Major ‘Solar Module Super League’ (SMSL) member JinkoSolar has guided 2021 total product shipments (wafers, solar cells and modules) to be in the range of 25GW to 30GW.

The wide range – a 5GW spread – is stark in comparison to JinkoSolar’s initial annual shipment guidance range for the previous year (2020), which included only PV module shipments and was guided to be in the range of 18GW to 20GW, a spread of 2GW.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Management had noted in delivering fourth quarter and full-year 2020 financial results that it had been a very challenging year due to the COVID-19 global pandemic, while also noting the challenges in the mismatch between material supply (polysilicon and solar flat glass) and strong domestic and international downstream demand in the second half of 2020.

Xiande Li, JinkoSolar’s chairman of the Board of Directors and CEO said, “2020 was a very challenging year for the solar industry as global markets were shrouded in uncertainty due to the COVID-19 pandemic.”

“Since the fourth quarter of 2020, the mismatch between supply and demand continued to drive volatility upstream and downstream. We predict this scenario will continue into the second quarter of this year. While there are still supply shortages, there is enough polysilicon to support over 180GW of module production and supply is sufficient in most segments of the supply chain. As global installation levels are still likely to increase this year, demand for modules will revive once market prices are stabilized,” Li said.

Management noted in its latest earnings call with financial analysts that although the company had secured sufficient materials and products to meet its 2021 guidance range, it was still dealing with high material prices that in turn meant PV module pricing would have a negative impact of downstream markets until the supply and demand metrics rebalanced.

As many major PV manufacturers are facing, raising prices is almost inevitable as margin pressure accelerates due to high product demand.

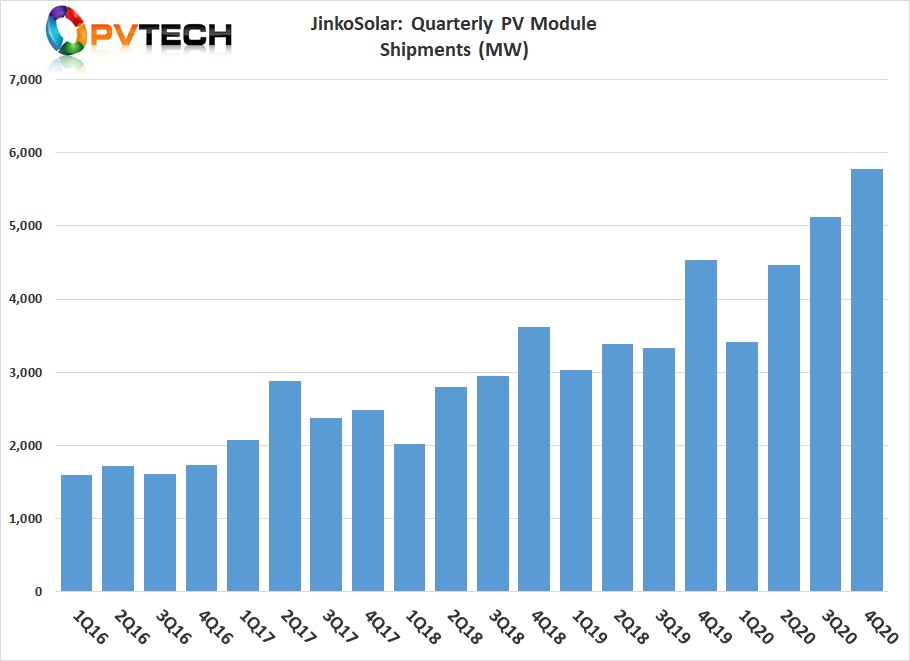

JinkoSolar reported strong fourth quarter 2020 shipments of 5,774MW, up 27.2% year-on-year.

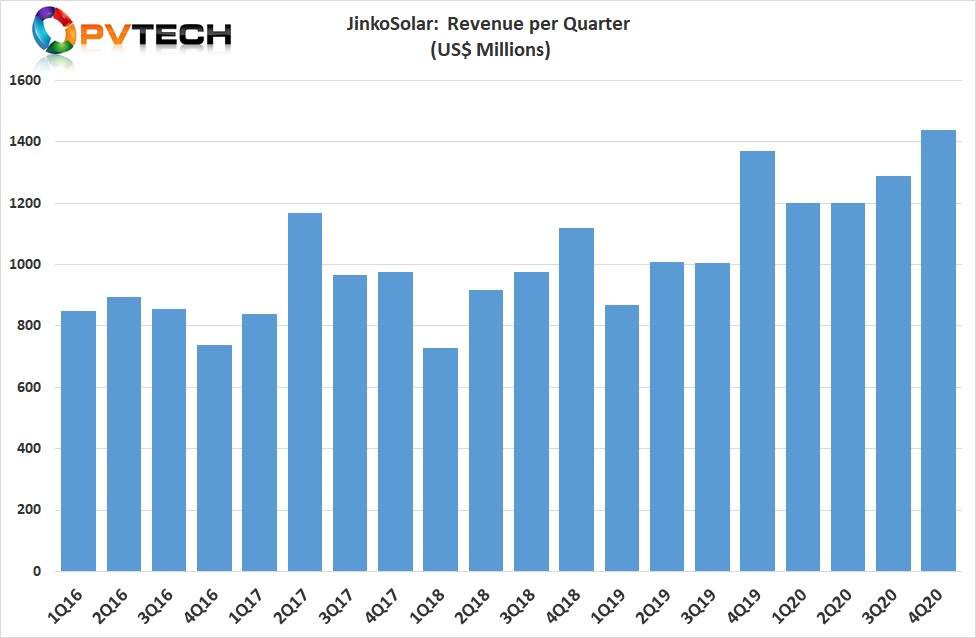

Fourth quarter revenue was US$1.44 billion, compared to US$1.37 billion in the prior year period, a 5% increase.

Although the company reported a gross profit in the quarter of US$230.9 million, which was down down 12.9% from the prior year period, JinkoSolar reported income from operations of US$11.0 million, down 88%, year-on-year.

JinkoSolar also reported a net loss of US$57.8 million that was attributable to the company’s ordinary shareholders in the fourth quarter, due to US$65.5 million loss of change in fair value of convertible senior notes and call option, according to the company, which was as a result of the sharp rise in its stock price during the quarter.

Not surprisingly, gross margin has been declining. In the fourth quarter, gross margin was 16.0%, compared with 17.0% in Q3 2020 and 18.2% in Q4 2019.

The company guided gross margin in the first quarter of 2021 to be between 12% and 15%.

Overall, JinkoSolar’s shipments in 2020 reached a company record of 18,771MW, up 31.4% year-year, and resulted in total revenue of US$5.38 billion, up 18.1%, year-on-year, another company record. Gross profit was US$945.8 million in 2020, up 13.6% from the previous year.

The wide shipment range for 2021 would seem to be attributed to the complexities of the upstream supply and material cost dynamics, coupled to strong downstream demand that could oscillate wildly as the downstream is highly sensitive to PV module average selling prices.