‘Solar Module Super League’ (SMSL) member LONGi Solar, a subsidiary of LONGi Green Energy Technology, has achieved its highest ratings to date in the recently released Bloomberg New Energy Finance (BNEF) Solar Module & Inverter Bankability 2019, report.

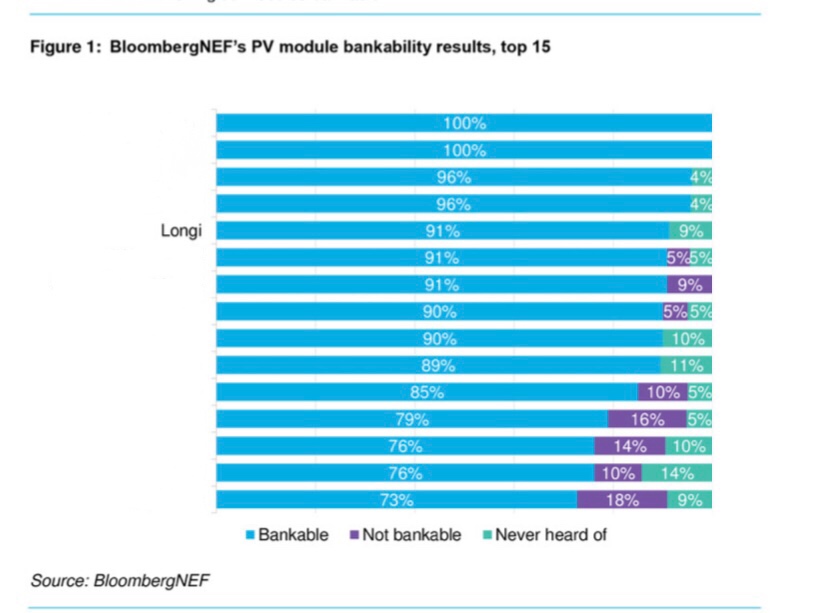

Within BloombergNEF’s latest bankability rating survey that asks banks, funds, developers, EPCs and technical due diligence firms, which brands out of 48 modules manufacturers they considered bankable, LONGi Solar was rated 91% bankable, its highest ever ranking.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

LONGi Solar was also ranked within BloombergNEF’s latest report as the most creditworthy module manufacturer. Its Altman-Z score of 3.1 indicates strong financial health and bankruptcy to be highly unlikely, and is the highest score among pure-play module manufactures, according to the report.

LONGI was the second most used brand with 1,447MW deals financed, according to the latest BloombergNEF’ report, out of its Top 15 PV module suppliers.

First PV module supplier bankability ratings tool created by PV Tech research team

PV Tech research team has recently introduced a new methodology that allows leading PV module producers to be categorised by manufacturing and financial strength metrics, ultimately providing an investor-risk (or bankability) profile for non-residential end-market selection, which has been detailed on six articles on PV-Tech.org.

The output from the analysis – undertaken by the PV Tech research team over the past five years – will form a key part of my opening talk at the forthcoming PV ModuleTech 2019 conference in Penang, Malaysia on 22-23 October 2019.

Finlay Colville, Head of Research, PV Tech & Solar Media, will deliver online webinars over 21-22 August 2019 (register to watch here), and give the 45-minute opening talk at the forthcoming PV ModuleTech 2019 conference in Penang, Malaysia on 22-23 October 2019.

In particular, during the forthcoming webinar presentations on 21-22 August 2019, I will reveal for the first time which PV module suppliers fall into the highest PV ModuleTech Bankability ratings grade today.