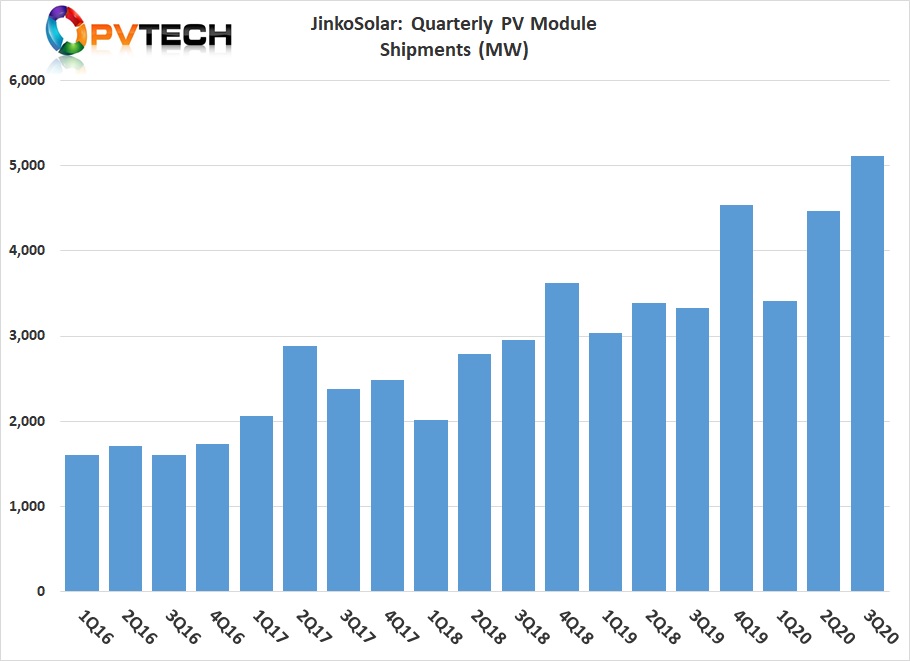

Leading ‘Solar Module Super League’ (SMSL) member JinkoSolar set a new quarterly module shipment record in the third quarter of 2020, reaching over 5G of shipments.

But the company has lowered its full-year shipment guidance, due to supply chain material shortages, notably solar glass, it revealed in a Q3 2020 update issued today.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The SMSL member reported total module shipments in the third quarter of 2020 of 5,117MW, up 53.8% year-on-year and 648MW higher than the previous quarter.

Module shipment guidance for 2020 was said to be in the range of 18.5GW to 19GW, down from previous guidance of 18GW to 20GW.

Kangping Chen, JinkoSolar's chief executive officer, revealed the company also expects its in-house annual monocrystalline silicon wafer, solar cell and module production capacity to reach 20GW, 11GW and 30GW, respectively.

“Even though we faced some pressures this quarter due to the shortage of raw materials which increased production costs, coupled with the impact of US dollar fluctuations and higher logistics and transportation costs, we have approached these issues proactively in a few ways. We managed to ensure the stable supply of core raw materials and auxiliary materials through long-term purchase agreements, strategic cooperation, and our R&D team identified and applied substitute materials to help ease supply chain volatility,” he said.

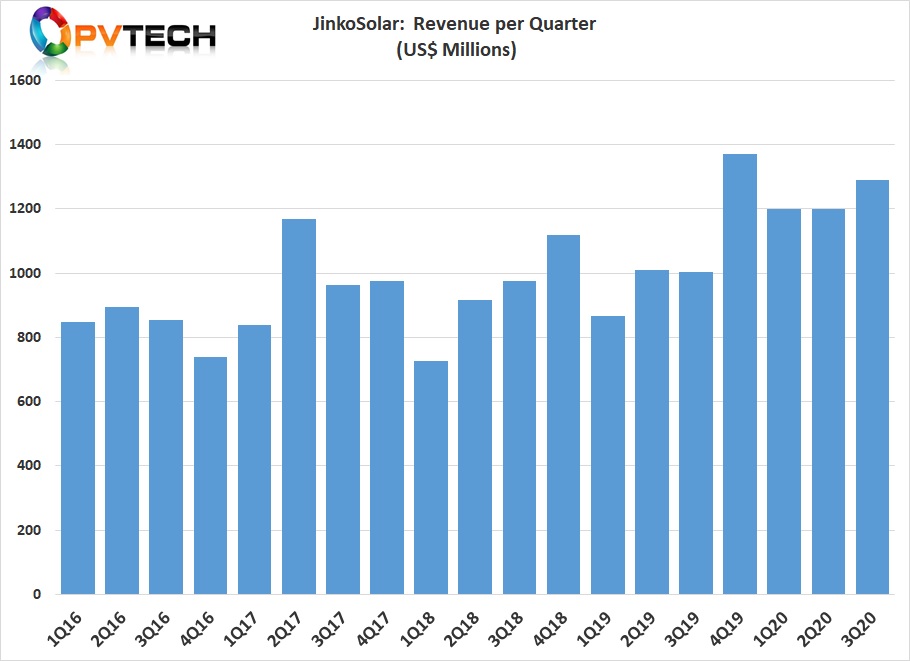

JinkoSolar reported total revenue of US$1.29 billion, an increase of 3.8% sequentially and 17.2% year-over-year.

Gross profit was US$220.2 million, up 8.2%, year-on-year, while gross margin was 17.0%, compared with 17.9% in Q2 2020 and 18.5% in Q3 2019. The decline was primarily due to the continued reduction in average selling price of solar modules.

Guidance

For the fourth quarter of 2020, JinkoSolar expects total solar module shipments to be in the range of 5.5GW to 6.0GW, while total revenue is expected to be in the range of US$1.31 billion to US$1.43 billion. Gross margin for the fourth quarter is expected to fall further and be in the range of 13% to 15%.

The company also said that it expected a significant increase in demand 2021 but bottlenecks of raw materials experienced in the third and fourth quarters of this year were expected to gradually improve in 2021.