned firm Solar Energy Corporation of India (SECI) accounts for nearly a third of all the capacity, with 12GW.

The main reason for the delays in signing the PSAs is due to the expectation from energy offtakers of continuously falling renewable energy tariffs.

“Delays in project implementation pose a significant challenge to India’s renewable energy target for 2030,” said Ashita Srivastava, senior research associate at JMK Research and co-author of the report.

“Ongoing issues with project realisation could deter investor interest in future renewable energy projects in India, potentially affecting the availability of low-cost financing from large-scale investors,” added Srivastava.

The third and last challenge that has been on the rise in the past few years is the cancellation of tenders, which ties in with the previous two challenges. Between 2020 and 2024, 38.3GW of capacity was cancelled, which represents nearly a fifth (19%) the total issued capacity tendered during that period.

These cancellations can occur at any stage of the bidding process, either before or after the auction. According to the report, cancellations beforehand occur when authorities identify substantial challenges related to tender design, location or technical complexity, which is based on feedback received after issuing a request for selection (RfS).

On the other hand, cancellations after the tender has been done are due to the two previous challenges mentioned earlier: tender under subscription and delays in signing PSAs.

The report recommends that the government focus equally on all aspects of the tendering process, from the issuance of RfSs to the allotment and signing of PSAs.

Moreover, the Indian government should establish annual targets for both allotments and the execution of PSAs a this will ensure that renewable energy implementing agencies (REIAs) issue bids only after securing the necessary offtake agreements. Enforcing stricter renewable energy purchase obligations and associated penalties is essential to sustain renewable energy demand, according to the report.

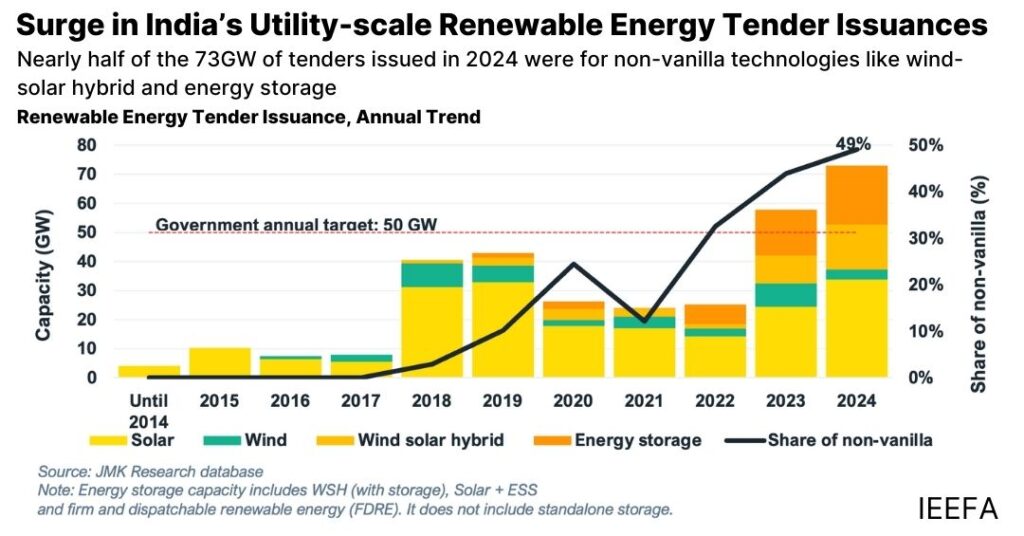

Solar-wind hybrid and energy storage on the rise

Despite these challenges that could trigger a slowdown in renewables growth in the coming years, India has seen, for a second year in a row, a record growth in capacity tendered.

Tenders issued in 2024 grew by 25% from 2023 with hybrid solar-wind and energy storage systems (ESS) accounting for nearly half of the 73GW of capacity tendered in 2024.

Last year also marked the second year that India tendered more than the 50GW of renewable energy target set by the government in order to reach its goal of installing 500GW of non-fossil fuel generation by 2030. The annual government target of 50GW was set in 2023 for a duration of five years and followed a three-year period (2020-2022) where the country tendered less than 30GW of renewable energy utility-scale capacity. This target is distributed among four REIAs which are SECI, NTPC, SJVN and NHPC.

SECI has been the largest utility-scale renewable energy tendering agency with more than 113GW, with nearly 60GW coming from solar PV, of tendered capacity as of December 2024. This is treble the amount issued by NTPC, the second-largest issuer of tenders.

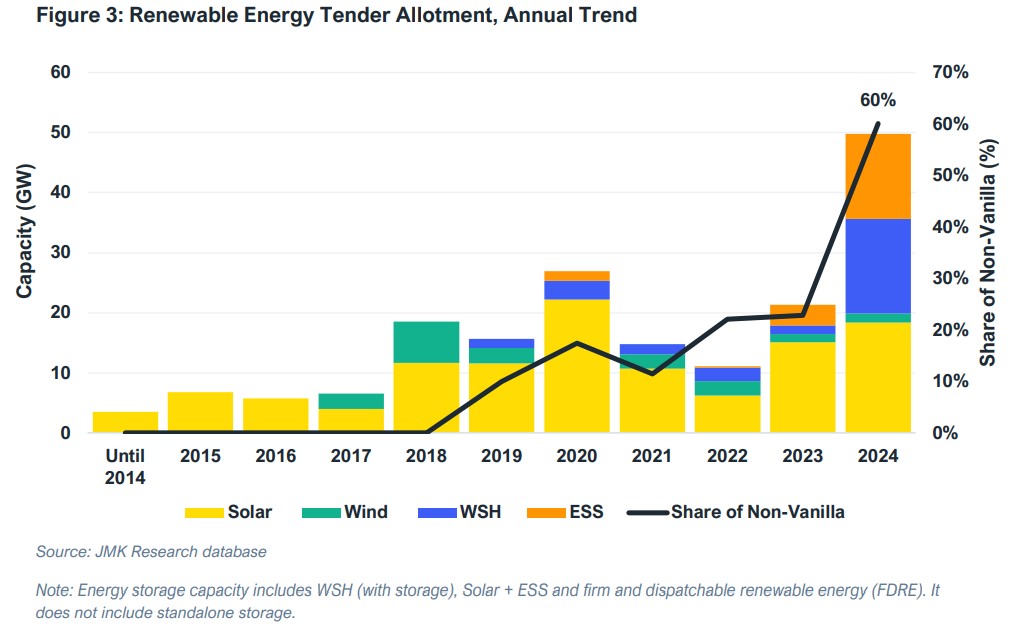

Capacity awarded doubled in 2024

With the increase of capacity tendered in 2023 and 2024, last year saw more than 50GW of awarded capacity, doubling from the numbers in the previous year.

Similarly to tendered capacity, the growth was achieved from what the report calls non-vanilla renewable energy technologies—which are solar and wind as a standalone—with hybrid solar-wind projects accounting for the most awarded capacity in 2024.

With more than 15GW of allotted capacity, hybrid solar-wind surpassed solar energy in 2024 as the largest utility-scale renewable energy segment that year.

“The evolution of renewable energy tenders demonstrates that market stakeholders are actively working to overcome shortcomings,” said the report’s contributing author, Vibhuti Garg, Director – South Asia at IEEFA.

“The renewable energy market has matured considerably, and all stakeholders, from investors to energy offtakers, have built a strong understanding of the intricacies of renewable energy technologies,” added Garg.