Swedish energy giant Vattenfall has issued its second €500 million (US$571 million) green senior bond.

The issue was oversubscribed by over six times, the company said, with the proceeds to be used to finance investments in the four eligible categories specified in the Vattenfall’s Green Bond Framework.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The categories – renewable energy and related infrastructure, energy efficiency, electrification of transport and heat, and industrial projects – were also the target of its first green bond, issued last June.

For Vattenfall, the issuance of its second ever green bond follows its enlisting this year of Deutsche Telekom as the 10-year PPA offtaker of a 60MW PV plant in Germany, due to complete in mid-2021.

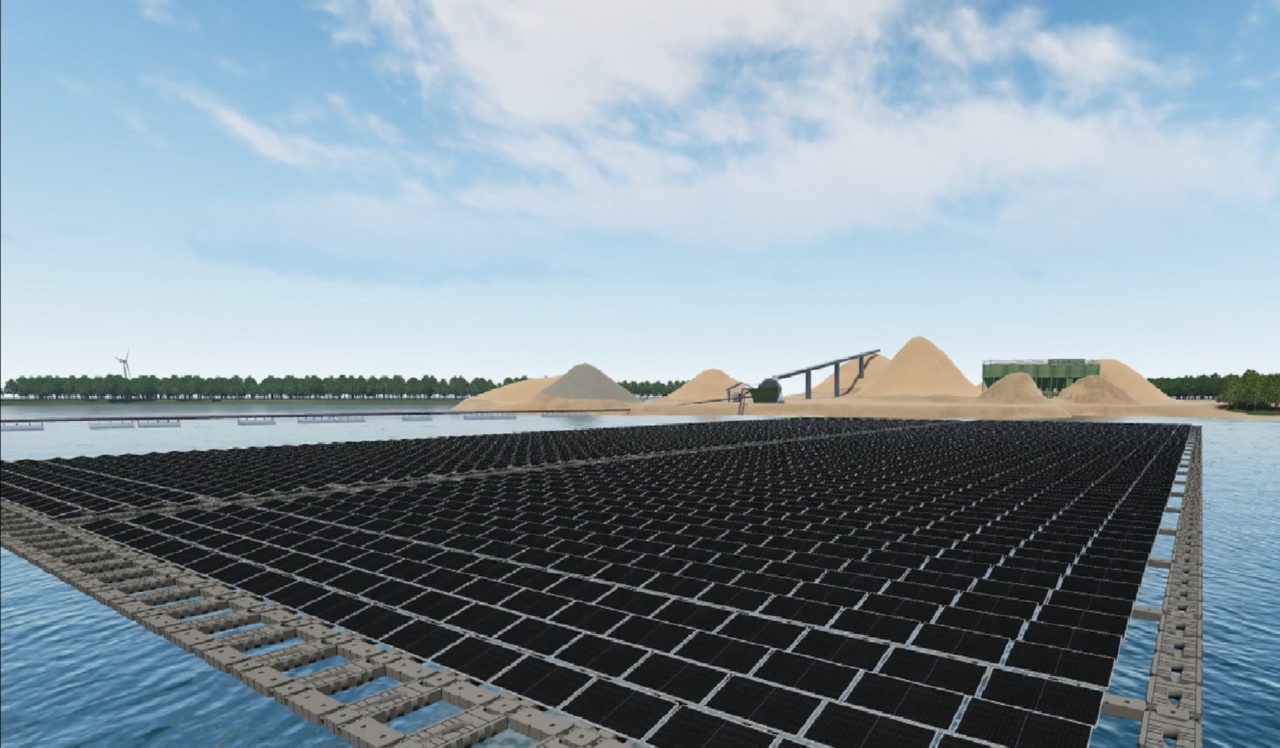

Across the border in the Netherlands, the Swedish firm is working on a solar-plus-wind-plus-storage hybrid as well as a 1.2MW floating PV plant, its first such development anywhere.

See here to read the story in full, as originally published by PV Tech's sister title Current±

The prospects and challenges of European solar will take centre stage at Large Scale Solar Europe 2020 (Lisbon, on 31 March-1 April 2020).