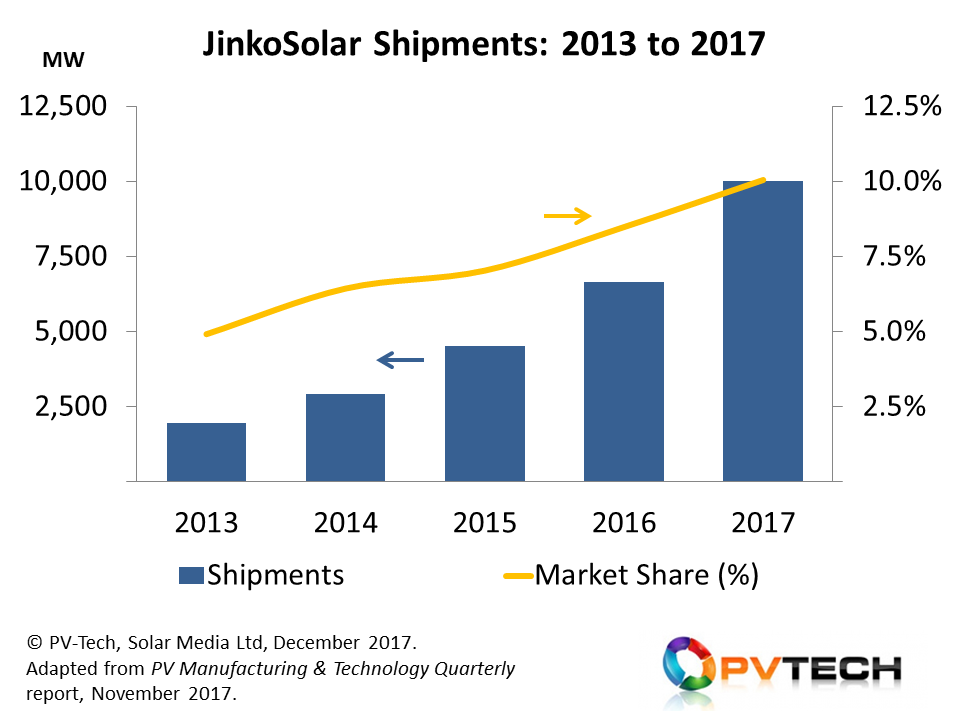

When JinkoSolar released its third quarter results last week – and guided full year 2017 module shipment figures – the company remained on track to overachieve on final quarter shipments, thereby becoming the first ever PV supplier to ship more than 10 GW of modules in a calendar year.

If this landmark figure is reached, JinkoSolar will effectively have 10% market-share, and it will have achieved one of the key goals set internally 12 months ago.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This article tracks how JinkoSolar has managed to move so quickly in the past four years, from having 5% market-share in 2013 (with module shipments less than 2GW), to 2017 where 10% and 10GW has been the goal for its global sales team.

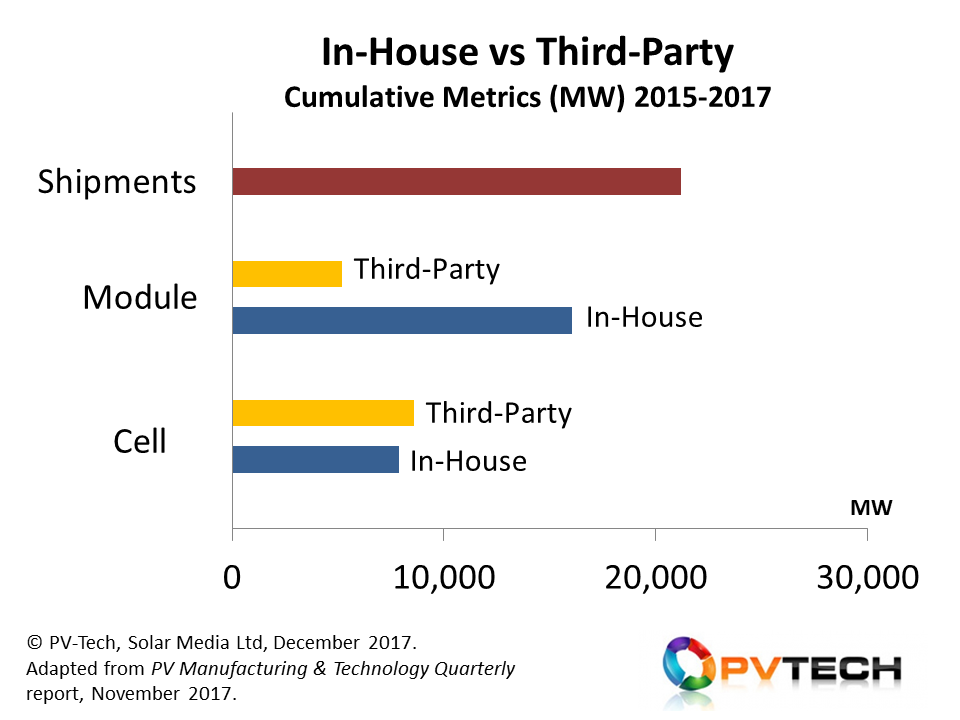

The question of ‘what next’ is also discussed, in view of JinkoSolar having relied heavily on third-party cell and module supply during the past four years to support its module shipment aspirations; and from an audited reporting perspective, being essentially a pure-play module revenue operations.

The 10GW dream

In February 2017, JinkoSolar gave its first guidance for 2017 shipments, at 8.5-9GW. However, it was generally understood that JinkoSolar had set an internal goal for its sales team closer to 11GW, providing the first indication that hitting 10GW was seen as the real target, and one that would yield significant marketing kudos during 2018 and beyond.

When first half shipments in 2017 exceeded 4.9GW, further signs emerged that 10GW would be achieved rather easily. Even during 2016 (with the China slowdown in Q3’16) second-half shipments exceeded first-half by more than 10%. Previous years for JinkoSolar have been significantly higher than 10% half-year growth.

When 9-month shipment figures were reported by JinkoSolar last week, the annual level of 2017 had exceeded 7.3GW, almost perfectly on track to reach the 10GW shipment goal. Guidance for 2017 was given at 9.6-9.8GW.

However, the final quarter has generally been the strongest quarter for JinkoSolar, with approximately 30-40% of annual shipments occurring in Q4 during the past few years. If 2017 follows this trend, then the 10GW annual figure will be met, and explained simply by final shipment figures coming in just above the high end of Q4’17 guidance.

Therefore, when JinkoSolar reports its final 2017 shipment figures (during February or March 2018), don’t be surprised at all if the company begins its press release with a simple and clear message, based firmly on being the first ever PV company to ship more than 10GW of solar modules in a single year.

Expect no shortage of marketing collateral and fanfare should this occur!

Doubling market-share in a high-growth segment

Any company that doubles its market-share in four years – in any sector – will generally be accompanied by its chief executives shouting from the rooftops, happily receiving plaudits from the investor community in recognition of a strategy successfully enacted.

However, to do this in a sector that has seen more than 25% compound annual growth during the same period, there has to be more than just a few stars fortuitously coming into alignment to help things go your way.

And for good measures, let’s add in a bunch of unforeseen trade cases impacting place-of-manufacture and shipment-destination, and a 40% reduction in market pricing due to chronic oversupply.

This is indeed what has happened in the PV industry during the past four years, while JinkoSolar has moved its market-share from 5% to 10%, is likely to hit the 10GW module shipment figure this year, and will be miles ahead of any other module supplier as the leading and single most important module supplier to the PV industry going into 2018 and beyond.

Nothing like this has been seen before in the PV industry, when it comes to module shipments. So let’s have a look at what has enabled this, leading finally to the big question now – what next!

How did JinkoSolar do it?

There are many reasons behind the sub-header question here, but four issues prevail in dissecting JinkoSolar’s rise from a 1-2GW module supplier to a 10GW player in 2017:

- Flexibility in cell and module supply to meet market-growth opportunities

- Having a competitive module product offering at any given time

- Maintaining gross margins in the 10-20% range

- Having a global sales operations capable of winning opportunities in all key end-markets

While other companies have laid claim to meeting the first three bullet points shown above, it is the final issue that probably differentiates JinkoSolar from other competing global module suppliers in the past few years.

Indeed, having a truly global sales presence and operations is something that most PV module manufacturers have struggled with over the past decade, dating back to efforts from Sharp Solar, Suntech (pre-Shunfeng), Trina Solar, Yingli Green, and many others headquartered in China, Japan and South Korea.

Parallels exist today with other Chinese companies that are driven to play on the global PV stage, including LONGi Solar, GCL, BYD, Astronergy, Risen, Talesun, etc., and those that once had an overseas route-to-market but are now constrained to domestic efforts: Kyocera, Solar Frontier, Panasonic and a myriad of Chinese cell/module makers that had briefly flirted with the legacy FiT days of mainland Europe.

Chinese companies that manage to create global brands, accompanied by sales operations that, to the outside world, operate as local entities, are few and far between – in any sector. However, this is something that JinkoSolar appears to have managed to do in the past few years, and the company is certainly the first and only Chinese module supplier to get this right.

The facts and figures clearly support this strategy in 2017. If we split the global PV end-market into six regions/counties, this comes through.

During 2017, JinkoSolar will rank number two in the Chinese and Japanese markets, third in India, fourth in the US, and top-rank in Europe and the all-other category (less the countries/regions just mentioned). There are very few companies that can claim to be top-4 suppliers to every key region globally in the industry today.

Supply enabled, with flexibility

The previous section of this article flagged up the need to have flexible supply. This is key in the PV industry today, as the seasonal demand profiles from the key markets have often been out of phase, and have been impacted by pending or enacted trade-related deadlines for shipments.

Being able to manage these cycles has been a massive challenge to companies seeking to serve the market globally, and has been amplified for companies confined to cell and module manufacturing operations based purely in mainland China.

This has impacted on how much midstream capacity has been brought online within China or at overseas plants across Southeast Asia. Ideally, these sites should be run to serve the baseline demand coming from the regions that the manufactured product is intended; Japan, China and India for Chinese-produced product, and US and European supply coming from Southeast Asia.

Upside – and market-share gain – therefore has to rely upon outsourced cell and module supply/production when needed. Managing this from quarter to quarter has been one of the biggest challenges for global module suppliers in the past few years.

The figure below consolidates JinkoSolar’s in-house and third-party cell and module supply levels across the period 2015-2017, shown against the total module shipments from the company over the same time period.

Using third-party suppliers may have the benefit of flexibility in supply (assuming you are the dominant party in the contractual agreements), but the downside is a hit of 2-3 pennies per Watt on the cost side. (In-house manufacturing ideally is a lower cost operations compared to buying in components from outside.)

JinkoSolar’s strong use of third-party cell supply can actually be traced back to the company’s initial entry within the PV industry, when it positioned itself as a low-cost module assembly company in China before integrating upstream to cells and ingots/wafers.

However, all this has changed in the past three years and is discussed in the section below.

Technology leadership could be the key differentiator

During the past decade, many module suppliers have been rather fixated on claiming the mantle of being the number-one module supplier to the PV industry, based purely on having shipped the highest MWp-dc of company-branded modules.

The driver from any marketing department is simple; it enables legitimacy on claiming to be the market leader based on a universally accepted metric – module shipments.

However, any historian of the solar industry will instantly flag the fact that most companies that had achieved number-one status (in modules and cells) were subsequently left exposed from a what-next strategy standpoint, and within a few years, had sadly fallen from grace: Sharp, Q-CELLS, Suntech and Yingli Solar being names that spring to mind here.

However, JinkoSolar’s tenure as number-one module supplier appears to have a few key differences that are not widely known or discussed, and this may suggest that we are potentially seeing the first major globally-dominant module supplier to the PV industry.

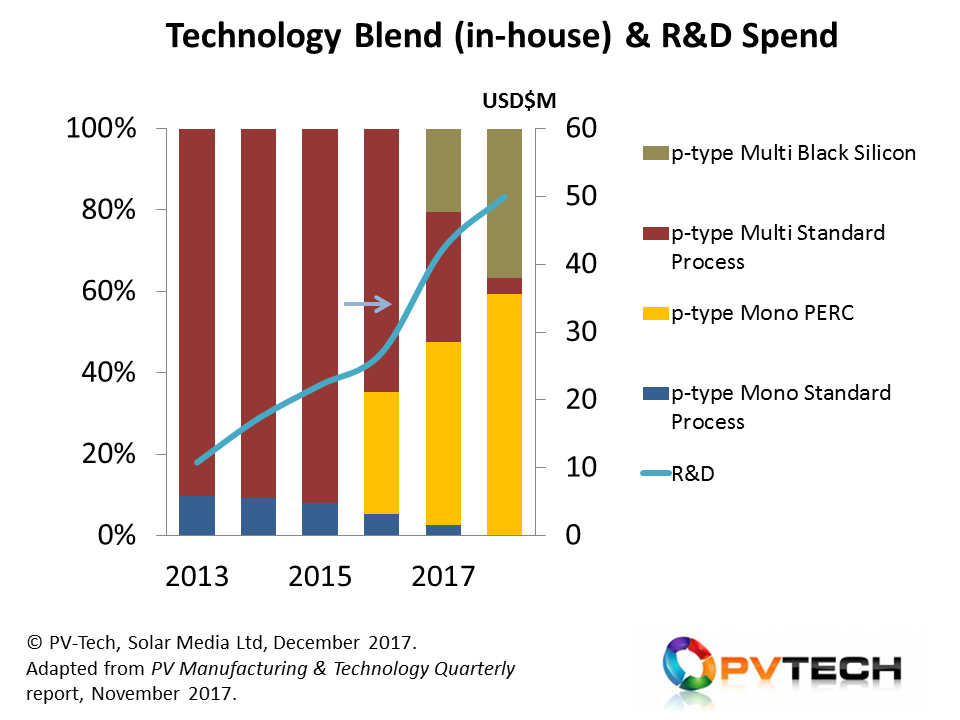

Looking at the Chinese and Japanese companies that held leading market-share status in the past, this accolade was not the result of having a differentiated product offering; and once these companies become market leaders, they failed to invest heavily in R&D or made the wrong decisions with regards cell manufacturing technology. Very quickly, competition overtook them in terms of product performance.

What we see with JinkoSolar is very different to the behaviour of the other aforementioned companies, and come over clearly when we dissect the company’s operations since 2013, and forecast 12 months out to the end of 2018. This is shown in the graphic below:

Since becoming the leading module supplier in 2016, JinkoSolar has doubled investments into R&D, and by the end of 2018, will have shifted completely its in-house technology mix, aligned with having performance leading p-multi and p-mono module offerings.

If one single graph explained why JinkoSolar is different from other market leaders in the past, then the one above would take some beating. But this is probably not the main thing, as discussed now below.

Being non-Chinese outside China on the global stage

Of course, having strong R&D allocations and GW’s of differentiated technology-capacity only really takes one thing: cash. Selling this globally requires a winning sales and marketing strategy.

Perhaps indeed this is the hidden gem that JinkoSolar has in its arsenal, and what really differentiates the company when compared to all other module suppliers headquartered throughout China, Japan, Taiwan, Korea and Southeast Asia – with the exception only of Canadian Solar, JA Solar, Trina Solar, Hanwha Q-CELLS and REC Solar.

But the gap between JinkoSolar and all other companies mentioned just above is not insignificant, and has certainly grown in the past few years. Indeed, on the global stage today, the leading Chinese companies that truly portray global-brand status can be counted on one hand: JinkoSolar, Canadian Solar and Trina Solar.

It is actually the above two factors combined that make JinkoSolar’s place in the PV industry right now different. The solar industry has not seen this before from a Chinese headquartered company, and during 2018, there is not a single reason why JinkoSolar will not further increase its market dominance.

What happens in 2019 is too far to speculate – there are way too many variables in the PV industry that can change quickly, impacting fortunes overnight.

Whether we are truly seeing the first signs of a global manufacturing powerhouse emerging in the industry, or just another cycle that will be replaced by another Asian company in a couple of years, is going to be a fascinating dynamic to observe and track over the next 12 months.