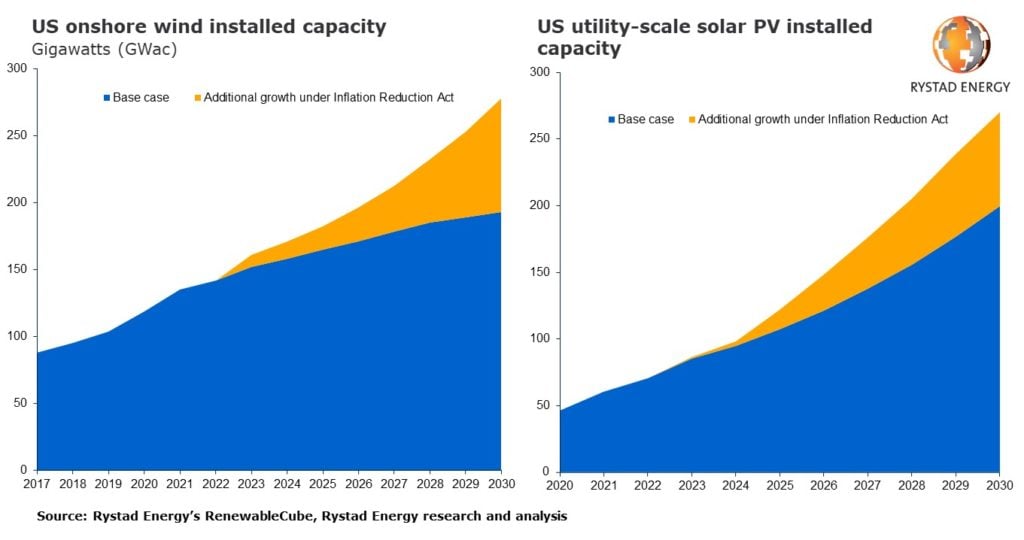

The Inflation Reduction Act (IRA) is expected to add an extra US$110 billion in investment for utility-scale solar in the US by 2030, increasing the country’s utility-scale deployment by more than 70GW.

That is according to consultancy Rystad Energy, which now expects the US to hit 270GW of utility-scale PV by 2030, from from 200GW, due to the incentives contained within the IRA.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The act will have a significant positive impact on the US solar industry, Rystad said, but the effects will not be immediate as the sector still grapples with recent headwinds, such as the anti-dumping and countervailing (AD/CVD) investigation, the ban on polysilicon coming from Xinjiang and vast interconnection queues across the US.

The effects of the new incentives will be fully felt in 2024, according to the consultancy.

Marcelo Ortega, renewables analyst at Rystad Energy, said: “The Inflation Reduction Act is a game changer for the US wind and solar industry. The tax credits in the bill will strengthen the economic feasibility of new project developments and boost the wind and solar markets’ growth trend this decade and beyond.”

Moreover, the new legislation will make the production tax credit (PTC) – which has earmarked US$30 billion to help boost domestic clean energy manufacturing – available for solar projects, with developers able to choose between this and the Investment Tax Credit (ITC).

Meanwhile, the internal rate of return (IRR) – a measure that evaluates the profitability of project investments – will increase by one or two percentage points for solar and wind project, Rystad said.

“We estimate that for a 250MW utility-scale solar project, the PTC will be the most beneficial tax credit until a 7.5% discount rate is achieved, after which the ITC will be the preferred tax credit,” said Rystad Energy.