BP has set lofty targets for its renewables ambitions, backing bifaciality and merchant revenue strategies to provide major boosts as it targets 50GW of renewable capacity by 2030.

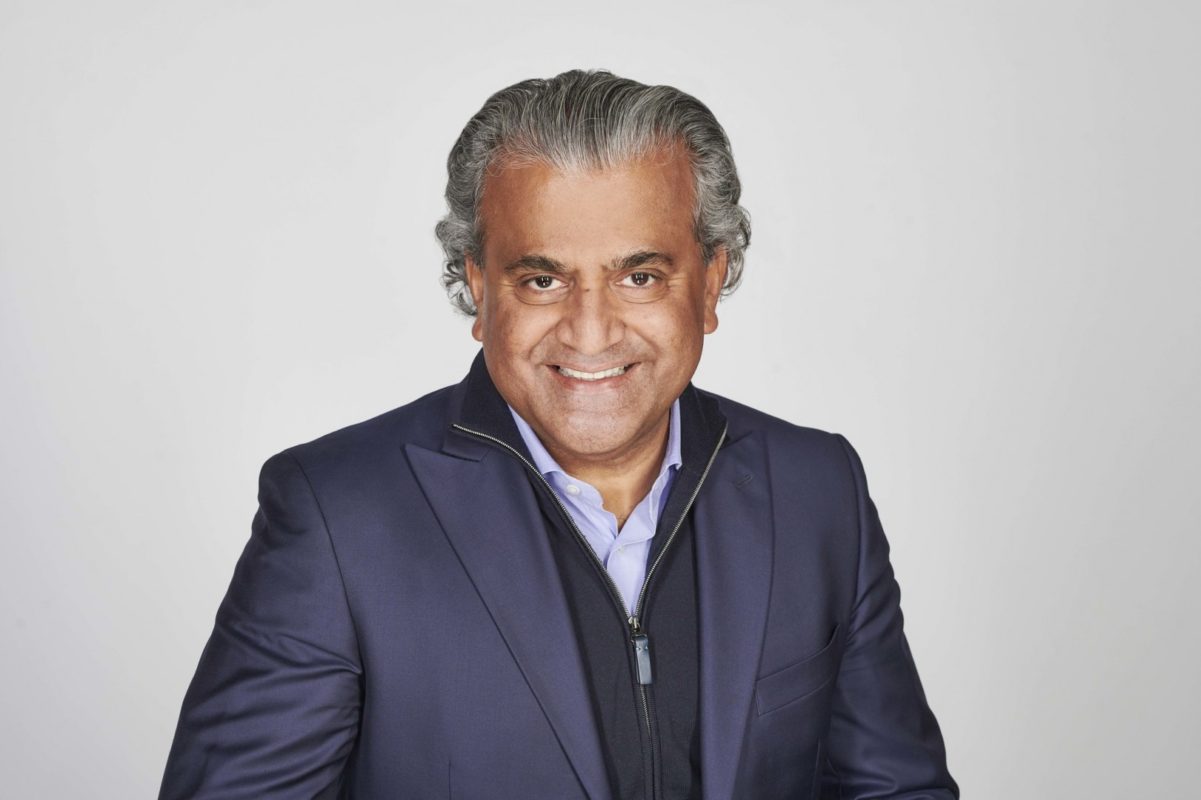

This week sees the publication of BP’s strategic overhaul as it reveals how it intends to decarbonise its business and attain net zero status by 2050. The so-called ‘bp week’ comprises numerous events and speeches, with Dev Sanyal, the company’s EVP for gas and low carbon electricity, providing new detail on BP’s growth targets in the clean energy sectors.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Central to BP’s plans are a mass upscaling of renewable capacity over the next decade. It intends for its renewables capacity to reach 20GW by 2025 and 50GW by 2030, indicating a meteoric rise for the company as the decade draws to a close.

Having earlier this week unveiled a strategic partnership with Equinor to target offshore wind, Sanyal yesterday spoke at length about the company’s solar ambitions, with bifaciality and merchant power strategies set to play a key role.

Lightsource BP, the O&G major’s solar development arm it acquired a preliminary stake in nearly three years ago, is set to play a crucial role in reaching that target after Sanyal referred to it as an “execution powerhouse” during yesterday’s event, citing its ability to develop pipeline projects “at pace”.

Kareen Boutonnat, group chief executive for Europe and Asia, explained how BP’s role in the company had enabled it to increase its reach from five countries to 13, progressing towards an aim of becoming a “global force for solar”.

Its pipeline now stands at around 16GW, and Boutonnat revealed that the company had now started migrating all of its solar project designs to incorporate bifacial technology. Lightsource BP first teased the move in an exclusive interview with PV Tech at the end of last year as group CEO Nick Boyle said most, if not all, projects within its pipeline, which at the time stood at 12GW, would be deployed using bifacial panels.

Boutonnat also noted the company’s use of solar inverters during night hours to deploy reactive power service for the UK grid and the exploration of green hydrogen opportunities in Australia as other examples of Lightsource BP’s adoption of new technologies and innovations.

However Sanyal also discussed how BP saw the solar sector moving beyond power purchase agreements and towards an increased merchant exposure when it comes to project returns. While the solar sector had traditionally sought to sell power to governments, utilities and corporations at locked-in rates for the purpose of stability and financing, as solar development costs continue to fall, BP considers merchant pricing strategies – wherein power from solar projects can be integrated with other sources – can deliver higher returns.

Sanyal said this played to BP’s strengths and would allow the company to leverage its existing trading business and capabilities. “We have the expertise, track record and the capacity to manage and optimise volatility and risk. This is a competitive advantage and a source of differentiation versus pure play companies,” he said.

“Today our renewables businesses provide stable returns. And as the market evolves, as an integrated energy company, we are positioned to capture growing returns.”