Cubico Sustainable Investments is to acquire solar generation platform T-Solar to strengthen its Spanish portfolio in a deal worth €1.5 billion (US$1.8 billion).

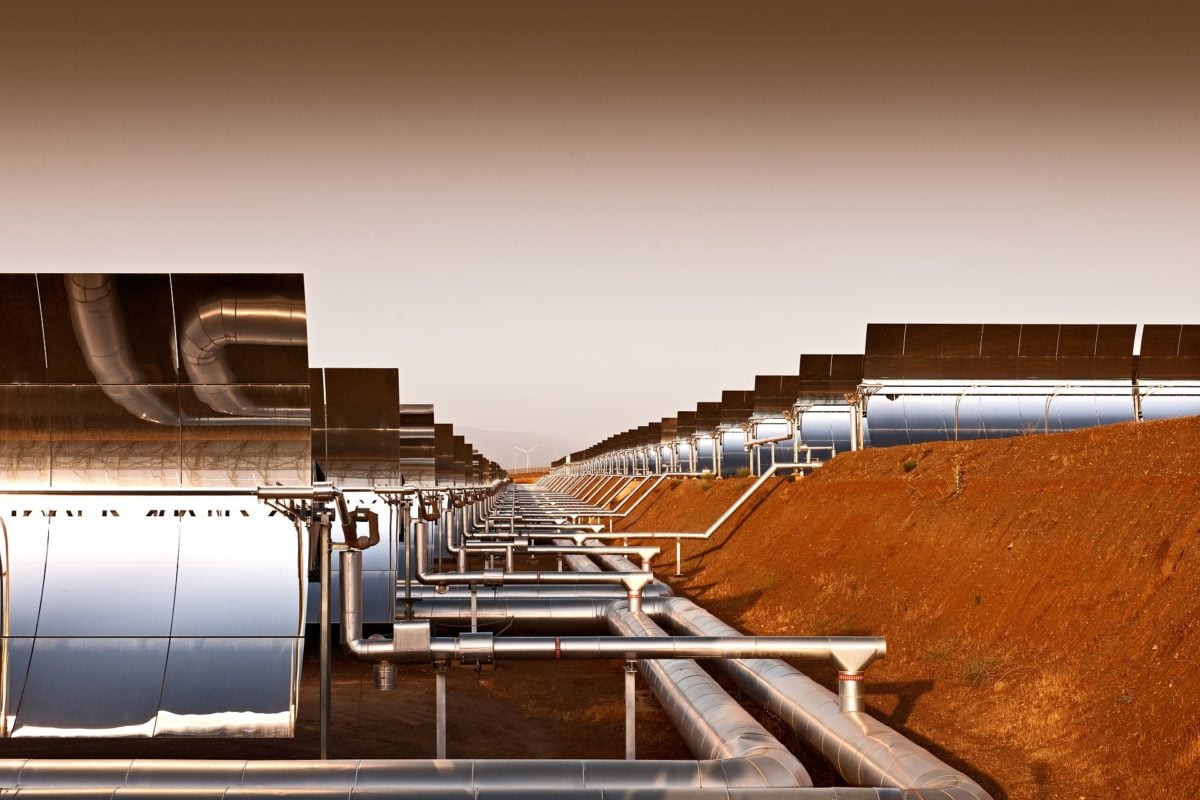

Infrastructure investment manager I Squared Capital has agreed to sell Grupo T-Solar’s portfolio to the London-based group, which encompasses 47 assets and a capacity of 274MW. The majority of this is in Spain, with 167MW of solar PV and 100MW of concentrated solar power. There is also a further 1.4GW of solar development in the company’s pipeline.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Grupo T-Solar secured €567.8 million to refinance 23 PV power plants located in Spain at the start of this year, totalling 127MW. It is thought to be one of the largest financings of the renewable energy market to date.

The acquisition will more than double Cubico’s Spanish portfolio, with control of more than 440MW of solar capacity in the country, David Swindin, the investor’s head of Europe, Middle East and Africa, said.

Solar PV has been the driving factor behind the growth of Spain’s green energy sector so far this year and developments have become highly attractive to foreign investors. Grid operator Red Eléctrica de España (REE) said in October that PV energy generation was 67.5% higher year-on-year, followed by hydropower, which was up 41.6%.

Spain’s government passed a Royal Decree earlier this year to accelerate the growth of the renewables market by removing barriers to large-scale deployment, as well as incentivising new opportunities for the hybridisation of different renewables technologies such as solar, wind and storage combined. The country plans to install around 60GW of renewables by 2030.

I Squared bought T-Solar from Isolux Corsan in 2017, and instigated the sale to Cubico around June or July this year.

The announcement comes weeks after Cubico, which is jointly owned by the Ontario Teachers’ Pension Plan and PSP Investments, finalised the acquisition of two solar projects in the US from solar developer RES.

Swindin said in a statement that Cubico will “continue to explore further opportunities” to own and operate more solar projects.

“We were one of the first international investors to re-enter the Spanish market and now it has grown to be Cubico’s largest market by value,” Swindin said.

“We continue to explore further opportunities in which we can use our core skill of operational excellence with a long-term ownership mindset and look forward to more success in the future.”