For module buyers looking to manage quality, the speed at which the photovoltaic (PV) market has evolved in recent years can be both exciting and concerning. Along with the promise of greater efficiencies as advanced technologies come to market, recent developments have also amplified the risks associated with PV module quality, long-term reliability, and regulatory compliance. At the centre of this transformation are PV cells, the sometimes overlooked but critical component of every solar module.

Kiwa PI Berlin, a leading global technical advisor for PV and battery storage quality assurance, has reported on these issues in our recently released white paper, The Race to PV Cell Quality & Compliance. Together with Kiwa PVEL, the report examines how policy pressures, shifting manufacturing geographies and evolving cell architectures are reshaping industry risk. Leveraging our insights and expertise, we elaborate on why buyers can no longer rely on module-level diligence alone.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

PV module buyers now need to focus on upstream due diligence to manage quality. New US policies like the One Big Beautiful Bill Act (OBBBA) and Foreign Entity of Concern (FEOC) rules have shifted compliance focus upstream to the cell itself. At the same time, the industry is rapidly adopting advanced cell designs such as TOPCon and HJT, scaling to larger wafer formats, and diversifying manufacturing into emerging regions. These transitions create new technical risks that must be addressed at the source.

By outlining the latest risks and providing technical detail on production processes, defect modes and reliability test data, we aim to equip the industry with practical tools for proactive risk mitigation. Below, we summarise some of the key insights from the report, which is now available for download.

Policy pressures demand cell-level diligence

Compliance is now anchored at the cell level. OBBBA ties federal tax incentives to domestic content requirements and restrictions on sourcing from foreign entities of concern. With cells carrying the heaviest weight in domestic content cost allocation, even one non-compliant factory can jeopardise a project’s Investment Tax Credit (ITC) eligibility.

Layered regulations—including AD/CVD investigations, Section 232 tariffs, and UFLPA enforcement—add further complexity. In response, new facilities are emerging in regions like Africa and the Middle East. While these hubs may offer tariff advantages, they also present variability in manufacturing maturity and quality culture. That makes independent audits, bill of materials (BOM)-level traceability, and rigorous supplier verification essential safeguards.

Rapidly evolving cell architectures increase technical risk

TOPCon and HJT cells are scaling quickly, but their adoption compresses the technology lifecycle. As with earlier surprises like LETID in PERC modules, new degradation modes such as UV-induced degradation (UVID) are now surfacing in n-type architectures.

Manufacturers are retooling lines and retraining operators to accommodate these designs, but every change introduces opportunities for latent defects. The report underscores that standard factory checks are insufficient. Robust process validation, in-line metrology and independent audits are required to detect risks early and protect long-term module bankability.

Wafer size progression presents new reliability challenges

The industry shift toward M10 (182 mm) and G12/M12 (210 mm) wafers has enabled higher power classes and better system economics. But larger wafers are thinner and more fragile, making them prone to microcracks, edge chipping, and other mechanical defects.

Manufacturing larger formats also demands tighter process control and significant equipment upgrades. Without enhanced QA frameworks, the performance gains from bigger wafers risk being offset by yield loss and field reliability issues.

Production process risks and defect categorisation

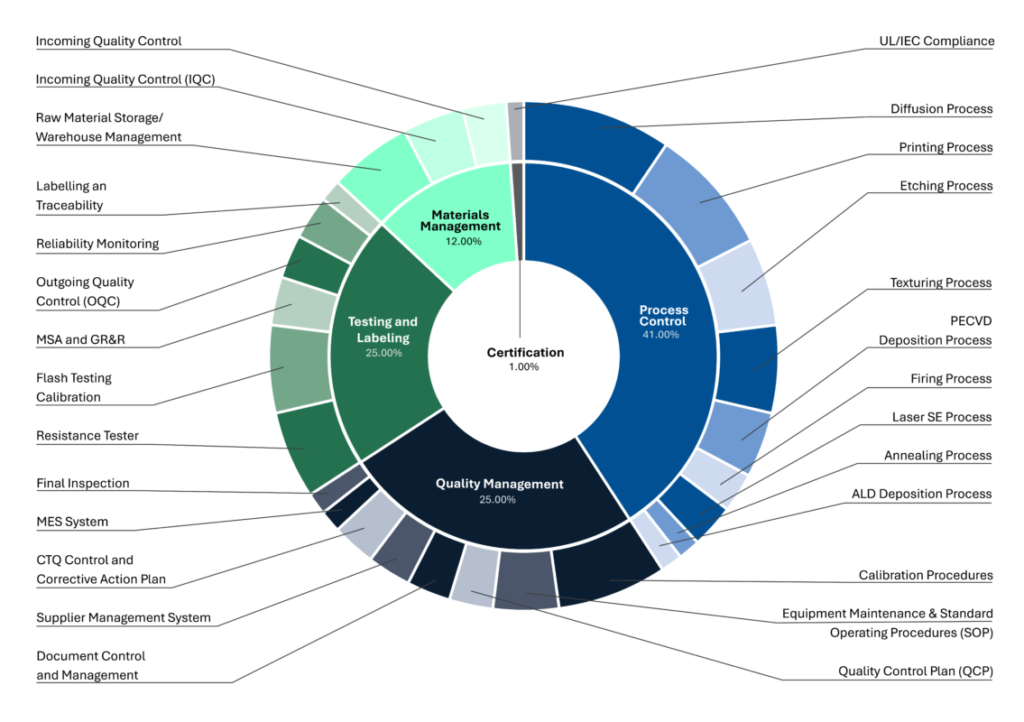

Kiwa PI Berlin’s factory audit data reveals four critical categories of cell manufacturing risks:

- Process control deficiencies (41%). Even small deviations in temperature, doping, or chemical concentrations can create latent defects.

- Weak quality management systems (25%). Missing SOPs, poor calibration, and inadequate supplier oversight are common in emerging factories.

- Unreliable testing and labelling (21%). Improper calibration leads to mislabeled power ratings, an issue corroborated by Fraunhofer ISE findings.

- Material qualification gaps (12%) – Poor raw material inspection and storage practices introduce defects early in the cycle.

For advanced designs like TOPCon and HJT, these risks are amplified by the sensitivity of ultra-thin passivation layers and multi-material interfaces.

Reliability testing confirms cell-level impact

Kiwa PVEL’s Product Qualification Program (PQP) demonstrates how minor cell-level changes can ripple into major reliability outcomes.

Recent results highlight:

- UVID. One manufacturer reduced UV120 degradation from 6.5% to 1.3% by improving coatings and passivation, but only if upgrades are consistently applied.

- Thermal Cycling (TC600). Power loss varied from 0.3% to 3.3% in modules of the same power class, depending on the cell supplier.

- Damp Heat (DH2000). Nearly identical BOMs from the same maker showed 1.5% vs. 3.8% degradation depending on the cell model.

- PID. Two similar TOPCon BOMs recorded sharply different results: 1.6% vs. 7.2% power loss.

These findings reinforce the need for retesting whenever cell suppliers or processes change.

Conclusion

Kiwa PI Berlin’s 2025 whitepaper makes one thing clear: in today’s market, PV cell diligence is no longer optional—it is mission-critical. Regulatory compliance, technical reliability, and financial viability all converge at the cell level.

For developers, investors, and EPCs, this means adopting a multi-layered strategy that includes BOM traceability, supplier verification, independent cell factory audits, and ongoing reliability testing. Only through this approach can stakeholders manage regulatory exposure, secure project bankability, and ensure long-term performance.

As the solar industry accelerates toward advanced cell technologies and broader global manufacturing, proactive diligence at the cell level will define success in the race to quality and compliance.

Don Cowan is director of sales and marketing and Mayhar Mohammadnezhad is principal PV module consultant at Kiwa PI Berlin.