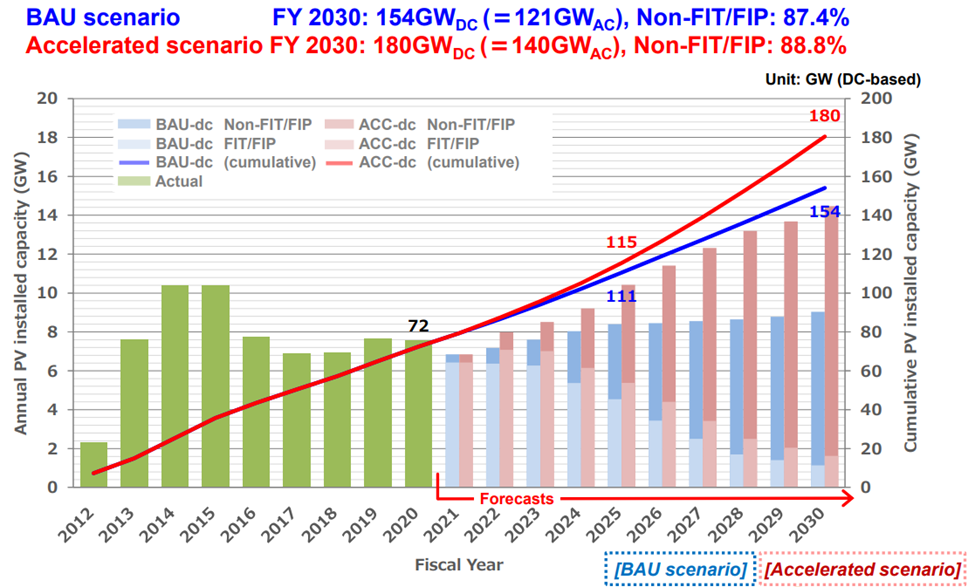

Japan is forecast to have 111GW of installed solar by 2025 under a business as usual scenario, with this rising to 154GW by 2030. If it were to aim higher, however, under an ‘accelerated scenario’, it could hit 115GW of installed PV by 2025 and top 180GW by 2030, according to a new analysis by RTS Corporation.

The business as usual scenario (BAU) assumes the continuation of Japan’s current energy policy, the cost reduction of PV systems and no external shocks or pressures. The accelerated scenario (AC), on the other hand, forecasts for a more favourable policy environment, further cost reductions of PV products and the emergence of new markets.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The solar consultancy firm said that, under the BAU, annual PV installs could top 8GW a year by 2025 and 9GW by 2030, assuming the country’s feed-in tariffs (FiT) are steadily reduced. Meanwhile, under the AC, annual installs could exceed 10GW in 2025 and surpass 14GW by 2030, again assuming that non-FiT systems do much of the heavy lifting by the end of the decade (see chart).

Japan, which has targeted a 43% reduction in emissions by 2030 and net zero by 2050, has been impacted by the same market forces affecting the global PV industry, such as the “price hike of PV modules due to the shortage of raw materials, suspension of shipments of inverters due to the shortage of semiconductors and the issues related to the polysilicon production in Xinjiang Uyghur Autonomous Region,” said the report.

In the report, RTS Corporation made forecasts of PV installed capacity in Japan toward 2030 by application, capacity range, area and other segments while assuming a price outlook that would see the cost of all PV systems fall significantly through to 2030.

It predicted that the price of a residential PV system (less than 10kW) would drop from ¥235/W (US$1.76/W) today to around ¥125/W (US$0.9/W) by 2030, with small-scale PV systems (10kW-50kW) falling from ¥194/W today to a similar amount. The same is broadly predicted for both medium and large-scale solar projects, with all four system types expected to drop down to between ¥100-150/W by 2030 under the BAU scenario.

In October last year, the Cabinet of Japan’s government approved a plan to raise the national target for renewable energy in the electricity generation mix to between 36% and 38% by 2030.

PV Tech Premium has taken a closer look at the task of decarbonising the Japanese economy, with an examination of the challenges and opportunities for large-scale PV in a country historically dominated by smaller systems.