The annual module group procurement tender of China’s central state-owned enterprises is always something of a barometer, revealing the fierce competition within the industry over everything from module technology to pricing.

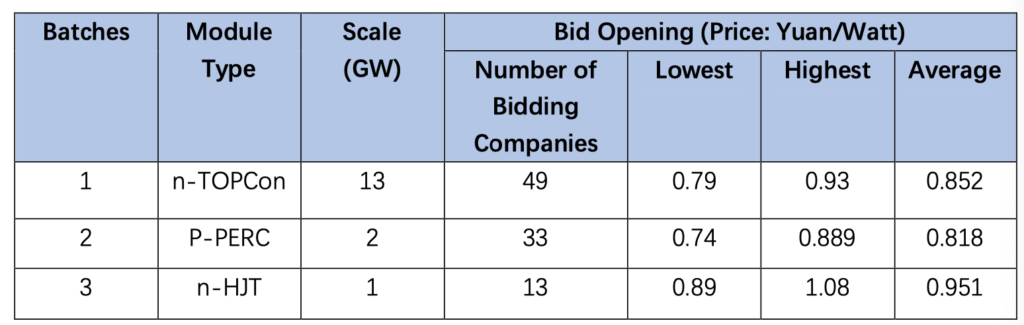

Recently, the results of state-owned utility China Datang Group’s 2024-2025 PV module procurement programme were announced. Divided into three batches, the total scale of this round of procurement reached 16GW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the public notice, among the three batches, the first one is for n-type TOPCon PV modules, with an estimated procurement capacity of 13GW; the second one is for p-type PERC PV modules, with an estimated procurement capacity of 2GW; and the third one is for n-type HJT PV modules, with an estimated procurement capacity of 1GW.

In terms of module classification, n-type modules account for nearly 90% of the tender, reaching 14GW. Against the backdrop of the industry’s tendency of efficiency improvement, p-type capacity is being phased out at an accelerated pace.

This round of bidding has attracted competition from many well-known PV companies. Among them, in the TOPCon module sector, several PV companies including Jinko, Trina Solar, JA Solar, GCL, Chint and Tongwei have been shortlisted, with a quotation range of RMB0.845-0.8948/watt (US$0.117-0.122), and an average quotation of RMB0.852/W.

In the HJT module sector, three companies have been shortlisted – Risen Energy, Huasunsolar and Golden Solar – offering two bidding prices of RMB0.92/w and RMB0.958/W. The average bidding price is RMB0.951/W, which is a certain premium compared with PERC and TOPCon modules.

As early as January of this year, during China Huaneng Group’s 10GW PV module group procurement, HJT modules were, for the first time, tendered as a separate category, which sparked widespread industry discussion. It also marked the beginning of HJT modules being featured as an independent tender category.

“Despite the overall downward trend in module prices, HJT modules still maintain a relatively high premium, which also stems from customers’ recognition of the module performance. The advantages of HJT’s higher efficiency and lower LCOE are gradually being accepted by the market,” said Yinghong Zhuang, global marketing director of Risen Energy to PV Tech.

According to him, as of March 2024, Risen Energy has achieved a cumulative shipment of over 3GW of Hyper-ion HJT PV modules.