Investors are turning away from fossil fuels and shifting into renewables because of falling costs and climate targets, with US banks lagging behind their European and Asian counterparts.

This was the message from the Institute for Energy Economics and Financial Analysis’s (IEEFA) report Global Investors Move into Renewable Infrastructure, which was based on data from BloombergNEF.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It put the increasing investment down to “the inherent advantages of investment in clean energy”, such as higher risk adjusted returns and stable cashflows, along with the COVID-19 recovery packages of some governments incentivising green investment.

The report showed how in the financial year 2020, the clean energy sector received record investment, with US$501 billion committed – an increase of 9% of the previous year. Of this, the renewable energy sector received US$303 billion (60%) of total investment.

Total renewable energy installations hit 260GW last year despite COVID-19 pressures, which is 50% more than 2019. In contrast, total fossil fuel capacity dropped to 60GW in 2020 from 64GW in 2019.

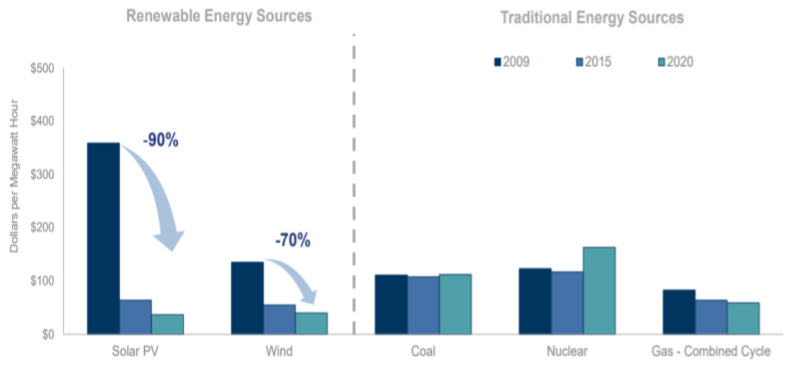

A key factor here is the levelised cost of energy (LCOE) for renewables versus fossil fuels. Solar PV’s LCOE has fallen 90% since 2009, according to the report, while those of coal, nuclear and gas have either increased, remained flat or dropped only slightly.

BloombergNEF’s data highlights the top ten global investors that are investing heavily in renewable energy and that together provided US$30 billion in cumulative debt. No US banks appear in the top ten, which is dominated by large European banks along with three Japanese investors.

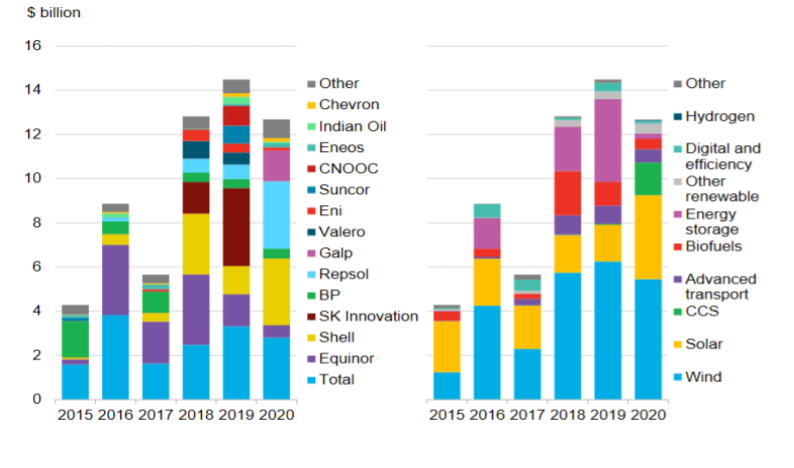

Crucially, an increasing number of oil and gas companies are pivoting their investments into renewable energy. While renewable investment from some of the biggest oil and gas companies reduced by 12% last year, capex investment rose by 6%.

Recent net zero pledges have created a “strategic shift in dialogue” and have overseen “a divestment away from carbon intensive assets and mobilising capital towards low carbon energy transition assets,” said the report.

The report included a quote from former Bank of England Governor Mark Carney: “A transition to net zero will affect how risk is measured and managed, and how assets are valued. This transition is creating the greatest commercial opportunity of our age.”

In June, an International Energy Agency (IEA) report called for greater spending on clean energy to meet climate goals and a subsequent report showed how global demand for electricity was outpacing renewable energy supply, with fossil fuels making up the gap.

The IEA has also said green energy investments in developing countries must hit US$1 trillion by 2030 to reach net zero targets.