Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member LONGi Green Energy Technology (LONGi Group) set new record revenue, profitability and product shipments levels in 2019, while continuing growth through the challenging first quarter of 2020, due to the COVID-19 pandemic.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

2019 financials

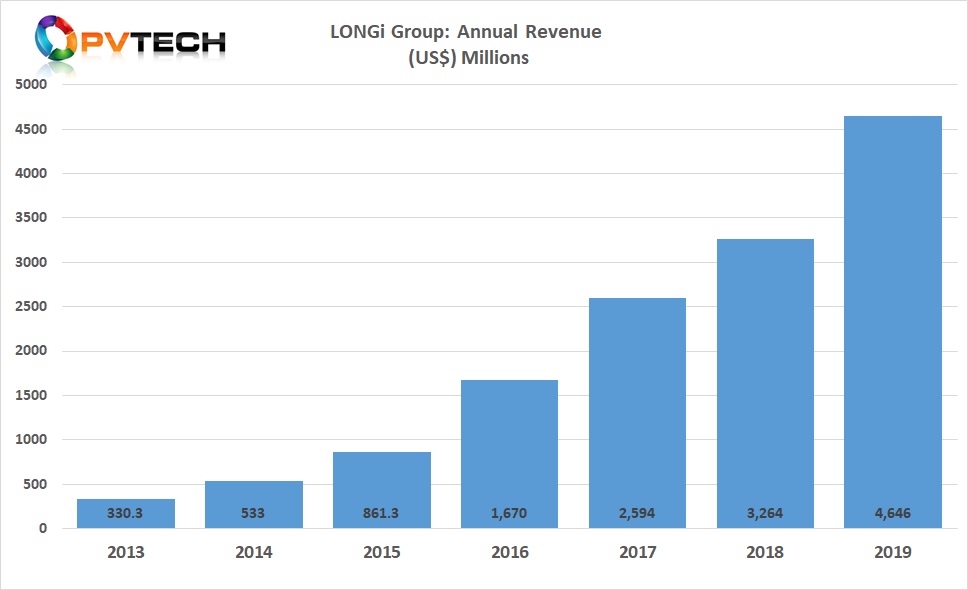

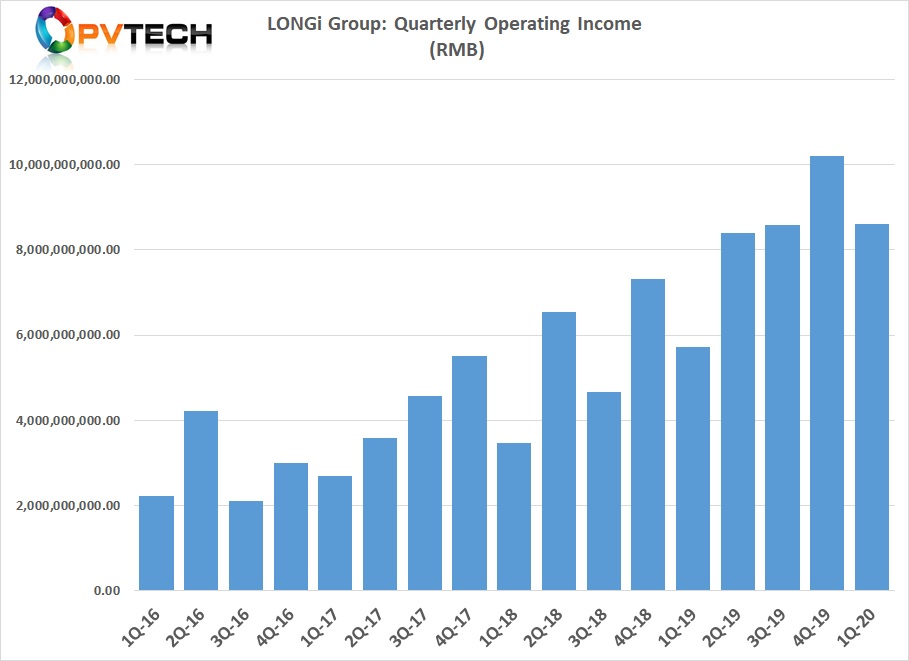

LONGi reported full year 2019 operating income (revenue) of RMB 32.897 billion (US$4.64 billion), an increase of approximately 49% from 2018, and a new company record.

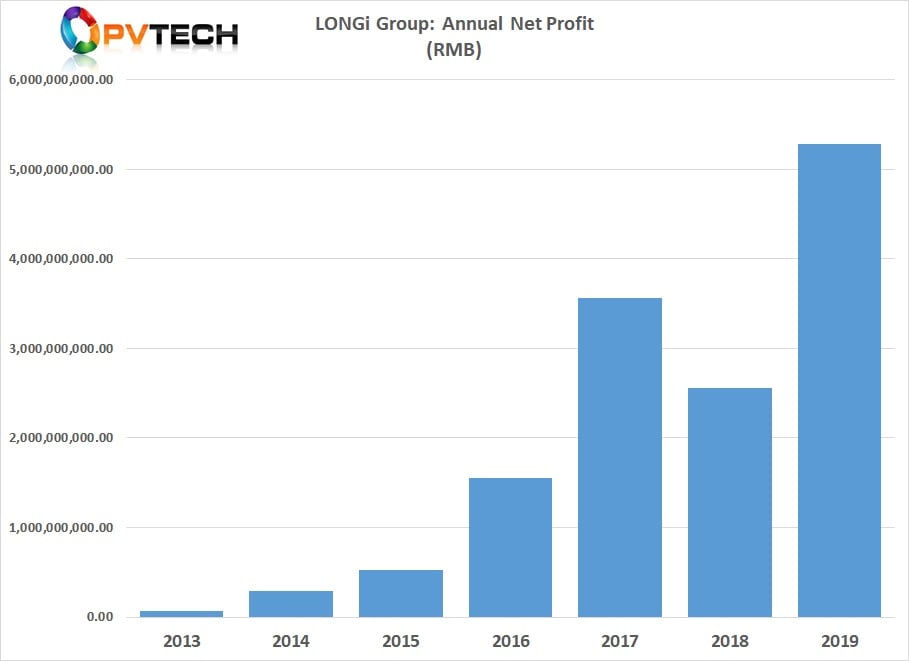

Net profit attributable to shareholders increased by around 106.41% in 2019 to RMB 5.28 billion (US$745.9 million), compared to the previous year. The significant leap in profitability set a new benchmark for the company.

Both record revenue and net profits were driven by significant increases in product sales during the reporting period.

LONGi reported annual monocrystalline silicon wafer unit sales of 4.702 billion pieces in 2019, a 139% increase, year-on year. As of the end of 2019, the company's monocrystalline silicon wafer production capacity reached 42GW. LONGi plans to reach a monocrystalline wafer production capacity of 75GW in 2020.

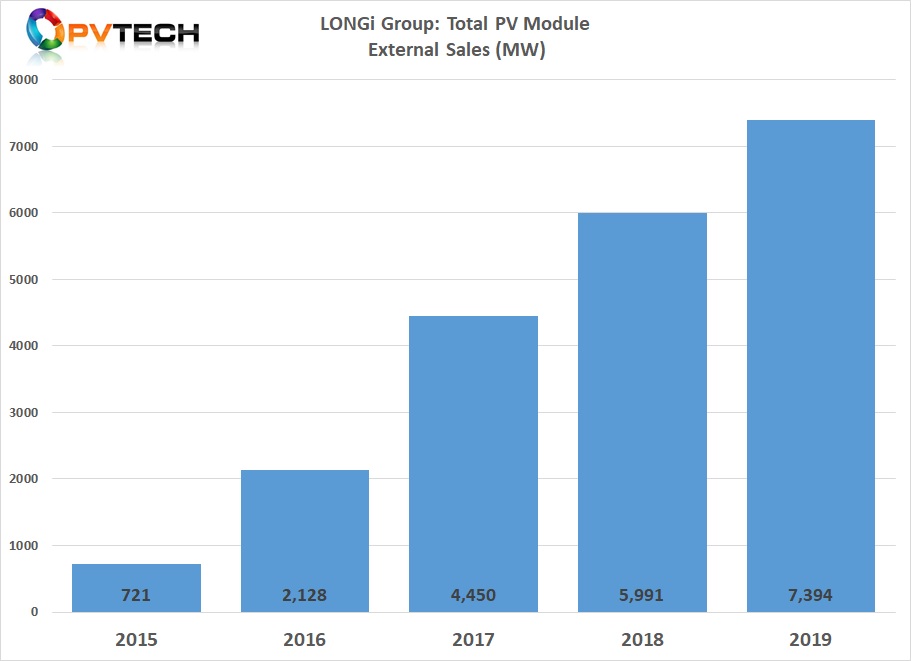

Volume sales of solar cells and PV modules through its subsidiary, LONGi Solar reached 7,394MW, a 23.43% increase, year-on-year. This was also a new record for the company.

Overseas PV module sales reached 4,991MW, a year-on-year increase of 154%, and accounted for 67% of total external sales of modules.

LONGi Solar’s module production capacity 14GW as of end-2019, while plans are to more than double module capacity to 30GW by the end of 2020.

During 2019, LONGi launched key new products such as the M6 larger-area mono wafer and Hi-MO4 PV module. The company noted that it had secured global orders exceeding 10GW for the of Hi-MO4 module.

Q1 2020 financial results

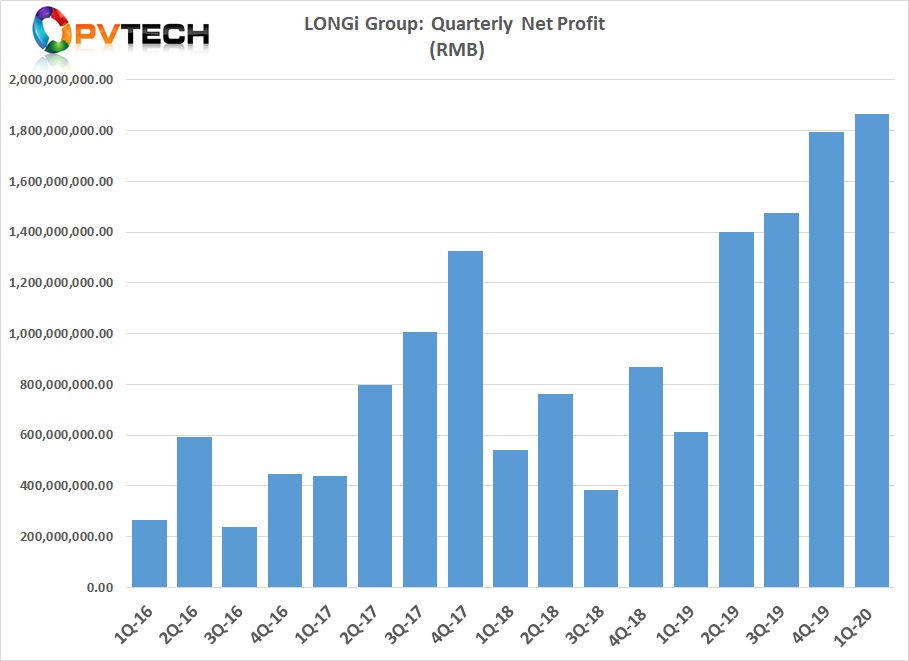

LONGi also released first quarter 2020 financial results, which included revenue of RMB 8.599 billion (US$1.21 billion), compared with US$826.3 million in the prior year period.

The company reported a net profit at RMB 1.864 billion (US$263.37 million in the first quarter of 2010 ($267.4 million) , up around 205% compared to the prior year period. A new record for the company.