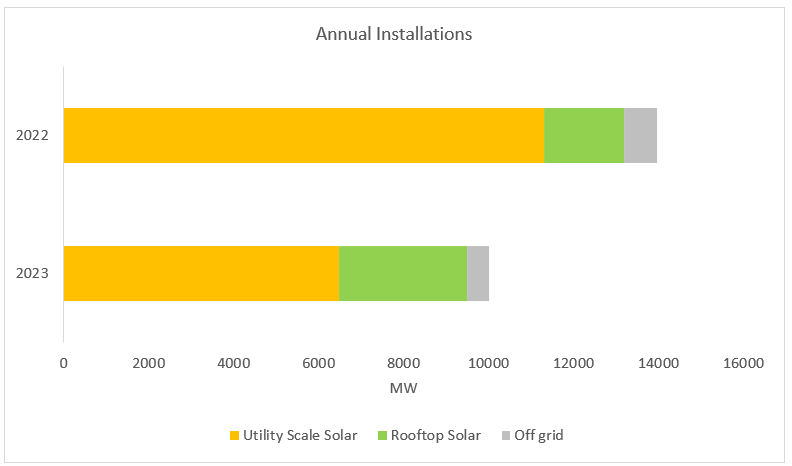

India installed 12.9GW of renewable energy generation capacity in 2023, over 10GW of which was solar PV. This represents a 28% decline in PV additions and an 18% drop in overall renewables capacity additions year-on-year.

These figures are according to Indian market research firm JMK Research, using figures from the Ministry of New and Renewable Energy (MNRE). Approximately 10,016MW of solar PV was installed in 2023 alongside 2,806MW of wind; the country’s total renewable energy capacity now sits at 133.89GW according to the MNRE, of which solar represents a roughly 55% share.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The downturn in installed capacity additions came largely from the utility-scale sector, which saw only around 6.5GW of new capacity last year. This was a 42.5% drop compared with 2022. Indeed, earlier research from JMK on Q1-Q3 2023 reported that just 5.06GW of utility-scale PV was connected to the grid in the first nine months of the year, which represented a 45.6% decline compared with the equivalent period in 2022. The decline over 2023 was consistent, at least.

JMK blamed “below-par tender issuance activity” between 2020-2022 for the utility-scale sector’s underperformance last year. Projects – or the lack thereof – from those tenders would have been scheduled online around 2023.

On a more positive note for the market, JMK forecast that a recent rise in tender activity would see utility-scale capacity additions in the future.

Rooftop solar, by contrast, saw a 58% uptick compared with 2022. Around 3GW was installed in 2023 on Indian rooftops, alongside ~500MW of off grid/distributed solar. But the rooftop sector is far smaller than the utility-scale market and was unable to make up for the latter’s shortfall. For reference, there was more utility-scale solar added in 2022 (around 14GW) than all deployments in 2023.

However, in a report published in November 2023 the Indian policy research institute Council on Energy, Environment and Water (CEEW) said that the country’s residential rooftop solar potential could tip the scales at around 32GW with a subsidy programme from the MNRE. Currently, of the approximately 11GW of installed rooftop solar only ~2.7GW is residential.

State breakdown

Unsurprisingly, Rajasthan led the solar installations in 2023 with 2.139GW followed by Gujarat with 1.317GW. These states have been the major hotspots for Indian solar deployments for some time and accounted for the majority of large-scale projects in 2023, JMK said. A major reason for Rajasthan’s preeminence in the solar market is its geography; flat, sunny land can accommodate a lot more ground-mounted solar than the more mountainous regions to the east and north.

Maharashtra was the third-largest installer (979MW) followed by Tamil Nadu and Madhya Pradesh.

Beyond the report

2023 was the year that India reached 70GW of installed PV. Whilst this is a good milestone, the country originally had a target of 100GW by 2022, and it has been underperforming on installations for some time.

In addition to the tendering shortages mentioned by JMK, India has had ongoing solar supply issues brought about in part by its protectionist Basic Customs Duty (BCD) policy which aggressively taxed solar imports from China whilst its Approved List of Models and Manufacturers (ALMM) programme and Production-Linked Incentive (PLI) – both targeting a domestic manufacturing base – lacked the muscle to pick up the slack.

PV Tech Premium spoke with analyst firm Bridge To India last year about the supply issues.

In an effort to remedy this imbalance, the Indian government announce a two-year relaxation of the ALMM in February 2023 to encourage installations to get back on track. The change effectively broadens the scope of products and companies allowed access to the Indian market.