The price of Chinese module imports to India has dropped 8% over the last quarter and 29% year-on-year, according to new price indices calculated by consultancy firm Bridge to India.

The consultancy has analysed import prices for modules and inverters, as well as costs of utility-scale and rooftop EPC, by interviewing up to 10 leading project developers, EPC firms and module suppliers.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Modules

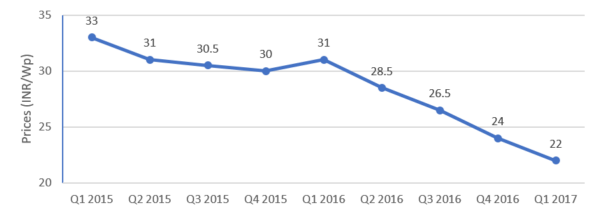

Looking specifically at multi-crystalline PV module imports from China for orders of minimum 50MW in size, Bridge to India calculated cost, insurance and freight (CIF) to India, not including any further port or inland transportation costs.

Module prices have been falling steeply due to oversupply combined with quarterly demand fluctuations in China.

Inverters

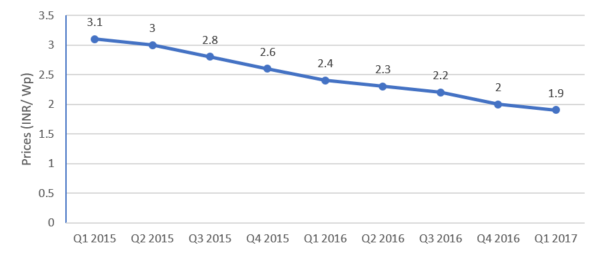

Inverter prices were shown to have fallen 21% year-on-year and 5% over the last quarter, mainly due to increasing competition and new players such as TBEA, Huawei and Sungrow entering the market.

Utility-scale EPC

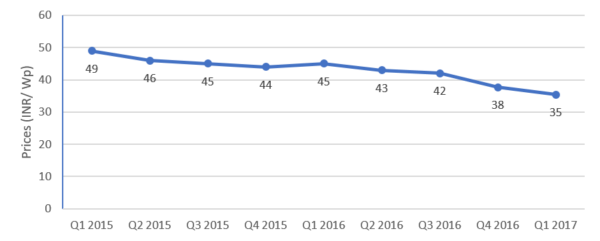

For utility scale solar projects of 50MW in size, EPC prices declined 22% year-on-year, and 8% over Q1 2017.

Rooftop EPC

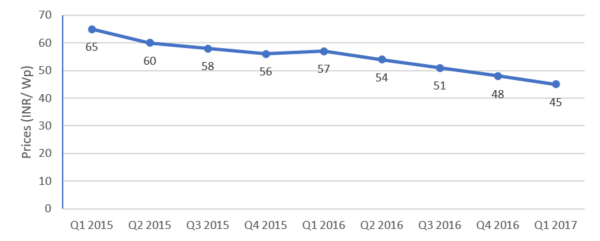

Meanwhile, for 500kW rooftop solar projects on an industrial pre-fabricated metal structure, EPC prices have declined 21% year-on-year and 6% over the last quarter.

Bridge to India, associate director, consulting at Bridge to India, wrote a blog on PV Tech today discussing the new tender process paradigm in India following recent record low solar tariffs.