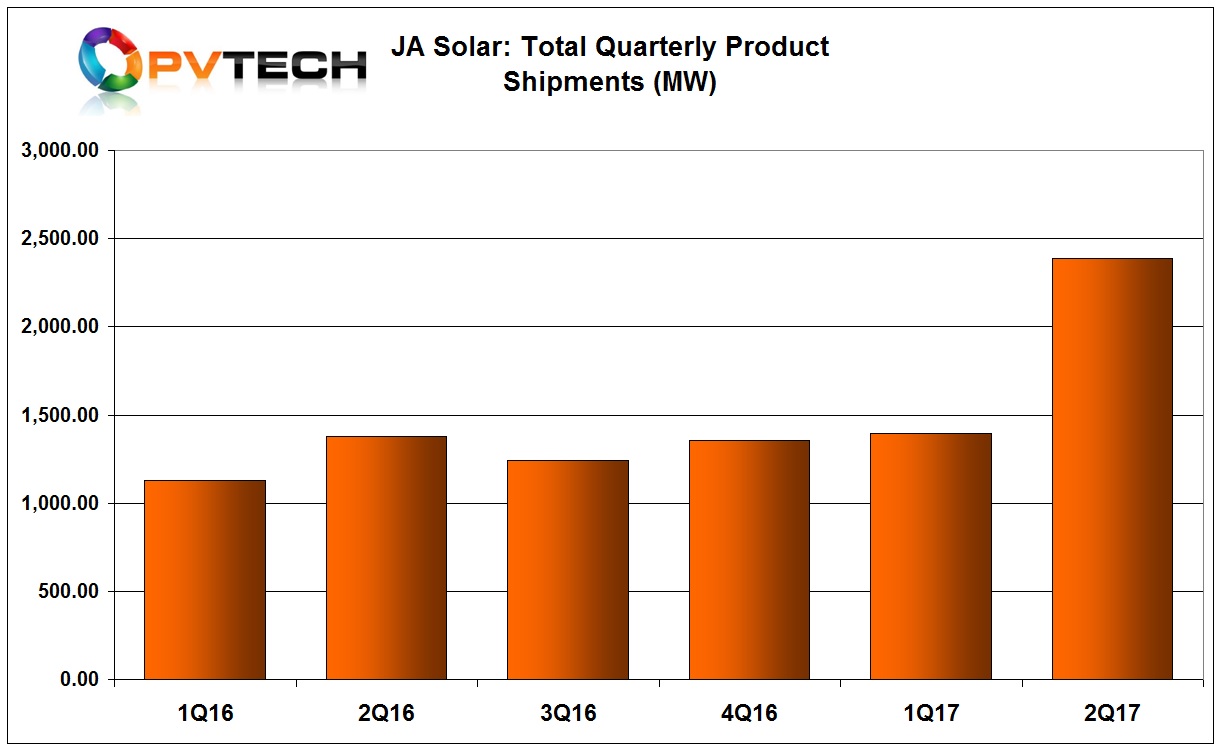

Having turned and continue to remain cautious about its business outlook for the second-half of 2017, JA Solar reported second quarter results that simply defied previous guidance, driven by greater than expected demand in China and a start of a rush to stockpile in the US.

JA Solar reported second quarter total shipments of 2,389.2MW. External PV module shipments were 2,147.5MW and solar cell shipments were 167.2MW, compared to previous guidance of 1,550MW to 1,650MW for the second quarter of 2017.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

External shipments were therefore up 88.3% year-on-year and up 68.3% from the previous quarter. Due to the strong customer demand that is expected to continue through the third quarter of 2017, JA Solar reduced its module shipments to its own downstream PV project business and cut expected project completions for the year from a high of 250MW to a new ceiling of 150MW.

Product shipments within China accounted for 59.2% of total shipments in the quarter, up from 39.7% in the first quarter of 2017.

PV module shipments to North America remained unchanged on a percentage basis at 8.1% from the previous quarter but total volume was around 174MW, compared to around 107MW in the first quarter of 2017.

To meet increased demand in China and the US, shipments to APAC on a percentage basis declined to 24.9%, compared to 44.2% in the first quarter of 2017.

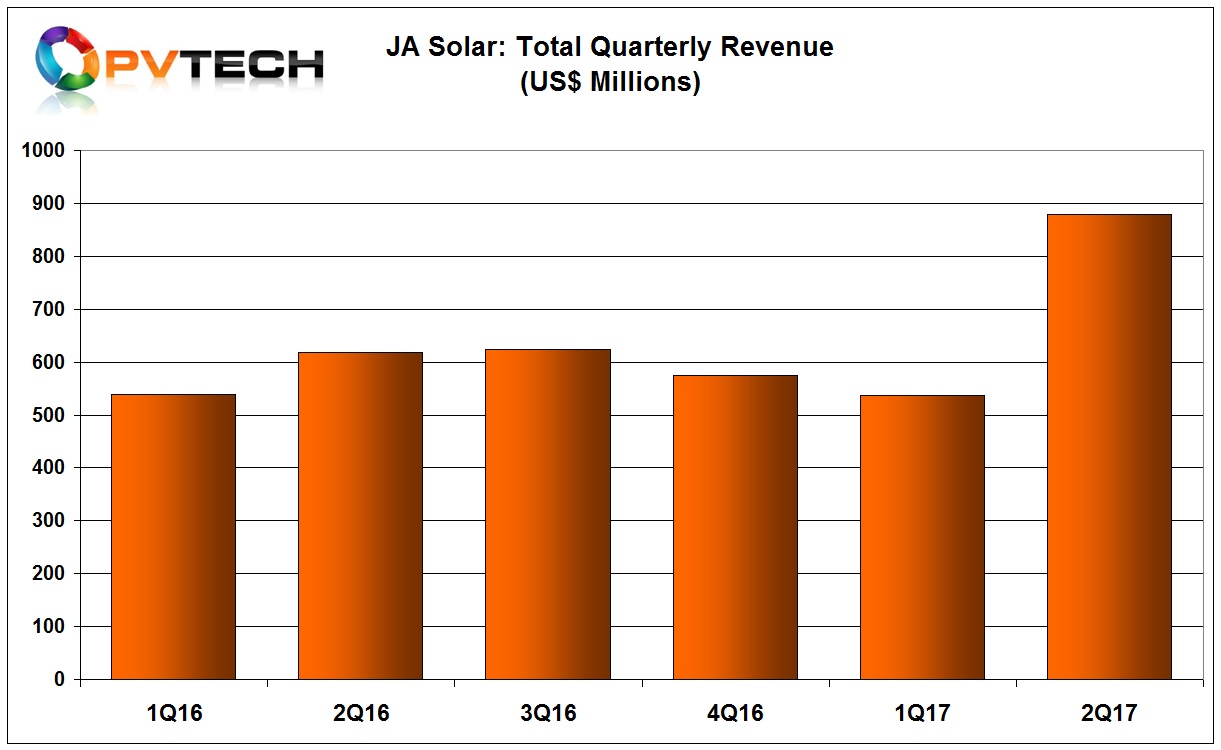

Financial results

JA Solar reported second quarter revenue of US$878.1 million, an increase of 44.7% year-on-year and 61.2% from the previous quarter.

Baofang Jin, Chairman and CEO of JA Solar, commented, “Second quarter results exceeded our expectations. Robust shipments in China, primarily attributable to accelerated activity ahead of subsidy reductions, drove our year-over-year double-digit revenue growth in the quarter. Additionally, better-than-expected average selling price and lower blended costs resulted in 120 basis-point sequential improvement in gross margin.”

JA Solar reported a gross profit of $113.7 million, which increased 22.7% year-on-year and 77.9% sequentially. Gross margin was 12.9%, which compares to 15.3% in the year-ago quarter, and 11.7% in the first quarter of 2017.

Operating profit was US$37.6 million, compared to US$27.7 million in the year-ago quarter, and US$11.8 million in the first quarter of 2017.

Operating margin was 4.3%, compared with 4.6% in the prior year period and 2.2% in the previous quarter.

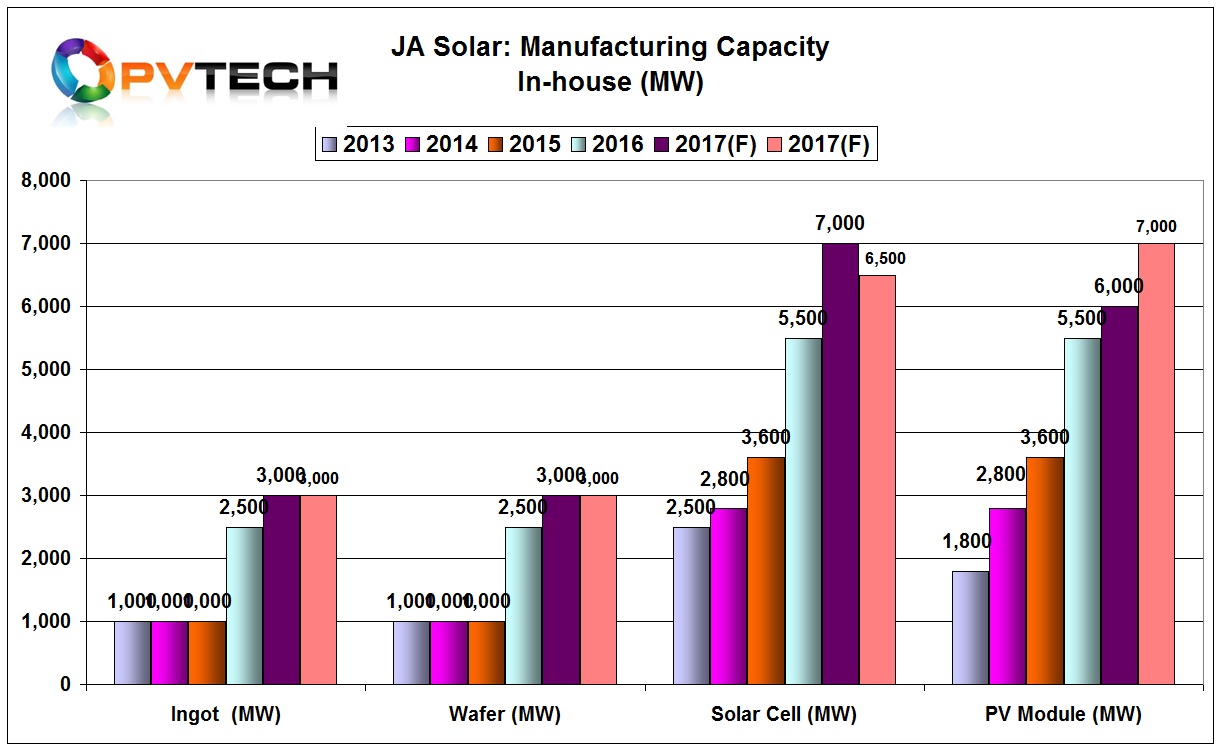

Manufacturing update

JA Solar said that it had lost around 500MW of solar cell capacity due to a previously announced fire its Fab 7 solar cell plant in Yangzhou, Jiangsu province, China in July. The company had noted it had been a significant fire but had not provided information on the hit to capacity.

As a result of the fire, JA Solar said that it nameplate cell capacity would be around 6.5GW at the end of 2017, compared to previous guidance of reaching 7GW. However, the 500MW lost production capacity was expected to replaced and operational in the first quarter of 2018. The cause of the fire remains under investigation, according to the company.

In a surprise move, JA Solar management noted that its module assembly capacity would increase to 7GW by the end of the year, instead of previous plans to reached 6GW, previously inline with its cell capacity.

Management also noted that it was expanding ingot production by 1GW to 4GW having previously said capacity would remain at 3GW in 2017.

Guidance

JA Solar said that it expected total cell and module shipments to be in the range of 1.6GW to 1.7GW in the third quarter of 2017. Nearly all shipments would be external shipments.

With the increased module capacity, JA Solar said that total cell and module shipments were expected to be in the range of 6.5GW to 7GW, up from previous guidance of 6GW to 6.5GW in prior guidance.

“We remain cautious on our business outlook as we enter the second half of 2017, given the slowdown in demand in our domestic market, coupled with the uncertainty around the Section 201 trade case in the U.S. While anticipated changes in incentives is expected to slow the Chinese market in the second half of the year, we continue to believe our balanced global footprint and flexible business model will enable us to adjust to evolving market conditions,” added Jin.