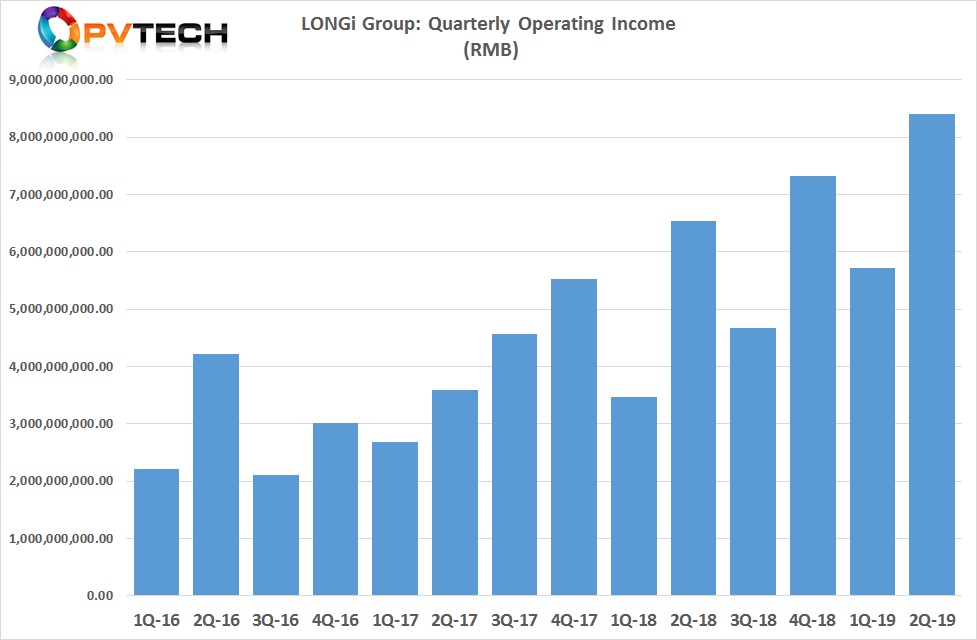

Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member LONGi Green Energy Technology (LONGi Group) has reported second quarter 2019 revenue of approximately US$1.17 billion, a new quarterly record, due to monocrystalline wafer shipments increasing by 183% in the first half of 2019, compared to the prior year period.

LONGi Group reported first half year revenue (operating income) of RMB 14.1 billion (US$1.96 billion), compared to RMB 10 billion in the first half of 2018.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Mono wafer shipments were the key driver for the first half year financial results. Mono wafer sales topped 2,148 million pieces, a 183% increase, year-on-year. A total of 795 million pieces were used in-house for SMSL member, LONGi Solar.

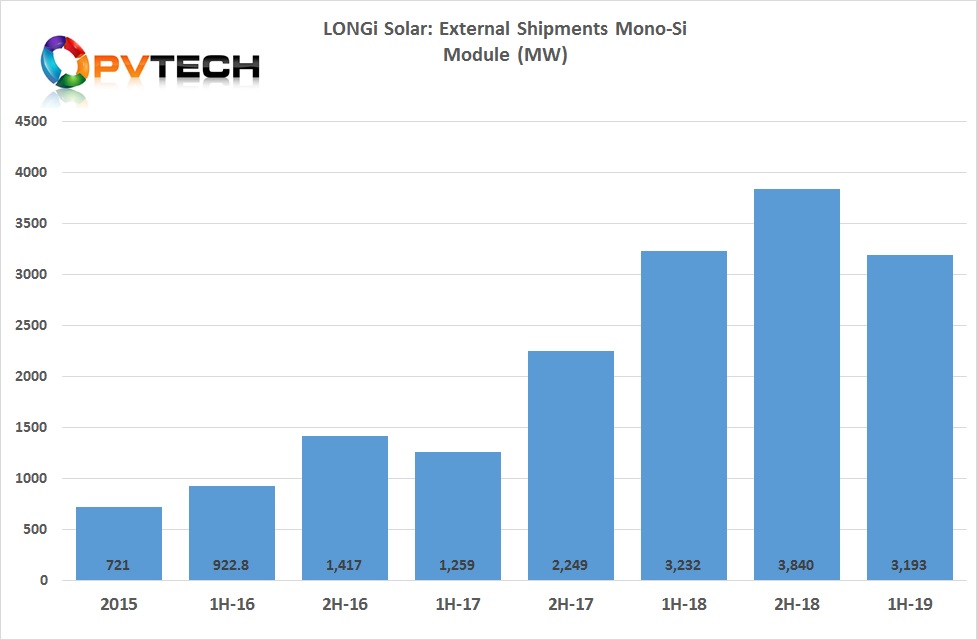

In the first half of 2019, module shipments reached 3,193MW, compared to 3,232MW in the prior year period. However, module shipments overseas accounted for 76% (2,423MW) of the total sales, with overseas revenue increasing significantly.

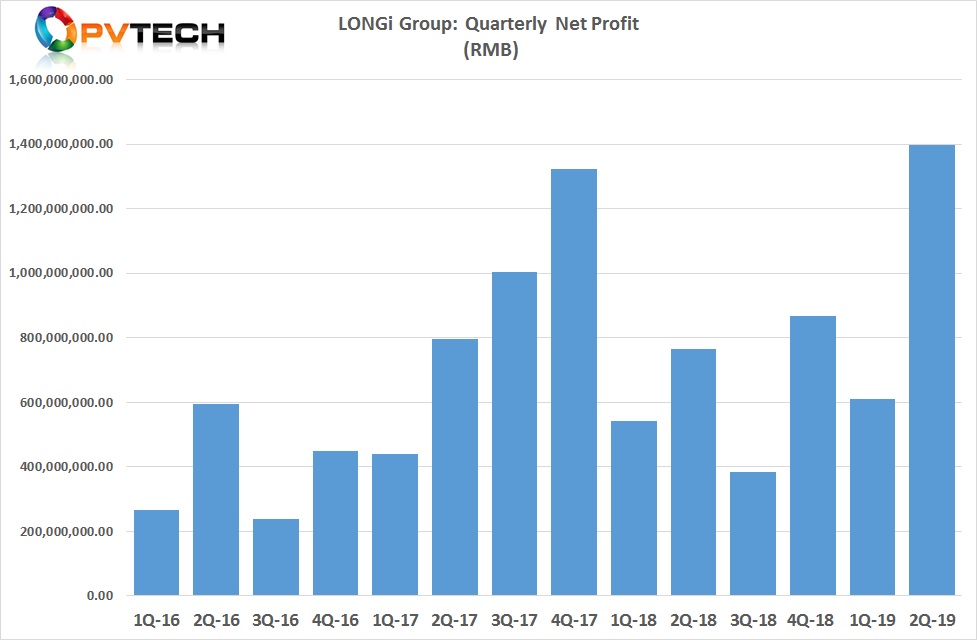

LONGi Group reported a net profit attributable to shareholders of RMB 1.996 billion, up 59.15% year-on-year. Group gross profit margin was 26.22%, an increase of 3.6 percentage points, year-on-year.

As PV Tech recently highlighted, LONGi was the biggest spender on R&D in 2018, its second consecutive year of topping the R&D rankings, having spent US$182.74 million, up from US$175.47 million in 2017.

In the first half of 2019, LONGi reported R&D expenditure of RMB 718 million (US$100.12 million). LONGi Group and Hanergy Thin Film were the only two companies to surpass US$100 million in R&D spending in 2018, from 21 public listed PV manufacturers tracked by PV Tech.

Manufacturing update

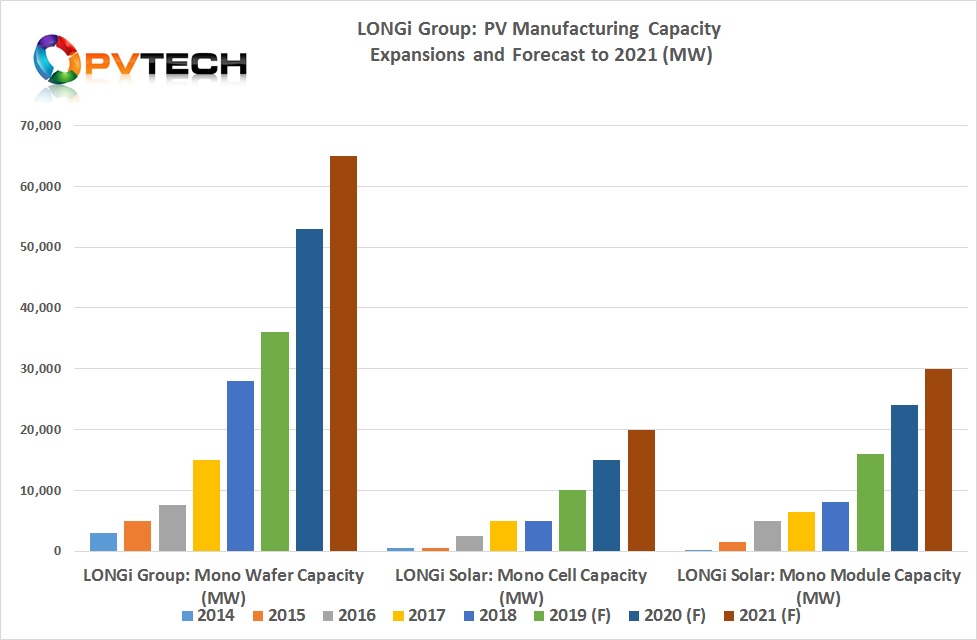

According to LONGi’s “Production Capacity Planning for the next three years (2019-2021)”, the company plans to achieve 65GW of mono ingot/wafer capacity by the end of 2021.

Solar cell capacity is planned to reach 20GW by the end of 2021, while module capacity is planned to reach 30GW by the end of 2021.