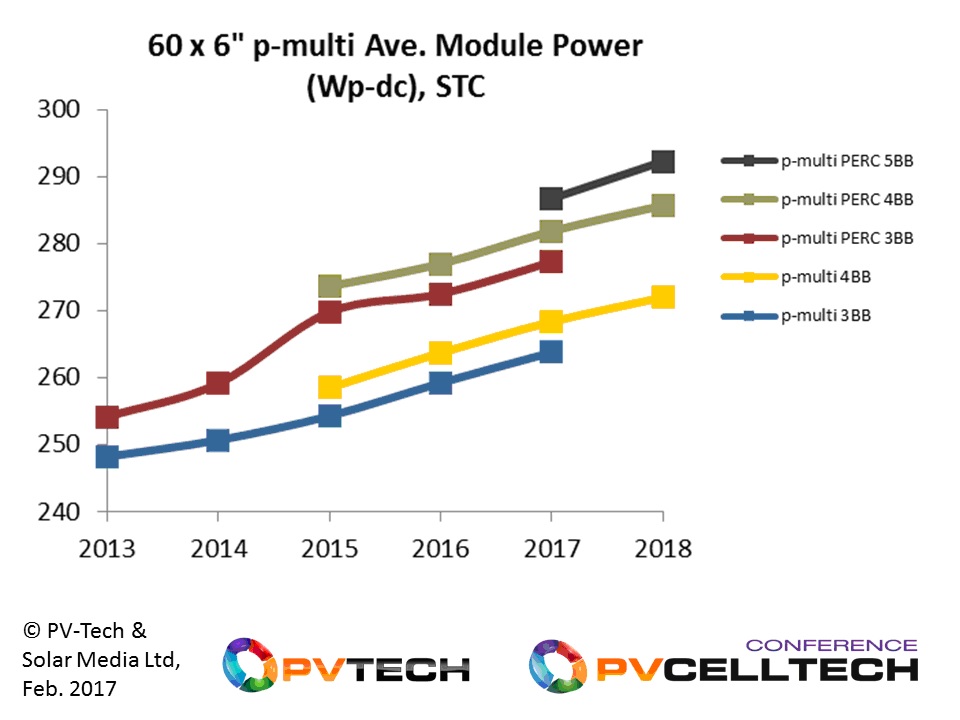

In 2013, the PV market was being served mainly by 60-cell p-type multi c-Si modules with average power ratings (Wp-dc, STC) of approximately 250W.

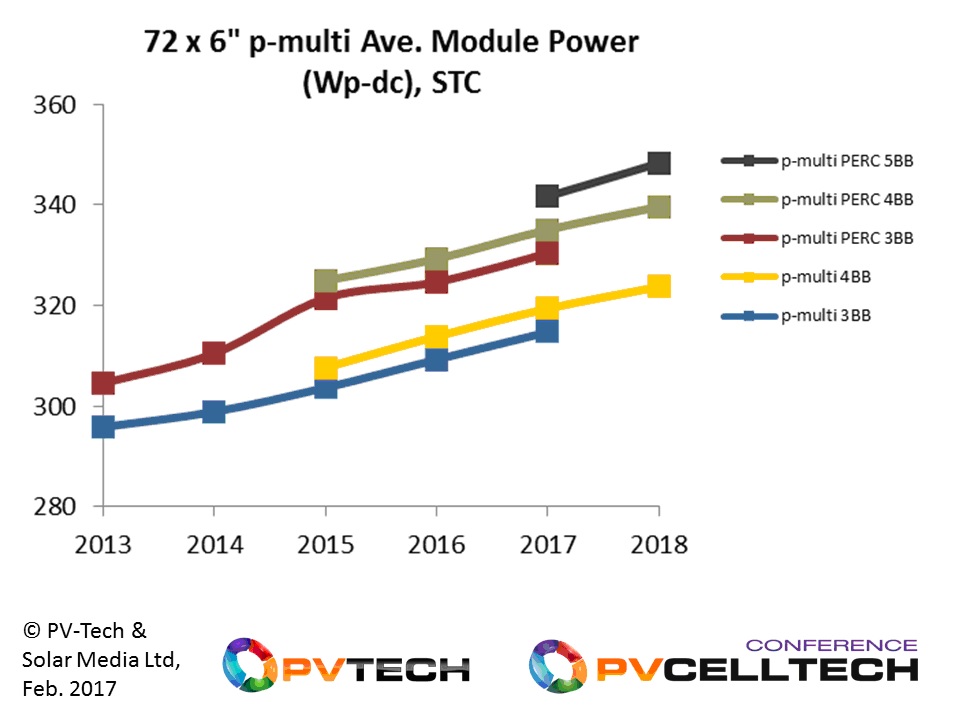

In 2018, p-type multi c-Si module supply will be dominated by 72-cell designs, with average power levels at 350W, with the 60-cell equivalent exceeding 290W.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This article explains the evolution of p-type multi module efficiencies and average power levels between 2013 and 2018 (forecasted), showing for the first time the output of new findings by our in-house market research team at PV-Tech’s parent company Solar Media Ltd.

The analysis is adapted from the January 2017 release of our PV Manufacturing & Technology Quarterly report. The themes are set to be discussed at the forthcoming PV CellTech 2017 event in Penang, Malaysia, 14-15 March 2017.

Why it is so important to understand p-type multi

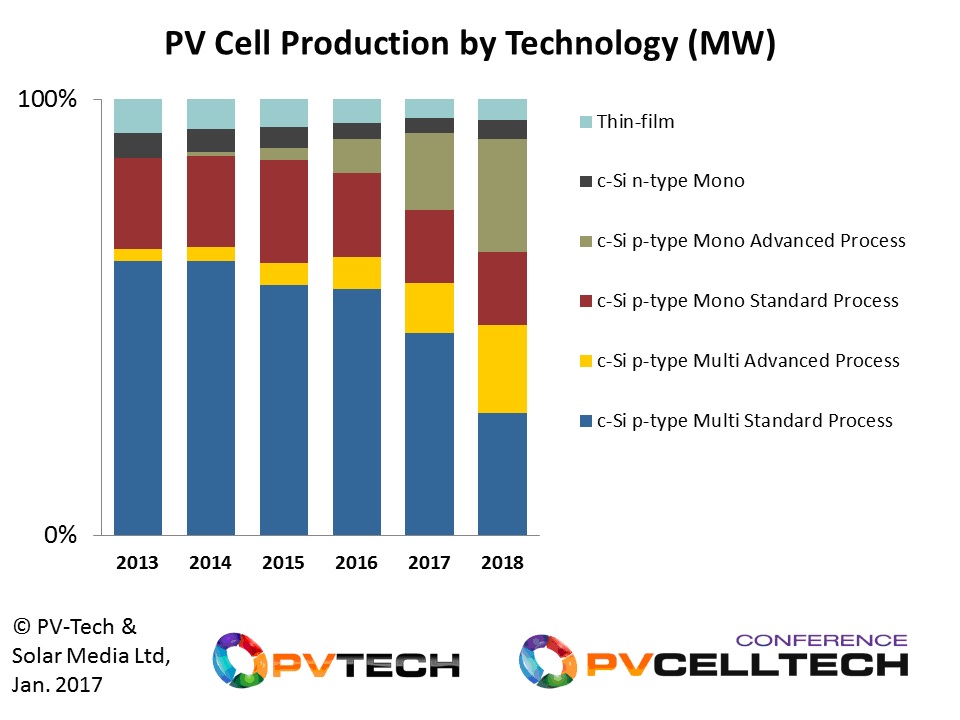

Recently, we showed the split of solar PV production for 2016, by technology type, across c-Si and thin-film, and the different variants for mono and multi c-Si.

One of the graphics is reproduced below, to set the scene for p-type multi.

The forecast above for 2017 and 2018 remains heavily contingent on a few upstream mono ingot/wafer suppliers adding capacity, in addition to GCL-Poly having a greater level of mono wafer supply in its mix. Of course, this is not a done-deal, and there is certainly the possibility that p-multi will not see the level of sustained market-share erosion to p-mono that is displayed here.

Actually, ‘resilience’ is the word to use for p-multi. And this should really not come as any surprise to anyone that has been observing the solar industry for the past couple of decades.

Casting multi c-Si blocks by directional solidification transformed the PV industry years ago, as the low-cost supply route for wafering that was deemed more aligned to the needs of solar cell processing, compared to higher purity pulling of ingots that had been used by the solar industry as an offshoot of semiconductor manufacturing.

However, p-multi only keeps strong market share if cell efficiencies are increased constantly, and module power ratings go up every year.

How busbars, PERC and 72-cell design became the p-multi roadmap

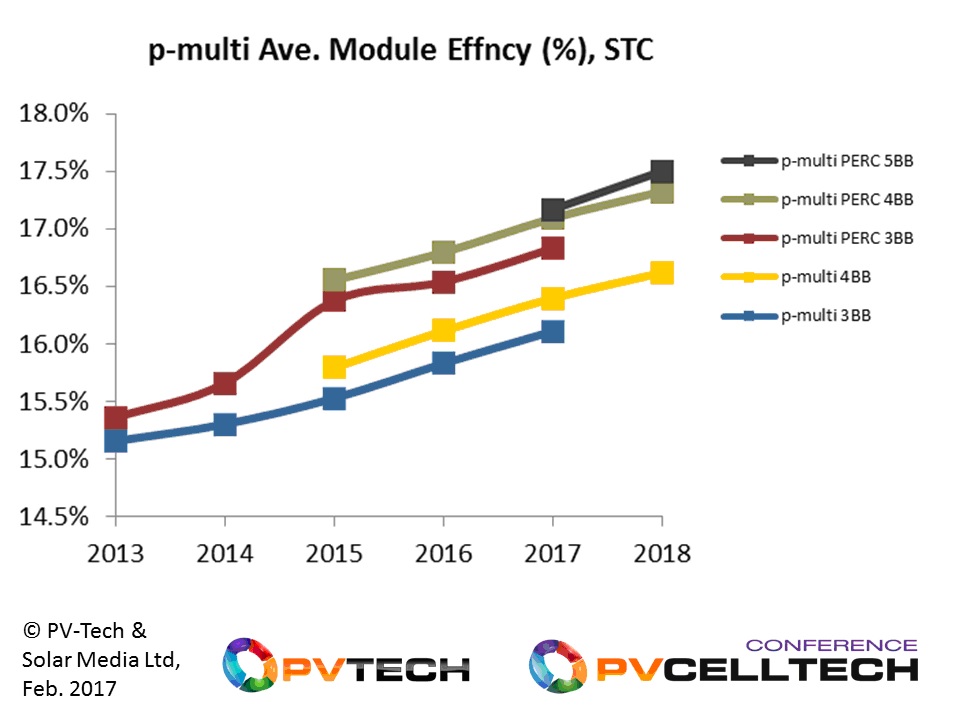

We now track through graphics the increase in efficiencies and module power ratings for p-type multi c-Si between 2013 and 2016. The first graphic shows average module efficiencies; the subsequent graphics show 60 and 72-cell powers.

The data is obtained using a new methodology developed by our in-house research team, where we painstakingly analysed the module supply from the top-100 companies to the industry between 2013 and 2016, classifying each module (efficiency and power) by cell type used, process flow, cell size, number of busbars, module area, cell-to-module loss, temperature-dependent coefficients, min/max range of module powers, and (crucially) quarterly and annual data-point entries.

To our knowledge, this is the first time this level of bottom-up data-driven analysis has been done: focusing on the leading module supply to the industry makes the analysis all the more pertinent and differentiates the results from hero-cell announcements, R&D results and pilot-line operations which all have a value but are not part of industry supply and distort real-world data significantly.

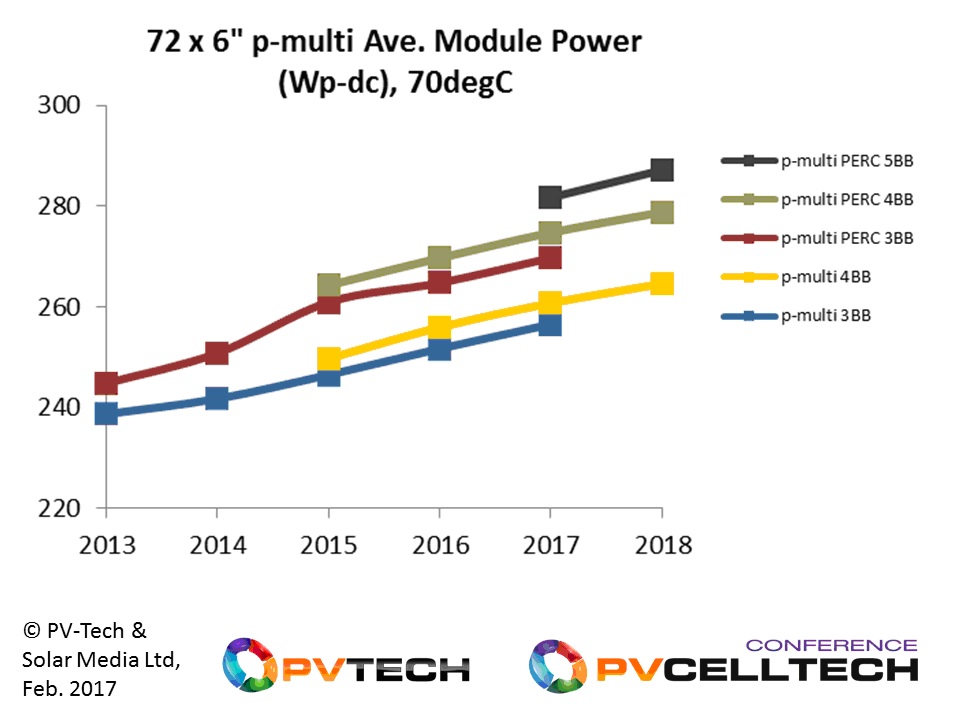

The graphic above shows the main multi c-Si variants which tell the story best for p-type multi technology evolution. We segment supply by number of busbars (BB) from 3BB in 2014 to 4 or 5BB in 2018. PERC is seen to have the strongest contribution from 2015.

The shift from mainstream p-type multi modules moving from 15-15.5% in 2013 to approximately 16.5-17.5% in 2018 has indeed occurred due to the incremental gains from both increases in busbars and through adding PERC.

Power ratings for p-type multi modules in 2018 will still have a strong contribution from standard (full Al-BSF) cells, with the technology barriers for p-multi PERC likely to still make this transition a gradual one. Many of the multi c-Si cell producers may choose to focus on moving to 5BB on standard cells, hoping that multi diamond wire sawing and black silicon provides them with sufficient scope to retain a competitive offering.

While the above findings for p-multi efficiency and 60-cell power ratings are important to understand, looking at 72-cell powers is much more useful. This is because 72-cell p-multi has become the main module type for utility scale solar, with markets such as the US and India seeing huge upticks in this module size and technology being imported during 2015 and 2016.

The final two figures below show 72-cell p-multi average annual powers for both STC and elevated temperature at 70 degrees.

As we move out to 2018, we are now forecasting that 72-cell p-multi modules will be shipping with power ratings (STC) closer to 320W for non-PERC and 340W for PERC, with the upper end of the 5BB p-multi PERC options exceeding 360W.

Finally, we look at elevated temperature operation for the 72-cell p-type variant. For utility scale, this is often a more relevant analysis. We use 70oC for our analysis here.

Further analysis to be presented at PV CellTech

The dataset contained within our analysis of cell/module efficiencies and module power ratings covers all thin-film, n-type and p-type mono supply to the industry, and the above analysis on p-type multi is available for these also.

This is all provided in one of the worksheets within the PV Manufacturing & Technology Quarterly report. Comparative data will also be shown at the forthcoming PV CellTech 2017 event in Penang, Malaysia, 14-15 March 2017.

To view the latest PV CellTech agenda, please follow this link. To register for the event, click here.

We are also doing our latest free webinar series, titled “Solar PV manufacturing and technology trends; impact of global market drivers” on 15 and 16 February 2017; click here to register to attend one of these webinars.