Average renewable energy power purchase agreement (PPA) deal price in Europe fell marginally to €46.37/MWh (US$53.36/MWh) in the last week of October, but this relative stability in deal prices comes as the number of deals signed has decreased.

This is according to the latest figures from Pexapark, which attributes the decline in the number of deals signed to “a lack of PPA pricing consensus” across Europe. Pexapark’s figures are broadly in line with those from fellow analyst LevelTen Energy—which reported that solar PPA prices had remained relatively stable, but fallen slightly, in the third quarter of this year—and Pexapark’s reporting shows that just three deals were signed in Germany in the third quarter, demonstrating this slowdown in dealmaking.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

These deals accounted for a total capacity of 169MW, and were “largely confined to niche on-site corporate arrangements,” according to Pexapark.

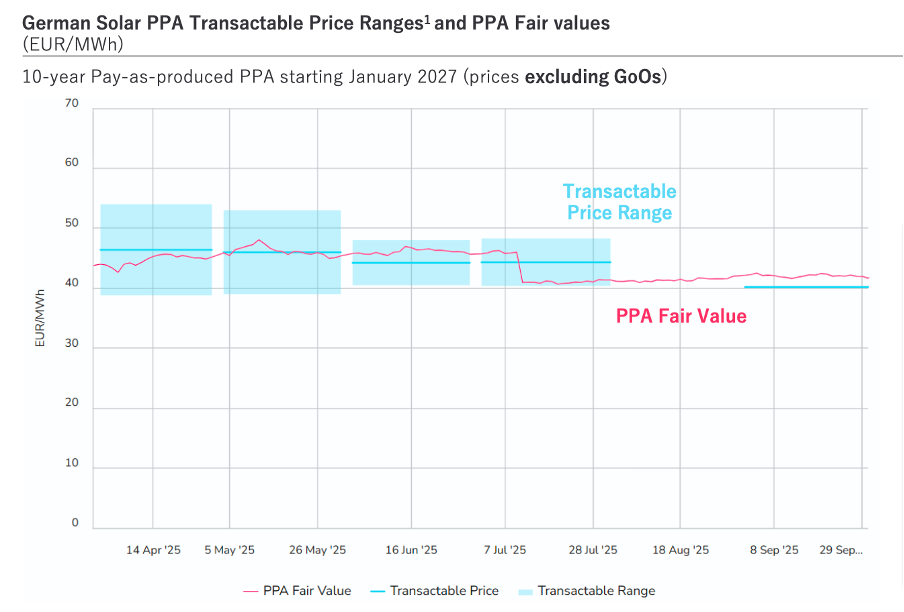

Pexapark demonstrates this trend further using a metric it calls “transactable price range”, the range between the highest and lowest bids received for an offtake contract that together show the maximum price range for which a deal could be signed. The graph below shows that, in the German solar space, April, May, June and July saw a healthy number of offers made for each project, leading to a wide transactable price range, but such a breadth of offers has not been apparent since August.

“The challenges observed in Q3 clearly show that the disconnect between price, driven by developer costs and regulatory benchmarks, and value, driven by forward prices, capture risk and buyer appetite, is a primary constraint on renewables dealmaking,” explained Pexapark COO and co-founder Luca Pedretti.

“When bid ranges fall short of minimum offer ranges, transactions stop. This isn’t due to a lack of ambition—it’s a symptom of poor information and understanding of pricing by different counterparties.”

Uncertainty in solar, complexity in storage

Pexapark suggests two key forces are affecting the European solar sector and slowing down the completion of deals. One pertains to solar itself, where buyers have “continually lowered capture assumptions” due to long-standing concerns of curtailment and negative pricing in Europe. Earlier this year, PV Tech Premium spoke to think tank Ember Climate about the vulnerabilities of Europe’s grids, with more than half of the continent’s power systems having “limited” electricity import options.

This uncertainty has caused buyers to lower offer prices for solar PPAs, as they are pricing in risk from oversupply and negative pricing into their bids.

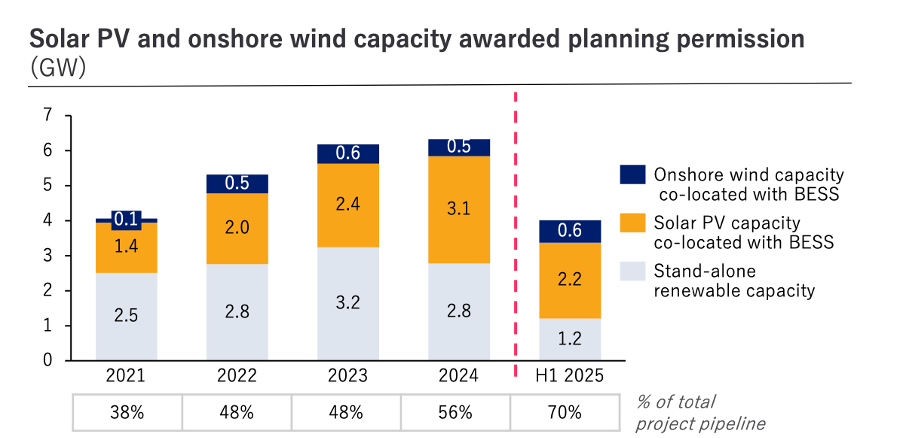

The second force is the growth of battery energy storage systems (BESS), with an uptick in the number of deals signed for projects that consist of renewable power generation co-located with batteries. In the UK, for instance, around 70% of new solar and wind projects that started operations in the first half of this year were co-located with batteries, in part to sidestep some of the concerns with the country’s grid capacity.

However, according to analysis from LevelTen Energy, the prominence of co-location has introduced additional complexities to renewable offtake dealmaking, slowing down the pace of deals being signed as developers and offtakers alike are having to manage more variables for each of their deals. While greater integration of storage into Europe’s renewable energy sector may well improve the reliability of renewable electricity generation in the long-term, in the short-term it is sharpening the learning curve for developers and offtakers in the sector.

Setting a precedent in Italy and the UK

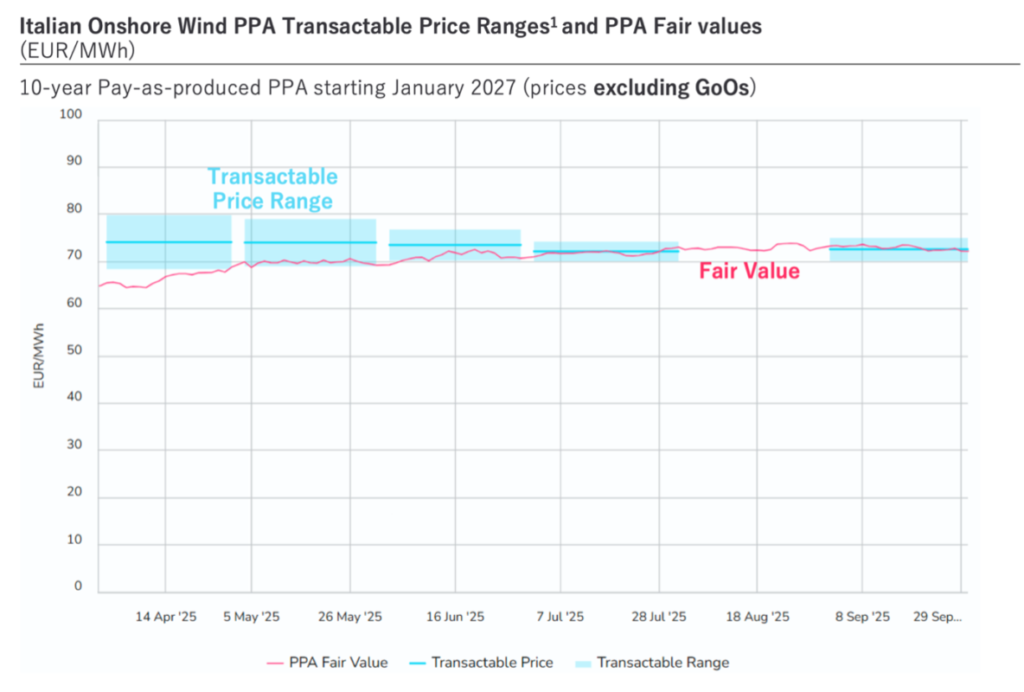

However, the Pexapark report does include some more positive trends for the European renewables sector, particularly in the form of Italy, which it says demonstrates a “strategic counterpoint” to growing concern and reluctance to sign deals.

The report argues that “structured, long-term regulatory frameworks” have secured investor confidence in the sector, and this is borne out in two key metrics: Italy saw ten renewable PPA deals signed in the third quarter of this year, an increase over the previous quarter; and offtake deals have seen a broader and healthier transactable price range than in Germany.

The graph above, covering the Italian wind sector, demonstrates how Italy has maintained a broad enough transactable price range to encourage investor confidence, even though this range has shrunk in line with diminishing investor optimism across Europe.

Supportive government policies have also helped prop up investor confidence in Italian renewables, with its latest renewable energy tender drawing 10GW worth of bids for new solar projects. This follows Italy exceeding 40GW of cumulative solar installations over the summer.

Similarly, the UK’s Labour government has sought to approve more renewable energy capacity since its election last year, particularly in the storage space. The graph below shows that the government has approved 2.2GW of solar-plus-storage capacity in the first half of this year, close to the total solar-plus-storage capacity approved in 2023 and more than in both 2021 and 2022.

Indeed, the UK has already approved more onshore wind-plus-storage in the first half of this year than the entirety of 2024, with co-located renewable capacity approvals across technologies already in line with the year-end totals of previous years.