Beijing Jingyuntong Technology Co (JYT) has secured four major large-area mono-wafer orders from PV module and solar cell producers totalling around RMB 16.78 billion (US$2.6 billion) in the last few weeks.

The combined four customer orders account for approximately 3.94 billion large-area wafers with supply starting in January 2021 through to the end of 2023.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The largest order received was from Solar Module Super League (SMSL) member JA Solar which was valued by JYT to be over RMB4.8 billion during the three-year contract.

JA Solar has historically met its wafer demand in-house with announced plans to take ingot/wafer capacity to almost 60GW in multiple phases over the next few years, up from 11.5GW of nameplate capacity in 2019. The manufacturer's order was announced on 7 January and is for approximately 1.26 billion wafers.

Major merchant solar cell producer Tongwei Solar (Chengdu) Co placed the second largest order, also filed on 7 January 2021, for around 960 million wafers, valued by JYT to be approximately RMB5.261 billion over the three-year contract.

Tongwei has previously secured the majority of its wafer needs from long-term strategic partner LONGi Group.

The third largest order was placed by Jiangsu Runyang Yueda Photovoltaic Technology Co (Runyang) worth RMB3.689 billion over the three-year contract, accounting for approximately 946 million wafers. This order was also signed on 7 January 2021.

Jiangsu Xinchao Photovoltaic Energy Development Co (Xinchao PV) placed the smallest of the four orders on 23 December 2020 and was valued by JYT to be worth around RMB3 billion. JYT will supply a total of around 774 million wafers over the three-year contract.

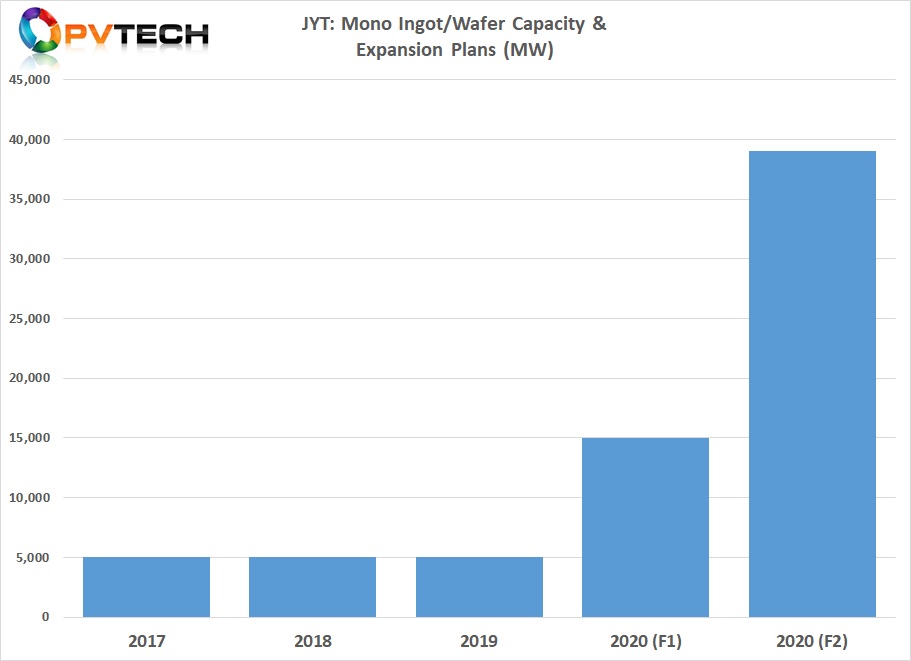

JYT had entered the mono wafer market in 2017, ramping a 5GW ingot/wafer facility in Wuhai City, Inner Mongolia.

In March 2020, JYT announced plans to increase capacity at the facility by a further 10GW. However, in November 2020, JYT announced it would build a 24GW ingot/wafer facility in Leshan City, Sichuan Province, dedicated to 210mm large-area wafer production.

The total investment in the large facility was said to be around RMB7 billion (US$1.0 billion), which would be built in two 12GW phases. The new project could take several years build and then fully ramped, according to the company.

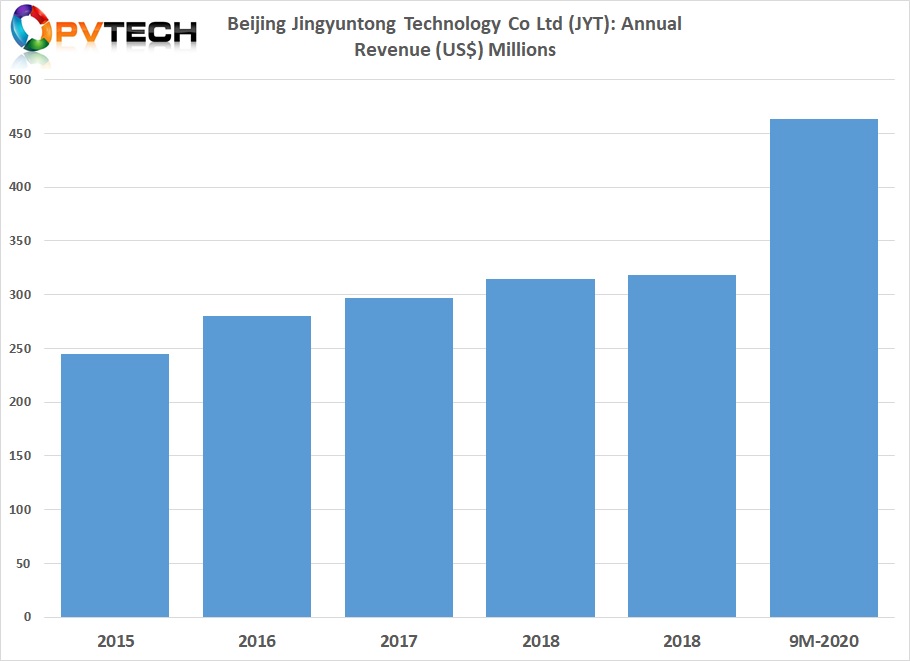

It should be noted that the initial 5GW wafer plant did not have any meaningful impact on revenue growth over the course of the three years it took to ramp.

However, from the first nine months of 2020, it is clear that the wafer business revenue has made a meaningful contribution and is set to become the key drIver of revenue growth going forward.