US renewables developer NextEra Energy has reported better-than-expected financial results for Q3 2022 despite the damage wrought by hurricane Ian as it continued to buildout its renewable energy pipeline and seeks to take advantage of the Inflation Reduction Act (IRA).

Released last week, the Florida-headquartered developer and parent company of utility Florida Power & Light (FPL) reported Q3 net income attributable to NextEra Energy of US$1.69 billion, or US$0.86 per share, compared to US$447 million, or $0.23 per share, for the Q3 2021. The company’s shares rose roughly 3% in trading on 28 October, when the results were released, to US$77.6.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

NextEra’s Q3 revenue of US$6.72 billion, which was almost US$1 billion more than expectations, was down to strong demand for renewable sources of power amid a rampant energy crisis that has served to push up inflation across the US, the company said.

“NextEra Energy delivered strong third-quarter results and is well positioned to achieve our overall objectives for 2022,” said John Ketchum, chairman, president and CEO of NextEra Energy. “Adjusted earnings per share increased by approximately 13% year-over-year, reflecting continued strong performance at both FPL and NextEra Energy Resources.”

Moreover, NextEra largely avoided the devastating impact of the category 4 Hurricane Ian, which ravaged Florida in late September, thanks to the mobilisation of thousands of ‘restoration workers’ by subsidiary FPL.

Hurricane Ian, with winds up to 150mph, caused more than 2.1 million FPL customers in 32 counties to lose power but NextEra said grid hardening, smart grid deployment and undergrounding investments “greatly benefitted customers”.

No transmission poles or towers lost, underground distribution power lines performed five times better than existing overhead distribution power lines and almost no structural damage occurred at any FPL power plant, including at the 38 solar sites exposed to storm conditions, according to the company.

“I am extremely proud that our team restored service to roughly two thirds of the more than 2.1 million FPL customers affected by the storm after the first full day of restoration, which represents the fastest restoration rate in FPL’s history for a major hurricane,” added Ketchum.

Meanwhile, NextEra said it was well positioned to capitalise on the US$369 billion IRA, passed to much fanfare in August by US President Joe Biden. The IRA is expected to boost utility-scale solar deployment in the US by 86%, according to analysts Wood Mackenzie.

The company said the IRA provides the policies and incentives that will allow NextEra Energy to achieve its ambitious decarbonisation goals. NextEra is aiming to eliminate all scope 1 and 2 emissions from its operations by 2045 without the use of carbon offsets and a massive increase in solar PV to 90GW by 2045 as part of its “Real Zero” strategy announced in June.

“The IRA is expected to significantly mitigate the bill pressure caused by fuel cost volatility through the adoption of production tax credits on rate base solar projects,” said the company, adding that the IRA was expected to save customers nearly US$400 million through 2025, including one-time US$25 million refund in January 2023 due to the solar production tax credits (PTCs) on its completed 2022 rate-based solar projects.

“We believe that the IRA makes every solar project, every battery storage project, every renewable gas project and every green hydrogen project more cost-effective,” NextEra’s CFO, Kirk Crews, said on a conference call with analysts, adding that it provided “decades of visibility to low-cost renewables”.

NextEra said its business unit Energy Resources’ scale, scope and experience “puts it in a unique position to deliver comprehensive clean energy solutions for our customers”.

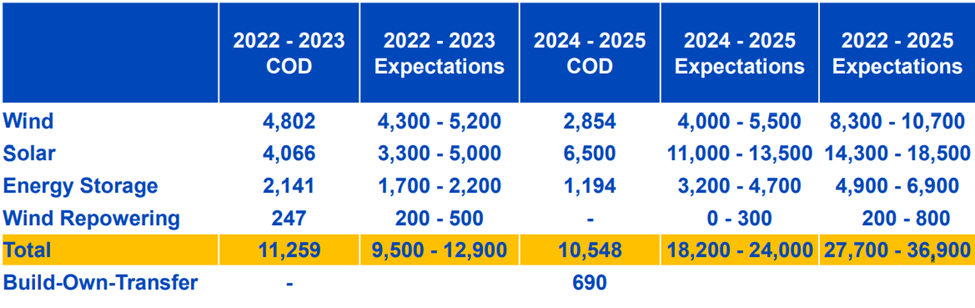

The company’s Energy Resources Development Programme originated more than 2,345MW of clean energy projects in Q3, including nearly 1GW of solar PV and 165MW of battery energy storage systems (BESS).

“Energy Resources had another terrific quarter of origination, signing approximately 2,345GW of new renewables and storage projects since our last earnings call,” noted Crews.

For 2022, NextEra continues to expect adjusted earnings per share to be in the range of US$2.80 to US$2.90, while for 2023 and 2024, it expects adjusted earnings per share to be in the ranges of US$2.98 to US$3.13 and US$3.23 to US$3.43, respectively.

Conference call transcript taken from The Motley Fool.