Undetected faults and damage in solar PV modules, like cracks, manufacturing errors and foreign material, pose a “significant risk” to the solar industry according to a new report from US renewables firm Clean Energy Associates (CEA).

Through testing over 300,000 modules deployed across 150 project sites in 16 countries, including the US, Canada, Australia and areas of Western Europe, CEA’s Solar PV Module Quality Risks report found defects present at over 80% of sites.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

‘Invisible’ defects

The two most common defects were line cracks and soldering errors, which CEA said can both occur during manufacturing.

In the case of line cracks, which were found in 83% of the tested sites, water imperfections, light impacts on the cell/module or pressure on the cell during manufacturing can ultimately lead to an increase in internal series resistance and a loss of power.

Soldering errors are more completely consigned to the manufacturing process and were found in 78% of sites. CEA said they reduce cell efficiency and, in severe cases, can cause hotspots which damage the modules.

Complex cracks, which occur through handling and installation or severe weather, were found on 76% of tested sites and can cause large inactive areas of the module that severely impact performance. 29% of sites had edge ribbon cracks, which form where the interconnecting ribbon (or wire) crosses the edge of the cell. However, in sites where modules with half-cut cells were used, incidences of edge ribbon cracks rose to 81%.

The most eyebrow-raising result was a “massive increase” in micro-cracks between the start of 2022 and mid-2023. CEA found that incidences of both line cracks and complex cracks in US modules rose 47% from the start of 2022, the period in which the US has begun to both produce and deploy more solar modules following the Inflation Reduction Act (IRA). But, it should be noted that correlation does not prove causation.

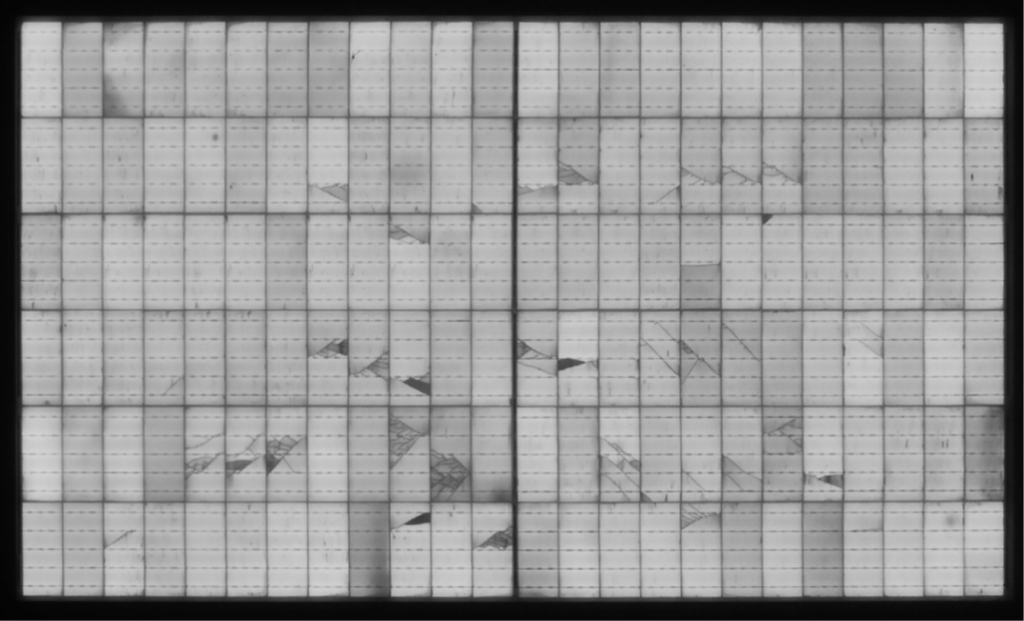

All of these defects are only visible through the use of electroluminescence testing, which CEA said is done by passing a current through a solar module in a dark environment and capturing the emitted infrared light with specialized cameras.

Visible defects

Foreign material present in modules was the top defect that could be found upon visual inspection, present in 55% of the 29 visually-audited sites in CEA’s report. Second was cell-to-edge of glass defects, which were present in 52% of sites. These, CEA said, could result in a fire risk in extreme cases due to internal electricity arcing.

45% also showed glass stains and encapsulant defects, many of which arise from improper diligence at factories and can impact module performance and conversion efficiency. Cell-to-cell were also found in 41% of sites, where cells are misaligned and the distances between them are inconsistent.

CEA did not clarify which technologies were tested, or if there were discrepancies between different cell technologies.

Quality assurance

Whilst defects occurred through shipping, installation and increased extreme weather events, the majority arose during the manufacturing process, CEA said, and show the need for independent, third-party quality assurance schemes and increased awareness of quality issues throughout the solar industry. It was not made clear in the report how significant any one of these issues is, or what the specific impact on module efficiency and performance might be.

One of the reasons for the issues is that “Many module buyers are procuring from new and inexperienced suppliers due to supply chain challenges, leading to increased quality issues.”

To this effect, testing centre PV Evolution Labs (PVEL) published a blog on PV Tech earlier this year outlining the new opportunities – but also the new risks – brought about for module reliability by the IRA in the US, where much of the new manufacturing capacity of the last year has been concentrated. Amongst the well-documented raft of opportunities that the IRA and a manufacturing boom holds for US developers, PVEL emphasised that in the US “regardless of their source, buyers need to take caution that not all PV modules are the same.”

A report from solar management software provider Raptor Maps in February projected that solar module underperformance could cost US$2.5 billion globally, and that reported incidences of underperformance had more than doubled since 2019. The number of modules being deployed, and by extension the number being analysed and defects detected, has also increased considerably since 2019.

In Europe, where domestic production is less and imports account for almost the entire market, the issue exists too. Speaking at the Solar and Storage Live 2023 event in Birmingham, UK last month, CEO of UK-based solar technical advisory firm 2DegreesKelvin, John Davies said: “We’re still seeing a huge, alarming amount of manufacturing defects coming through on brand new, fresh out of the packet modules from tier one manufacturers. There’s a lot of manufacturing defects that actually effect the power and will deteriorate over time.”

Concluding its report, CEA said: “There’s a need for awareness on the increasing quality issues seen in PV modules. It’s essential to address these issues on time, preferably before the project is installed, to ensure optimal performance.”