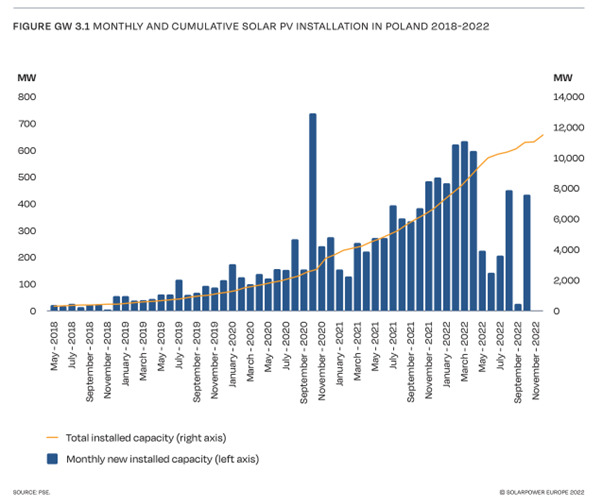

Given Poland is still firmly the largest hard coal producer in Europe, its attempts to decarbonise through renewables are critical for the climate mitigation agenda. With just 2GW of solar installed at the end of 2019, Poland has seen a meteoric rise towards becoming the third largest solar PV market in Europe in terms of installations in 2022 with 4.9GW deployed during the year, according to SolarPower Europe (SPE).

Much of the rise has been driven by a thriving rooftop market in home prosumer installations supported by a net-metering scheme and government programmes giving financial assistance to households, but a change in law is hampering the segment. Meanwhile, large-scale PV is rising at a pace to spearhead a second strong rise in Polish solar deployment.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Around 8GW of the 12GW of cumulative installs by 2022 year-end was made up of prosumers, householders and small businesses driven by government support. The most recent boom in large-scale PV, however, was initially driven by the auction system under contracts for difference (CfDs), but the main push now comes from increased public support for PV, high energy prices and Polish industry’s interest in securing solar-based corporate power purchase agreements (PPAs).

“Poland is a market that needs renewables,” says Eyal Podhorzer, CEO of Econergy, an international developer with headquarters in Israel and a pipeline of more than 1.5GW of large-scale PV projects in Poland: “70% of Poland’s electricity is based on coal and it’s the number one coal market in Europe. Obviously, it is looking to decarbonise as fast as possible.”

Despite the major focus on residential rooftops to begin with, Econergy has seen a huge growth in development and construction of large-scale PV projects in the last 12-18 months, with about 4.3GW of such projects installed in Poland in 2022 alone.

“It’s quite a large number for a country like Poland,” says Podhorzer, adding that the Eastern European country is not seen as a top tier location for PV given its more northern location with less favourable irradiation conditions.

But since the government curtailed the entry of new wind projects in Poland two years ago, investors have shifted their development efforts into PV. This has been supported by a reduction in capex in equipment prices that enabled projects to reach grid parity and become sustainable investments.

Power price effects

The significant increase in energy prices and lack of raw materials across the globe due the war in the Ukraine is helping to boost solar in Poland by driving local governments and businesses towards prioritising energy security with renewables, according to SPE. As a result, corporate PPAs are thriving in particular.

It’s a similar story to other European markets driven by the decarbonisation and energy independence process, says Podhorzer, however the increase in electricity prices in Poland was not as high as other markets like Romania, Spain and Italy because Poland’s heavy coal reliance makes it less dependent on Russian gas.

Nonetheless, as governments work to ease the process of renewable energy development, there is more interest from investors to enter new PV markets. Moreover, projects that are developed and ready-to-build are currently being sold by developers to investors at a much higher rate than the previous two years.

“It’s a combination of lots of money looking for deployment still in Europe – especially fresh new money coming in – looking at all these big words of energy independence etc. in the next decade,” says Podhorzer. “Also, because of the electricity prices, people are willing to pay more in order to connect projects as soon as possible and try to enjoy the short term, high prices.”

Terrain

There is no standout region for solar development in Poland according to the developers that PV Tech Premium spoke to. Econergy for example has PV plants all over the country.

It’s a similar story for Green Genius, a renewable energy arm of Lithuanian company Modus Group, which has implemented 129 solar projects in Poland and has nearly 700 in development.

Simonas Šileikis, head of solar business at Green Genius, which is expected to have 300MW cumulative capacity installed by year end with a pipeline of 0.5GW in Poland, says there are few regional specifics other than the obvious benefit of higher efficiency in the south due to moderately better irradiation.

However, availability of the grid in the south is more suited to small and medium size (<100MW) power plants. Most developers are just aiming for projects wherever capacity is available across the country’s five distribution grids.

Capacity is available in the north, but this has been blocked for impending offshore wind installations, leaving PV projects stuck at the future development phase. Šileikis says that as a result Green Genius is looking for more southern locations.

Grid trouble

PV Tech recently reported on an industry panel that said interconnection issues were the only impediment to the continued substantial expansion of Poland’s solar PV with grid operators unsure of when new capacity will open up. Likewise, an SPE report noted that the old grid requires modernisation for the energy transformation since “most of its components are over 25-years old, and a significant part is over 40-years old”.

Juxtaposing these reports, Econergy says it has not faced any connection issues in Poland and it continues to build substations and heavily invest in ancillary services and infrastructure for projects in order to connect to the grid.

“We priced it in our business model, but I don’t see an issue on a national level like we see in the UK, for example,” says Podhorzer. “In the UK, as a large developer we are facing – together with the other developers – huge issues at the moment.”

Econergy has 2.5GW of projects under development in the UK, but while it has had grid applications approved by the distribution network operators (DNOs), these were overruled recently by National Grid, meaning that projects approved for connection in 2023/24 are now pushed back to 2027 and beyond.

“We haven’t seen that in Poland meanwhile so I can’t see any special connection issues,” adds Podhorzer.

Šileikis, on the other hand, says that although larger projects have started to become successful, with Poland’s market seen as “stable, secure and predictable” and closing in on 12.5GW capacity, it suddenly became almost impossible to get grid connection confirmation for new projects since September last year.

The grid axis as a resource became very limited leaving Poland with a huge number of projects under development that have secured land but are struggling to get the connection confirmation from the grid. Green Genius, which is developing projects of around 5-50MW in size, has itself faced this grid issue.

Šileikis notes that to some extent the grid capacities that could be met by large-scale solar in Poland are being reserved for the huge capacities filled by potential offshore wind installations expected between 2026-2028.

“Utilisation of the current infrastructure could be much more efficient taking into consideration the installed capacity or the DC part of the generating asset of a solar power plant and the power which is injected into the grid, the AC part,” adds Šileikis. “Then the grid definitely might be used in a more efficient way adding easily some 20% or even 30% of additional DC power and not endangering the grid system itself.”

Green Genius is confident the right conversations for these issues will be had in the near future so it will continue to develop projects knowing that Poland will sooner or later have to face up to the reality that new generation capacity is necessary to phase out the heavy dependence on fossil fuels.

“I’m quite optimistic towards Poland,” Šileikis adds. “It’s just a matter of time. It’s a question of when people will be ready to change. That’s very much the political question as well as for the overall environment and European Union. So, from this perspective, I can say again that for us, Green Genius, Poland is a very important market.”

Entering the market

There are two general ways to enter Poland’s PV market says Dr Dariusz Mańka, director of legal and regulatory affairs at Poland’s solar association Polskie Stowarzyszenie Fotowaltaiki. The first and fastest is to make an acquisition of one of the many projects on the market already.

However, Mańka warns that after a few years of the market booming, the projects that have not yet been purchased tend to have “more or less serious” problems relating to grid connection and construction permits, so it’s quite difficult to get high quality projects to build and to operate.

“After you buy that kind of project, you have several problems to solve and that costs money,” he says.

The second way is to develop greenfield projects. This appears to be more difficult, but there is growing industry demand for solar, so developers can work in tandem with industry partners to develop projects with a direct line to the off-taker using the corporate PPA model.

Meanwhile, local governments will also be looking for cleaner and cheaper energy this year, offering another option for partnership.

“There’s going to be a mandate from provinces in Poland to get renewable capacity and those provinces will have to take it upon themselves,” says Mańka. “So, it will be a decentralised push.”

Part-2 of this article will discuss the rooftop segment and the new law hampering it as well as the plight of large-scale PV and the trajectory of the auction mechanism supporting it.

PV Tech publisher Solar Media will be organising the third edition of Large Scale Solar CEE in Warsaw, Poland during 14-15 November. The event will focus on Eastern Europe with a packed programme of panels, presentations and fireside chats from industry leaders responsible for the build out of solar and storage projects in Poland, Bulgaria, Romania, Greece and Hungary. More information, including how to attend, can be read here.