This article reveals the most important PV manufacturers and suppliers to the solar industry in 2016. The new analysis and methodology explains exactly which companies are currently controlling, shaping and influencing all metrics related to upstream manufacturing trends and final end-market module shipments.

Source data is taken directly from the PV Manufacturing & Technology Quarterly report, released March 2016, by the market research arm of PV Tech’s parent company, Solar Media Ltd.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The need for a new approach to upstream manufacturing analysis

The solar industry has struggled for years with how to rank and assess the relative strengths and impact of upstream PV manufacturers, from polysilicon production to module supply, and not to mention how to factor in thin-film companies within the dominant c-Si supply mix.

This is most evident when reading or hearing claims from different companies claiming to be Tier 1 listed on some random and somewhat confusing categories released by certain research firms. In fact, the whole Tier issue has become almost completely irrelevant in the past few years, with entrance criteria typically limited to end-market shipments, regardless of whether any upstream manufacturing even took place, and regularly featuring companies that have limited impact on the sector.

In addition to the Tier listing confusion, companies have also been clinging to third-party survey exercises that seek to offer some kind of badge-of-honour for getting tick-box customer satisfaction credit-ratings and which end up in colourful logos used in marketing related campaigns.

Surely the PV industry deserves better: something that is founded on hard facts; that can be traced back to real-world production that extends back to polysilicon; and a ranking system that offers a clear indication of the relative importance of solar PV manufacturers to overall industry trends going forward.

That said, the main driver for us is to pull out the solar PV manufacturers today that are not just serving existing market demand, but are also directly influencing the landscape in the years to come. By doing this, we are then able to fully understand technology roadmap indicators, market-share outcomes, cost metrics through the value-chain, and module supply variances.

These key objectives have driven our research team at PV Tech and Solar Media Ltd. to devise a brand-new methodology that we believe will help capture industry manufacturing and technology trends, in stark contrast to legacy Tier categorisation and brand-loyalty marketing gimmicks that are more a distraction than an aide.

Explaining the methodology employed

Often, when undertaking market research, the most useful analysis is typically the simplest one; where it is crystal clear how the research is done, what input data is used, and what assumptions are made. This simple rule guided our thinking more than anything else over the past six months.

Firstly, we needed to work out a way of how to rank a major pure-play polysilicon maker (such as Wacker) with a dominant cell manufacturer (such as Gintech), a thin-film company such as First Solar, and a multi-GW scale module supplier such as JinkoSolar.

For example, whenever you look at random Tier 1 listings of PV companies, it is always alarming that dominant upstream companies (that have way more influence on the industry) are simply not appearing. Surely a company manufacturing multi-gigawatts of ingots and wafers has a greater influence than a low-tech module-assembly company, say in India, that is simply packaging a couple of hundred megawatts of modules made with cells coming from third-parties?

Therefore, our starting point was to place more value on production than end-market shipments, but to ultimately factor in all aspects of the upstream (or supply side) from raw material manufacturing through to module shipments.

This involved pulling out in-house production only through the value-chain, and removing outsourcing and OEM supply numbers. In this way, we could see clearly who was making things, and which companies were largely shipping components by virtue of having captive sales channels to serve.

In-house production levels were compiled for major companies in the PV industry today, across polysilicon, ingot, wafer, cell and module segments. Of particular note was splitting out ingot production from wafer supply, recognizing that ingot production is critical to driving technologies used in cell manufacturing. In terms of shipments, only module shipments were extracted from our master database to feed into this specific analysis.

Having extracted only the in-house production figures for the companies, in addition to final module shipment levels, the next task was how to link the different parts of the value-chain, and address one of the key questions we outlined earlier: how do you, for example, compare a multi-GW ingot producer with a GW-level module supplier?

Here we introduced simple weighting factors that would finally enable a stack-rank of all companies involved in PV manufacturing and end-market supply today.

In fact, this is the only part of the methodology that is open to question, as putting weightings on the importance, or value, of the different parts of the value-chain will always be debated, depending on where your loyalties ultimately lie.

To set the weightings, we looked closely at the importance of each stage of the value-chain, and took on board a range of inputs from industry experts, many of whom were questioned on this over the two days recently of our inaugural PV CellTech conference in Kuala Lumpur.

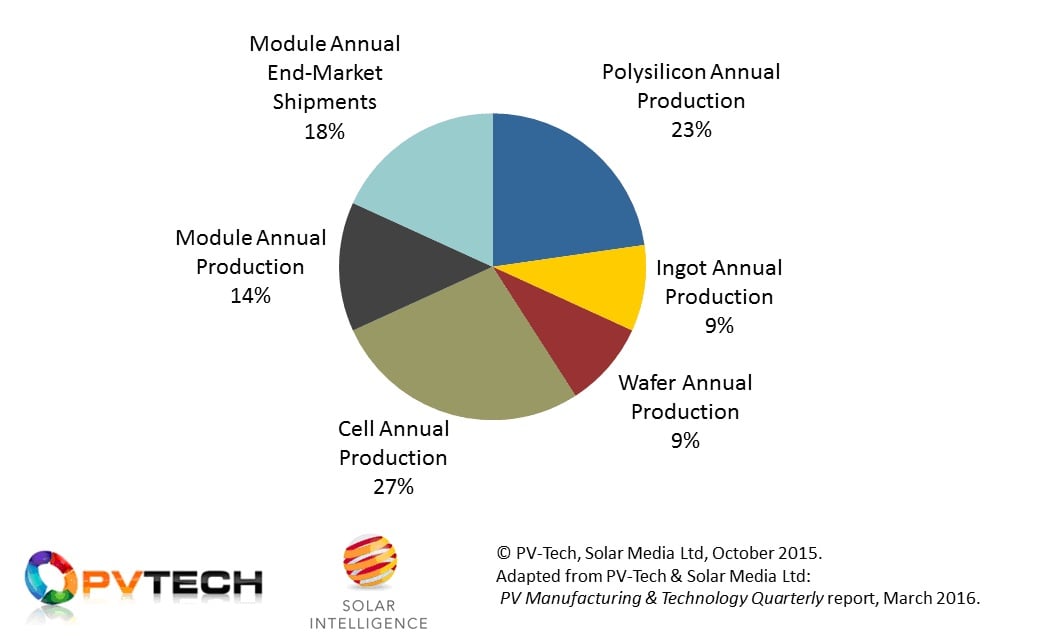

As a result, we set the weighting factors as shown in the figure below, placing the highest value on polysilicon and cell production:

In order to correlate thin-film manufacturers/suppliers, we allocated equivalent ingot/wafer/cell weightings to the companies analysed. In reality, this involves only First Solar and Solar Frontier today. Thin-film manufacturing is essentially a mirror image of c-Si manufacturing, if you replace raw material supply with coated glass, and then assume that a thin-film producer is effectively doing the full ingot-to-module production steps that an integrated c-Si manufacturer is engaged in.

Simply multiplying the in-house production and end-market shipments for each company with the above weighting factors brings us to the final output and allows us to rank the importance of the upstream/supply side today in the industry.

Role of GCL as number one PV manufacturer confirmed beyond any doubt

When we ran though the analysis across all major solar PV manufacturers, two key outcomes emerged:

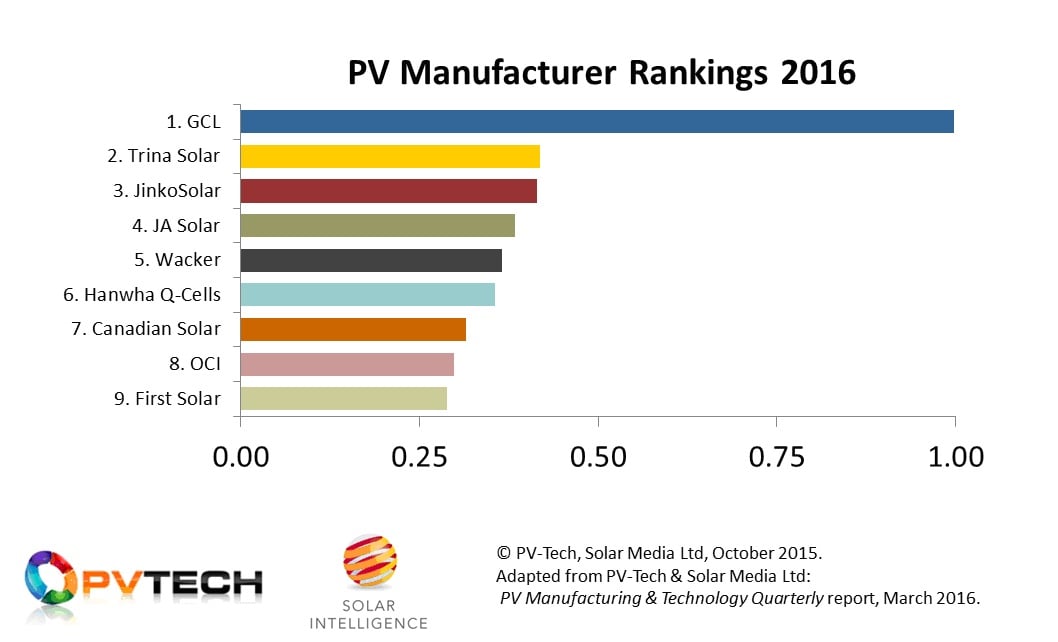

• A subset of nine companies is significantly ahead of all others, in terms of having a direct influence on the PV industry today.

• Within this group, GCL is by far the most important company, and is currently increasing its position and scope as potentially the biggest influence on the industry going into 2017.

The figure below shows a normalized stack ranking of the leading nine companies, with the magnitude of GCL’s dominance clear to see.

GCL (incorporating the full portfolio of GCL’s subsidiary and affiliate PV-related companies, including GCL-Poly, GCL New Energy and GCL Systems Integration) has now positioned itself, through its 2015 midstream cell and module capacity additions, to take an even greater hold of the solar industry going into 2H’16 and 2017. While nowhere in the league of its polysilicon and ingot/wafer capacity levels, becoming a GW-plus cell and module producer (almost overnight and in stealth mode), creates many possibilities for the company now.

While the scope of separate analysis and commentary, perhaps the biggest issue relates to GCL’s own aspirations and whether the company will simply become the dominant player in China serving the world’s largest upstream and end-market demand territory, or wishes to have a strong overseas presence on both module shipments and project development. Within 12-18 months from now, the answer to this will become much clearer.

While the snapshot above of 2016 is of incredible value, it is also useful to look at what has changed over the past few years, and also which companies (not highlighted above) are making moves to become key players in how manufacturing evolves in the near term.

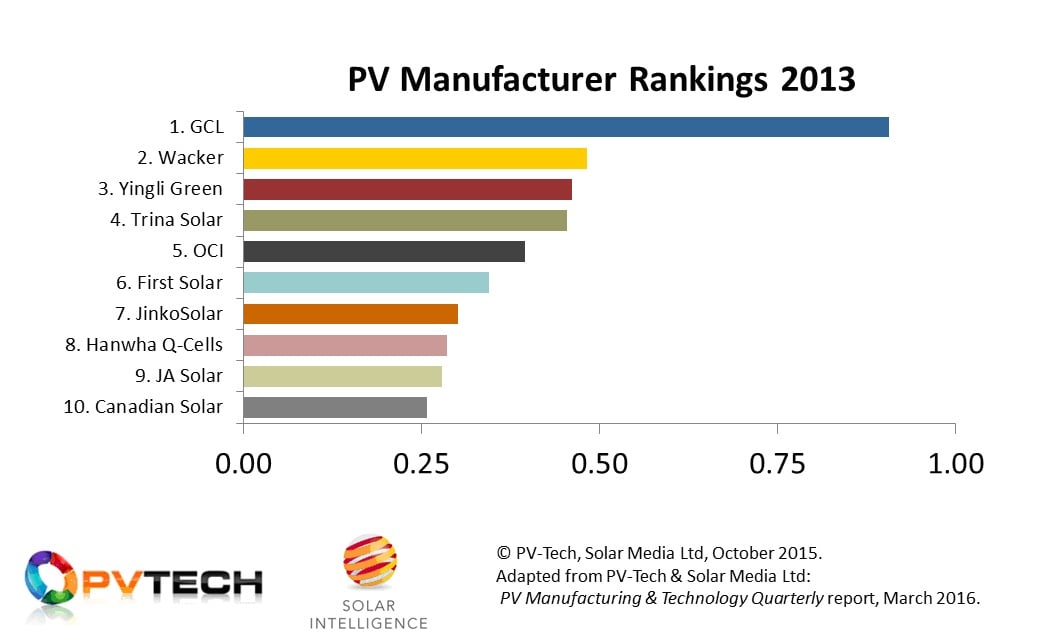

Performing the same analysis as above, but confined to three years back (2013), the following graphic is obtained, as shown in the figure below:

When comparing 2013 to 2016, it is interesting how the role of the pure-play polysilicon supplier has diminished somewhat, reflected today in the way that almost all polysilicon suppliers to the PV industry (with the exception of GCL) appear to be pulled by midstream company strategies, rather than driving change downstream.

Also of interest is confirmation of the problems at Yingli Green Energy, with the company going from 2013 when lining up sponsorship of the FIFA World Cup Finals in Brazil as the number 1 module supplier to the industry, to 2016 when the company is not featuring on the major producer rankings as shown above in Figure 2.

Finally, the growth from JinkoSolar and JA Solar (through a combination of midstream capacity additions in mainland China and Southeast Asia, and aggressive module shipment targets) can be seen clearly in each company moving closer to attaining the tag of ‘second-most-important solar PV manufacturer after GCL’.

The final output from our new analysis is to look for the companies that are seeing strong growth over the past two years; so looking at changes in power-rankings between 2014 and 2016. The two companies that jump out here are Longi Silicon Materials and Daqo New Energy, with LG Electronics also worth a mention too.

No industry can ever have one definitive rankings list that covers all bases, but in setting up the methodology, analysis and models outlined above, perhaps we are moving one step closer to really understanding what is behind the numbers and the marketing rhetoric appearing in the press on a daily basis.

And last but not least, getting the industry weaned off using the highly misleading Tier and customer-satisfaction lists that are simply not aligned with an industry trying to be taken seriously as a mainstream source of energy over the next few decades.