US-based renewables components manufacturer Gibraltar Industries has clinched a US$220 million deal to acquire solar racking provider TerraSmart.

Nasdaq-listed Gibraltar said the deal, announced today (4 January 2021), would strengthen its position as the largest turnkey provider for the domestic US solar energy market, providing it with a broad portfolio of solutions spanning ground-mounts, trackers and design software solutions.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Furthermore, Gibraltar said the acquisition would help scale the company to a US$700 million platform over the next five years, enhance the business unit’s revenue growth and boost its overall margins.

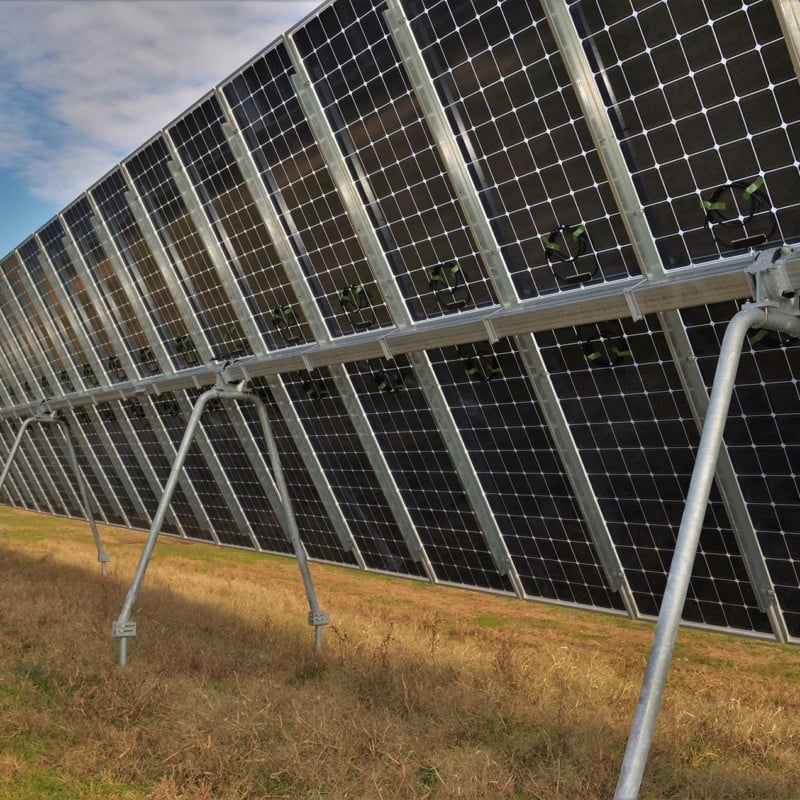

TerraSmart provides fixed-tilt and single axis tracker mounting systems under the GLIDE and TerraTrak brands, and has more than ten years’ experience in the US solar market. Gibraltar said the business was on track to post record revenues and earnings in 2020, amounting to in the ranges of US$150 – 155 million and US$26 – 28 million respectively.

Meanwhile, Gibraltar also announced the acquisition of solar system design software provider Sunfig for US$3.75 million in cash.

Bill Bosway, chief executive officer and president at Gibraltar, said adding to the two businesses to its solar unit would “significantly” increase its domestic presence.

“Equally important, this continued investment demonstrates our ongoing commitment to making solar energy the best choice in energy production,” he added.

Gibraltar has historically looked to grow both organically and through M&A activity, having acquired balance of system products provider SolarBOS in August 2018.