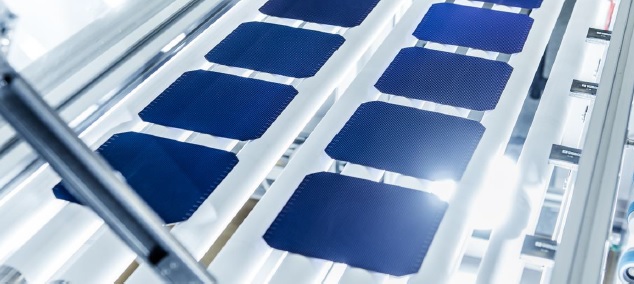

Leading solar PV manufacturing equipment supplier Meyer Burger has exceeded its revenue guidance as it discloses preliminary financial information for fiscal year 2017.

The company reported net sales of CHF 473 million (US$492.2 million), exceeding guidance of sales in the range of CHF 440-460 million and up 4% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Meyer Burger said that its previous EBITDA guidance at CHF 5-15 million (US$5.2-15.6 million was unchanged, while it expected a small reduction in its net loss for the year, compared to a net loss of CHF 97.1 million in 2016. The company has been undertaking a range of restructuring activities in 2017.

The company reported that incoming orders reached around CHF 560 million (US$582.7 million in 2017, an increase of 23% compared to the previous year and its highest order intake for the past six years.

Meyer Burger’s first half year financial results also reflected strong incoming orders, which reached CHF 308.5 million (US$316.6 million).

Order backlog was around CHF 343 million (US$356.9 million), up 40% compared to the previous year.

The company has been benefiting from a new wave of capacity expansions and a technology buy cycle, driven by a major migration to diamond wire and ‘Black Silicon’ texturing of P-type multicrystalline wafers, PERC (Passivated Emitter Rear Cell) technology and next-generation N-type heterojunction cell migration at a select number of PV manufacturers.

PV Tech’s Finlay Colville recently highlighted that capital expenditures would remain strong in 2018.

Meyer Burger plans to publish its 2017 annual report on 22 March 2018.