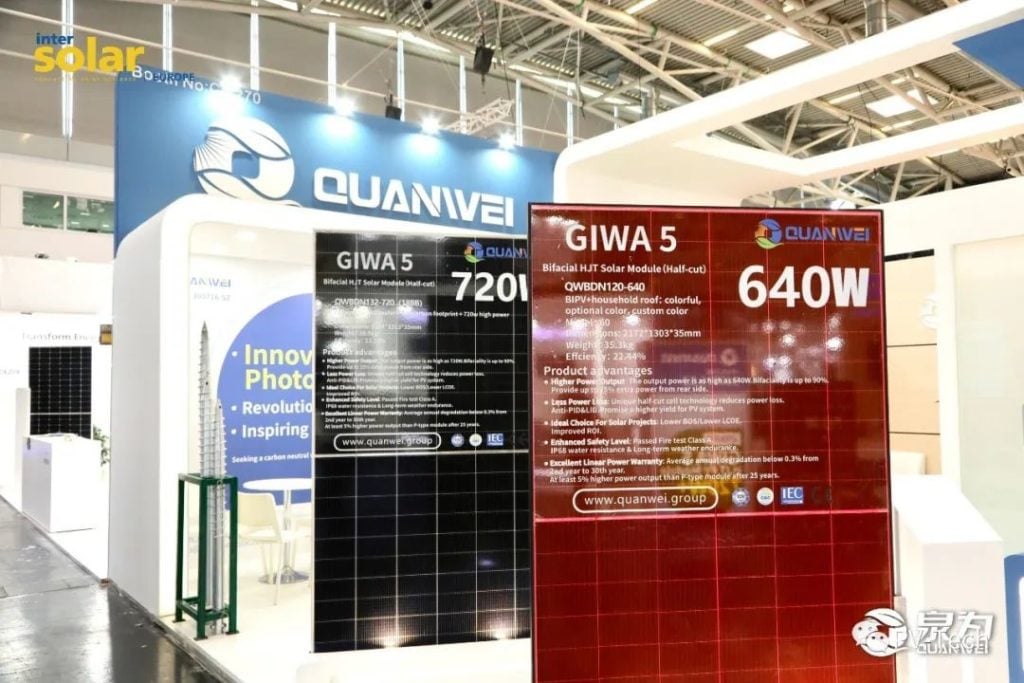

Quanwei Technology, a new rising player in the heterojunction (HJT) field, has exhibited at Intersolar Europe, showcasing its portfolio of products, including its high-efficiency HJT series modules and energy storage solutions. The highlight among products on display was the company’s 720W ‘GIWA 5’ module, launched and in mass production since February of this year.

With mass production underway at its Shandong base (6GW of modules and 1GWh of storage capacity), Quanwei’s new factory in Anhui is due to be operational in the third quarter of 2023, at which time the company’s total capacity will rise to 10GW of HJT cells, 20GW of HJT modules and 5GWh of energy storage.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

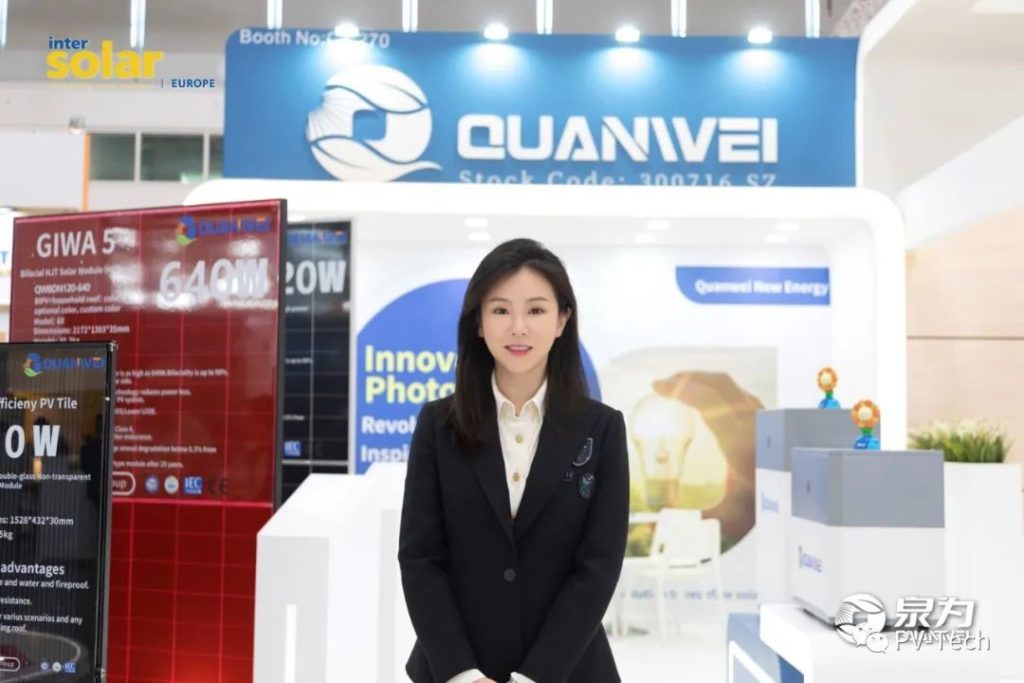

To gain an insight into the company’s plans and outlook for the industry, PV Tech met up with its chairwoman and general manager Ms Chu Yifan.

PV Tech: Can you give us a brief introduction to the company and its main products?

Chu Yifan: Quanwei Technology was founded in 2002 and listed on the Shenzhen Stock Exchange in 2017. During the years since its listing, the Chinese PV market has continued to flourish, and the global trend towards carbon neutrality and the role played by renewable energy has developed rapidly.

We were happy to see the launch of China’s national carbon neutrality and carbon peak policies, which are obviously beneficial to our growth, and we are fully committed to clean energy development as part of our PV business strategy. We are a high-tech company integrating the R&D, production and operation of heterojunction cells, modules, perovskites and commercial and industrial energy storage solutions. Our plan is to become a global leader in the manufacture of HJT high-efficiency cells and modules for gigawatt-scale systems worldwide and to provide one-stop intelligent energy solutions, including tailored and implemented PV power stations. At present, our main products are high-efficiency heterojunction (HJT) cells and modules, as well as commercial and industrial energy storage.

What is the current capacity for these main products? As a new, rising player in the industry, what do you see as your advantages?

We have strategically established bases in Shandong (Zaozhuang), Anhui (Sixian), and Shanghai (Marketing Headquarters). We also plan to invest in new factories in Guangdong and north-west China, creating a framework of four major bases and one marketing centre. This comprehensive layout includes production, transportation and installation support, enabling us to effectively meet domestic market demands while maintaining a cost-efficient structure. As of today, Phase 1 of the Shandong base has achieved mass production of 6GW of high-efficiency HJT modules and 1GWh of energy storage capacity. The Anhui base is under construction and is expected to be operational by the third quarter of 2023. Once both bases are fully established, our overall capacity will encompass 10GW of high-efficiency HJT cells, 20GW of high-efficiency HJT modules and 5GWh of energy storage. Looking ahead, once all four major bases have been completed, the company’s total capacity will reach an impressive 40GW for cells, 40GW for modules, 5GWh for energy storage projects and 1GW for large-size ultra-thin silicon wafer slicing.

In terms of advantages, despite being a newcomer in the field, Quanwei Technology boasts a highly skilled technical and management team, along with expert consultants who bring with them extensive technical expertise and experience. As a technology-driven company, we firmly believe in respecting the market and our customers and are meticulous in our attention to detail, delivering exceptional service as standard. We are also a green technology company, so are fully aware of our responsibilities in that area. This principle extends across our decision-making processes and work practices, the fundamental commitment to “going green” making Quanwei Technology both innovative and reliable.

Another advantage lies in the forward-thinking nature and progress of our technical roadmap. Heterojunction cell technology, the latest advancement in the PV field, offers huge development potential. While our investment in anchoring and reserving HJT technology has come at a significant cost, it has also consolidated our technological advantage. We are additionally simultaneously developing cutting-edge perovskite-related technology. We have established a mature technology development and management platform, striking a balance between cost-effectiveness and development efficiency. This positions us at an advantageous spot within the industry, particularly in terms of technological innovation efficiency.

Finally, our state-of-the-art 720W high-power and high-efficiency HJT module, integrating heterojunction, large-size silicon wafer, MBB and half-cut cell technologies, has proven extremely popular with customers due to its exceptional conversion efficiency, low temperature coefficient, minimal power attenuation and bifacial power generation capabilities. It consistently delivers outstanding performance, even in challenging conditions such as weak light and high-temperature environments, ensuring reliable power output.

What are the main products you are showcasing at this year’s Intersolar?

We are exhibiting a comprehensive product portfolio this year, designed to address a variety of scenarios for customers in Europe and around the world. The product range encompasses module series including high-efficiency HJT modules and energy storage products. Among these, we are particularly proud of our flagship product, the high-power 720W GIWA 5 series HJT module, which we officially launched in February this year, its Chinese name ‘Quanyao’ (meaning ‘shine’ in English) reflecting the endeavour and dedication we have invested on its development.

As our core product, the GIWA 5 combines advanced technologies such as heterojunction, large-size silicon wafers, MBB and half-cut cells, resulting in outstanding performance and exceptional cost-effectiveness.

In addition to the GIWA 5, we have also introduced three different application-oriented module series: ‘GIWA 3’, ‘GIWA 2 (G12)’, and ‘GIWA 2 (M10)’. Additionally, the GIWA energy storage series features a variety of products, including large-scale (distributed/integrated), unit-level and household energy storage. With flexible and diverse solutions and module options, we are confident in our ability to support users in tackling their energy challenges.

Regarding advanced technologies, what do you think is the main trend in PV module products this year? Which technologies and products do you favour as a company and what are your strategies?

Over recent years, there have been significant changes in the global macro environment, and the existing business logic in various industries is finding itself challenged. All industries are under pressure but also finding new opportunities and the PV industry is no exception. As a new technology company, Quanwei Technology pays close attention to the technological development of the industry. We have noticed that industry players are improving their responsiveness to market changes and increasing the scope of their R&D to achieve overall improvements in efficiency. This is a very positive phenomenon with the industry’s development accelerating with a number of innovative solutions emerging. The attempts to overcome challenges may bring about further changes in the industry. From our perspective, we believe that “large size + n-type + high power” will be one of the main trends in PV module technology this year and beyond, especially with HJT and TOPCon, together with future perovskite/HJT shingled cell technology. HJT combines advantages such as large size (adopting 210mm large silicon wafers) and high power (720W module power with dimensions of 2384*1303mm), while perovskite cell technology has obvious advantages in terms of high photoelectric conversion efficiency and low cost, with its compatibility with the structure and process of HJT cells. Therefore, combined perovskite/HJT shingled cell technology has the potential to become one of the optimized solutions for the industry.

Quanwei Technology has been developing silver paste, ultra-thin silicon wafers, OBB, and other technologies based on HJT cells to further reduce costs. At the same time, we are also conducting industrialization-oriented R&D and developing perovskite/HJT shingled cell technology. In the future, we will engage in extensive cooperation and strategic planning around this technology. By participating in this exhibition, we hope to establish relationships and partnerships with other exhibitors. We are willing to provide assistance to our partners, working together to achieve market success and customer satisfaction with high cost-effectiveness.

How does the company position itself in the international market? On which countries are you particularly focused? What are your market strategies?

While Quanwei Technology pays attention to and learns from international markets, we also hope to share the methodologies, solutions, technologies, products and insights gained from our experience of the Chinese market. We are committed to providing module products that offer higher economic benefits to global customers.

In addition to traditional European markets such as Spain, Germany, and Italy, we are also looking to develop emerging markets including Southeast Asia, the Middle East, Latin America and Australia.

We aim to leverage our strengths in large-scale ground-mounted power plants, commercial and industrial rooftop projects and floating solar applications in high-temperature environments.

How do you view the solar market this year? What are the company’s development goals for 2023?

With the continued increase in production capacity of upstream silicon material manufacturers, we expect that there will be a significant release of silicon capacity by the third quarter of this year. This, in turn, is expected to further reduce raw material costs in the PV industry supply chain, stimulating installation demand in the downstream. Additionally, due to the decline in electricity prices in the European and American markets, customers will pay more attention to module power generation efficiency and its impact on power plant returns. This provides favourable conditions for Quanwei’s HJT modules to expand both domestically and globally.

In 2023, the company will expand its global market presence while focusing on capacity and technological development. Specifically, we will further develop and optimize our Shandong and Anhui bases, gradually releasing capacity to ensure the timely delivery of large-scale customer orders. By the end of the year, we expect that the combined production capacity of the two bases will reach 5GW of high-efficiency HJT cells, 11GW of HJT modules and 1GWh of energy storage.