Identifying reliable module supply has become a huge challenge in the PV industry over the past couple of years. Moving forward, the industry needs to create a more globally-diversified manufacturing footprint, thereby avoiding any unexpected trade-related barriers that could be enforced. Understanding which module suppliers are going to prevail in this landscape will become of key importance over the next 12-18 months, Finlay Colville explains.

Since the start of 2022, the solar PV industry has been kept busy by strong investments in new capacity, record high levels of production through the value chain, and a new round of measures being considered in the US that may affect Chinese module suppliers with capacity in Southeast Asia.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Set against a backdrop of a 200GW-plus end-market in 2022, there are now 50-60 module suppliers seeking to ship as many modules as possible, keep manufacturing costs to a minimum and work out which regional end-markets are the best ones to focus on.

This article takes a fresh look at this select group of 50-60 PV module suppliers that make up 98-99% of all module supply to the industry this year, and are ultimately the ones that are being audited, accounted and inspected the most. Analysis and discussion is presented that explains how much of the module component supply (in particular polysilicon, wafers and cells) is from in-house sources, how many of the module suppliers are serving a global end-market, which companies are least impacted by duties when exporting to the U.S., and what if anything might change next year.

The key 50 – 60 PV module suppliers in 2022

Despite the perennial speculation within the industry that consolidation is imminent, all too often the opposite appears to be happening. However, it is important always to assess the importance of new entrants, in particular those that are established to be domiciled in their country-of-origin; or those set up to be OEM suppliers for named brands, for example. This topic is discussed in more detail later.

At the start of 2022, there are between 50 and 60 module suppliers that account for at least 98% of global supply. The remaining 2% is spread across a further 50-plus companies. It is perhaps a consequence of a rapidly growing sector – combined with various domestic drivers in place to stimulate final module assembly – that such a large number of entities exist today.

There are many different ways to rank the 100-plus companies claiming to be credible module suppliers. Sometimes, they are ranked on claimed nameplate module capacity levels. Another option (but harder to establish) is to list them all by module supply. Neither one of these really helps module buyers.

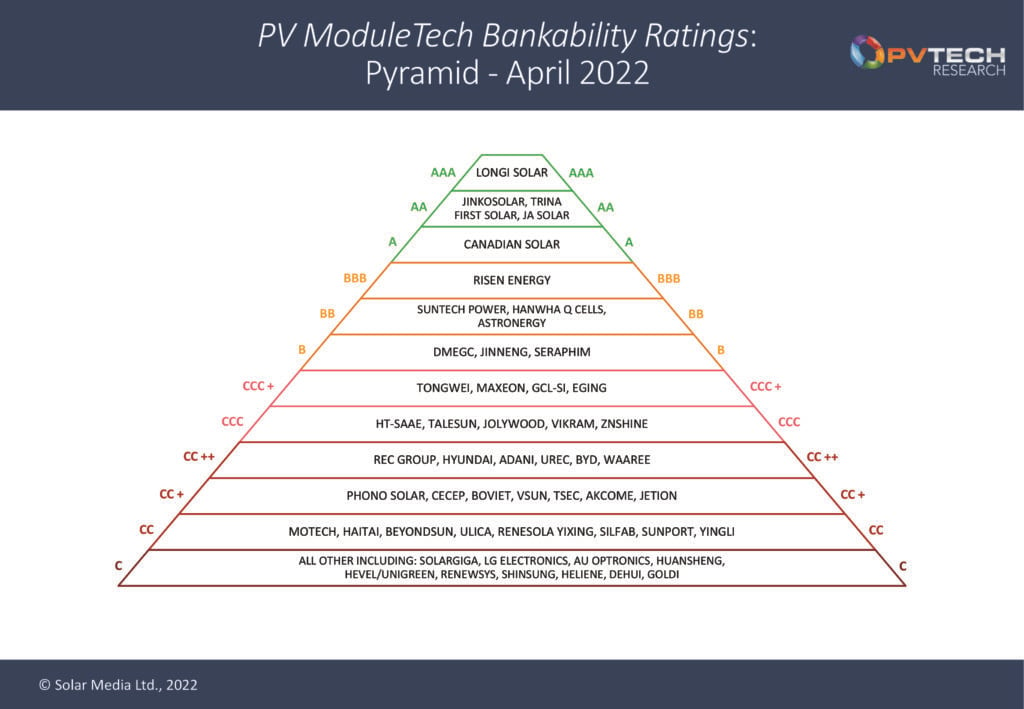

Released in 2019, PV Tech’s PV ModuleTech Bankability Ratings is now widely recognised within the industry as the first detailed analysis of module suppliers that can rank companies by examining a wide range of manufacturing and financial metrics every quarter. The latest bankability pyramid is shown in Figure 1, identifying the 50-60 PV module suppliers that occupy the various ratings bands from the highest (AAA-Rated) to the lowest (C-Rated).

Each of the 50-60 PV module suppliers has a different corporate strategy; a different focus on manufacturing components that go into the modules; differentiation in terms of module capacity allocations globally; and differences in shipment volumes around the world. Financial health shows far greater variation than manufacturing differences. The overall combination of manufacturing and financial health metrics ultimately forms the hierarchy shown in Figure 1, as the PV Tech measure of module bankability derived from both manufacturing and financial health benchmarking.

Who makes what in-house?

The Xinjiang issue – and more broadly module component supply-chain auditing – has become a major purchasing decision for US buyers (enforced by tariffs) and a sub-set of global entities that have a strong moral compass and want to show transparency and traceability in terms of module supplier selection.

This has exposed the whole who-makes-what issue within the industry to a level not seen before. Central to this is how many module suppliers, as shown in Figure 1, even make their own cells and wafers, far less have any control over where the polysilicon comes from (the Xinjiang issue).

Less than half of the module suppliers in the top 50-60 make their own solar cells. The rest buy in cells, and assemble these into modules, often serving domestic end-users. In fact, even across the 15-20 module suppliers that make cells themselves, most of these companies operate a flexible supply-chain model, typically buying in large volumes of cells from other companies.

Across the leading A-Grades (AAA, AA and A-Rated), only a small grouping makes a high proportion of their own cells. If like-for-like value-chain production is normalised between silicon-based product and thin-film manufacturing, then First Solar becomes the only module supplier that makes 100% of product in-house, with the exception of glass panels that are bought in as the starting point in the production lines. On the silicon-side, JinkoSolar, JA Solar, Hanwha Q CELLS and LONGi Solar are the most cell-and-module ‘friendly’, where it can be said that cell production is prioritised to the same level as module production/supply.

Therefore, even before moving to wafer (or further upstream to ingot pulling and polysilicon production), only a small handful of leading module suppliers can lay claim to being in control of cell manufacturing (and the associated wafer supply and cell processing materials).

The list of module suppliers that make wafers (and ingots) and cells is even more diluted. In fact, JinkoSolar, JA Solar and LONGi Solar are the only ones of note today. None of these companies makes their own polysilicon; this all comes from a separate group of (mainly Chinese) producers.

Therefore, before looking at any other benchmarking metric for the leading 50-60 module suppliers, it is clear that they differ hugely in terms of making module components in-house. However, the plot thickens even more when looking at manufacturing footprint; where wafers, cells and modules are made.

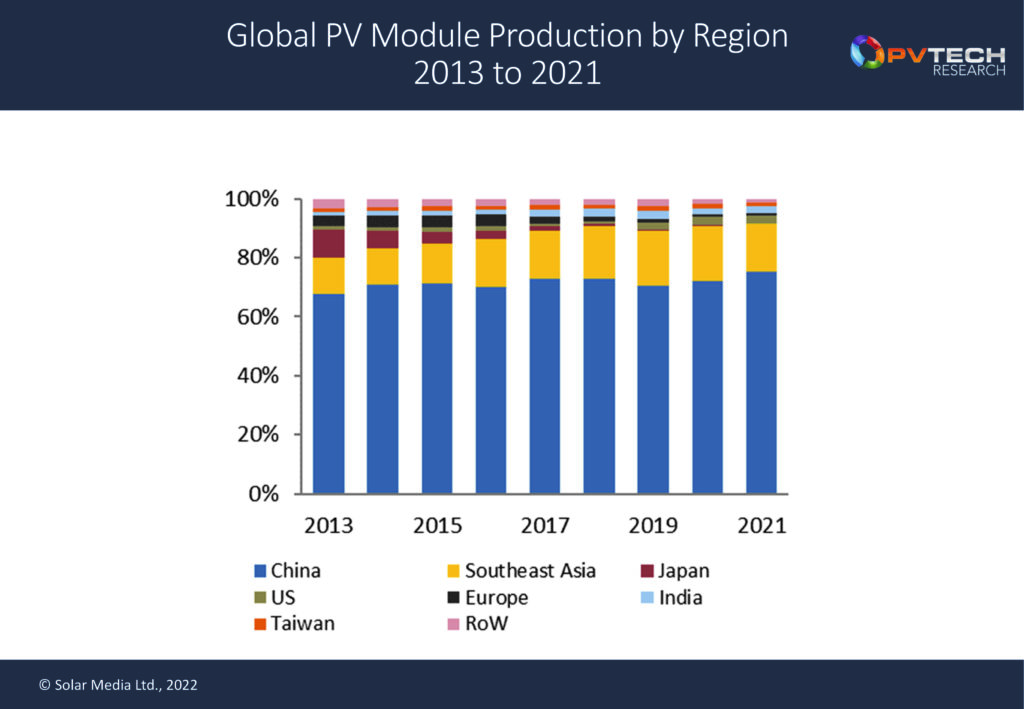

Focusing on the module suppliers (and their associated upstream manufacturing stages), almost all wafers are made in China, with the notable exception of LONGi Solar (some Malaysia capacity), JA Solar and JinkoSolar (each with some capacity now in Vietnam). The Southeast Asia capacity for these three companies was located there mainly for the purpose of feeding into cells (and modules) also made in Southeast Asia and shipped to the US market. Figure 2 shows recent trends in PV module production, with increased focus on China and countries across Southeast Asia.

At the time of writing this article (early April 2022), the PV industry is currently having to deal with potential outcomes of a new investigation by the Department of Commerce (DoC) in the US related to possible circumvention of its 2012 anti-dumping (AD) and countervailing duties (CVD) enactment that placed an import tariff on Chinese produced solar cells and modules shipping to the US. If this new case (AntiCirc ) is to be upheld by the DoC, it would create another level of scrutiny on the underlying who-makes-what-where debate. Simply put, anyone buying modules now has to be aware of far more manufacturing issues than was ever the case before.

How many module suppliers have a global footprint?

Putting all manufacturing nuances aside, a further issue differentiating the 50-60 module suppliers can be seen when looking at where modules are shipping to. Rather than working out and trying to explain company-specific market-shares in key end-markets (such as Europe or the US), it is more intuitive to review how many of the 50-60 module suppliers have strong overseas (or global) business.

This turns out to be an excellent filter to apply. Clearly, if certain companies are making all their modules in China and only serving the domestic market, it is questionable how relevant they are to overseas buyers. The same could be said of India, a country still dominated by domestic module suppliers doing business within the country.

Global module purchasing agreements are becoming more widespread in the solar industry today, driven by international corporates, major energy utilities, and diversified investors/funds. This trend is only likely to increase going forward, and almost every module supplier today would love to be on any of the respective short-lists for suppliers within these buyer categories.

Approximately 20 of the top 50-60 module suppliers can be considered as credible global players. Of this grouping, about half a dozen serve each of the key end-market countries/regions routinely. The others tend to be strong domestically, and then have a couple of overseas markets where they focus sales and marketing resources. In fact, if AntiCirc does come to fruition in the US, this very small subset could have even fewer members.

The lack of global module suppliers has come into being largely by default, rather than being a proactive decision on the part of module suppliers. Some companies have just found themselves in a position where domestic manufacturing levels are fully consumed (with decent margins) locally. In this situation, it could be argued that exporting is simply an unnecessary luxury. Conversely, other companies have spent much of the past decade trying to diversity manufacturing footprints, only to come up against unforeseen trade issues (AD/CVD, Section 201, AntiCirc in the US, and similar actions in Europe and India).

At some point in the future, the industry may see companies choosing to make modules (and better still wafers and cells) in different regions globally because they see this tactic as a way of serving local demand only: not simply as a way of avoiding import duties that may prevail at any given time, as has been the case with the US market for more than a decade now. It should be noted that there are no clear signs this is going to happen in the next couple of years. At best, this could be something to aspire to in the 2025-2030 period.

Which suppliers are AD/CVD, Section 201 & AntiCirc risk-free?

Currently, buying modules in the US has the highest barrier-to-entry from a module supplier standpoint. By contrast, the rest of the world is still largely open to modules made in China, and using an entirely Chinese-sourced/produced supply-chain. If this landscape was set in stone – with nothing changing in other regions or within the US – then the problems of US module buying would simply be localised and not of any great interest to companies doing business elsewhere in the world.

Of course, it is highly unlikely things will remain static. More likely, the current issues impacting module supply to the US market will emerge more frequently elsewhere in the world; and since the US is subject to so many of the pressing global trade issues today, it becomes almost an ideal case-study in terms of assessing risk across module supplier short-listing. So, what set of conditions would have to prevail to make a PV module supplier to the US market truly risk-free?

- Modules should not contain any polysilicon (or metallurgical-grade silicon) that was produced in Xinjiang; better still, to be truly risk-free, made outside China.

- The ingots and wafers should be made in-house by the company selling the modules, or specified by the cell producer (for the modules) in a way that satisfies the above condition.

- The cells used in the modules should be made in-house by the company selling the modules.

- The modules should be made by the company selling them, and not by a third-party entity (OEM).

- The cells and modules should be produced in countries that remove any import duties arising from conditions set out by AD/CVD, Section 201 or (possible) AntiCirc barriers.

- The module supplier should have sufficient product availability to meet gigawatt-levels of shipments within a three year period (specified to emphasize long-term high-volume supply).

- The module supplier should have a credible track-record in supplying (on-time and with reliable product) to large-scale solar farms in the US, having been through previous rounds of due-diligence and investor acceptance.

- The module supplier (or its parent entity/guarantor) should be financially healthy/stable.

- The module supplier should be considered low-risk in terms of honouring contractual agreements for shipment schedules.

Leading indicators for change

When looking at the scale of the problems buying modules today, there is almost no chance that any meaningful fix will appear in the next 12-18 months. In this context, 2023 could largely be a continuation of the factors prevalent in 2022.

When looking for signs of a changing module supply landscape, the willingness of leading module suppliers to commit to global regions for upstream manufacturing could be important. Until now, efforts in this regard have been defensive in nature; setting up cell/module capacity in Southeast Asia to ship to the US; investing in module assembly lines in the US.

The door would appear to be wide open now for a major silicon-based player to set up gigawatt-level ingot-to-module manufacturing across key regions; India, Europe, North America. This would be a major step in terms of decoupling shipments from tariff-related risks. This could have the scope to see 2024-2025 as the first time that manufacturing becomes truly global in nature, allowing buyers to plan ahead without worrying about unexpected trade wars having a catastrophic impact on module supply in the near- to mid-term. It will be fascinating to see if the sector as a whole unfolds in this way going forward.

Author

Finlay Colville

Finlay Colville is Head of Research at PV Tech and Solar Media Ltd. He has been tracking the PV industry for almost 15 years, focusing on manufacturing, company operations and end-market demand drivers.