Operations and maintenance will face huge changes as automation and predictive analytics transform the way projects are managed, writes Sean Rai-Roche.

In 2030, drones will patrol the skies over solar parks while ‘robot dogs’ stalk the ground. Together, they will ensure efficient operations, maintain modules and protect assets. Artificial intelligence (AI) and predictive analytics will enable greater energy yields and will better monitor module degradation. And the current skills shortages in operations and maintenance (O&M) will be resolved via widespread training and education programmes.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

That is a vision for the future put to PV Tech Power by industry insiders. We spoke to companies and experts about what will be required to ensure that a multi-terawatt fleet of global solar in 2030 stays operational.

A 2019 International Renewables Energy Agency (IRENA) Future of Solar Photovoltaic study notes how “the O&M phase is the longest in the lifecycle of a PV project, as it typically lasts 20–35 years”, meaning that “ensuring the quality of O&M services is essential to mitigate potential risks”. It is crucial that asset owners are aware of the true value of O&M when it comes to project lifecycles and returns on investment, with underfunding and underappreciation a key theme of conversations PV Tech Power had.

Mechanised O&M supported by predictive software

Currently, around 80% of the management and maintenance of solar assets is done by humans, says Will Hitchcock, founder and CEO of aerial inspection and data analytics company Above Surveying. “That’s the biggest in the energy industry”, he says, adding that a big prize for solar will be reducing this level through the deployment of mechanical solutions.

“I think the future will be fully autonomous drones,” says Hitchcock. And he isn’t alone. Already today in the energy industry, the market for unmanned aerial systems and drones for critical energy infrastructure is estimated to be worth US$1.4 billion this year, according to research firm Guidehouse Insights. It expects the market to increase to US$10.6 billion in value by 2030, with a compound annual growth rate of 24.9%.

In solar, Hitchcock says ‘drone in a box’ technology will be widespread by 2030. This is where a drone is located on a solar project in a protective box, with auto-landing, take off and wireless charging capabilities. They can then be programmed to deploy at regular intervals to check on the performance of modules across the site using mounted lidar, infrared (IR), multispectral and hyperspectral imagers, all independent of any human control.

“Inspection drones with picture analysis software will be the next big thing.”

German solar O&M company Enerparc agrees that the use of drones in the industry will be increasingly common. “Inspection drones with picture analysis software will be the next big thing,” says its COO Stefan Mueller.

The IRENA report notes how “drones are becoming highly suited to the solar industry due to a wide range of surveillance and monitoring capabilities” and how “in recent years they have become popular for their capability to monitor large-scale solar parks in less time than by human inspection.”

Contributors also noted how drones will provide enhanced security and protection for solar parks, with sophisticated imaging and built-in alarm systems providing far more security for assets then the current system of human monitoring, which can be hindered by delays and slow response times.

In addition to automated aerial inspection methods, the use of ground-based automated technologies, or ‘robot dogs’, will become increasingly common to perform ground maintenance, vegetation control and conduct inspections on the underside of modules, say Hitchcock and John Davies, founder and CEO of solar engineering company 2DegreesKelvin.

Presently, a couple of barriers exist to the widespread deployment of such technologies, namely high costs and regulatory hurdles. But Hitchcock believes this will be largely settled by 2030, with prices coming down due to research and development (R&D) and a more favourable regulatory environment as authorities increasingly recognise the value of such systems in driving down the levelised cost of energy (LCOE) through lower opex costs.

IRENA’s report describes how drones and other unmanned technologies “efficiently capture the necessary data and send them to the cloud for analysis in less time and in more accurate form” and the heavy use of predictive software, machine learning and AI alongside automated maintenance technologies was a key theme raised by contributors.

Solar software solutions company PVcase says powerful software solutions employing sophisticated algorithms can measure the expected yield of projects, map this against current output and identify malfunctions and defects in inverters or modules in real time. Its founder and CEO David Trainavicius says the use of predictive technology based on increasingly large datasets is crucial for the industry moving forward.

PVcase’s technology collects data from all of its clients’ solar projects, aggregates them, combines them with forecasting data and uses predictive software to identify when malfunctions or degradation will occur.

The biggest gap Trainavicius sees in the market is fragmented data sets as projects being rolled out at pace often change hands, in terms of ownership and software management, resulting in less accurate or consistent datasets from which to build predictions and identify maintenance issues. Solving these issues will optimise output, extend the lifespan of projects and give better returns to investors. Moreover, compiling robust data sets from existing plants allow developers to “optimise future assets, even before they’re built”.

While Mueller says, “machine learning for big data analysis is already there and are working”, Davies believes that predictive maintenance software is still in a relative infancy, adding that it will only grow in importance in years to come.

But while using predictive maintenance to estimate when a fault is more likely occur is an efficient way of reducing downtime from failures, it remains the case that faults are occurring. Greater understanding and application of such principles could, evidently, drastically reduce downtimes, and perhaps eliminate them altogether.

Preventing PID

PV module manufacturers generally guarantee a power reduction of less than 20% in the product’s 25-30 warranty period. Earlier this year, however, risk management firm kWh Analytics found that solar assets were “chronically underperforming”, with modules degrading fasting than anticipated. Annual degradation recorded in the field was observed at around 1%, almost double the previously predicted rate of 0.5%.

Davies says that potential induced degradation (PID) is rife within the industry, with many stakeholders either unaware or ignoring it. He says that one way of addressing the issue is through the use of smart string inverters, which the industry is trending towards. Smart string inverters will come with inbuilt IV curve testing, anti-PID testing and back powering for electroluminescence.

While no drone technology will ever prevent PID as it is caused by design oversight from module makers, Davies says, “advanced drone techniques and analytical software will provide early detection of PID, meaning that PID can be then confirmed by electroluminescence or testing, and then addressed quickly reducing losses for the asset owner.”

He says the ‘solar boom fleet’ of 2011-2017 will be particularly affected by PID in 2030, with so many problems identified that “asset managers and owners won’t know what to do first”. The key here, Davies suggests, is to “prioritise these issues in a consistent, credible and simple way, so that investment decisions can be made swiftly.”

So not only will drones provide an important role in monitoring solar plant performance and protecting assets, but they will also be critical in identifying faults in modules and, in turn, protecting investments through lower retrofitting costs.

Addressing skills shortages in O&M

The pace of solar deployment is far outstripping the availability of skilled workers in the O&M sectors, say Davies and Hitchcock. “The ratio of skills per gigawatt is decreasing,” says Hitchcock, who see this as one of the main challenges facing the O&M space.

He is part of UK trade association Solar Energy UK’s Asset Managers Working Group and says the organisation is having conversations about setting up an academy to train workers in key O&M skills. “I’m not talking about doing a Masters in renewable energy but more teaching people basic engineering skills,” he explains, adding that it is needed to tackle the “enormity of the challenge”.

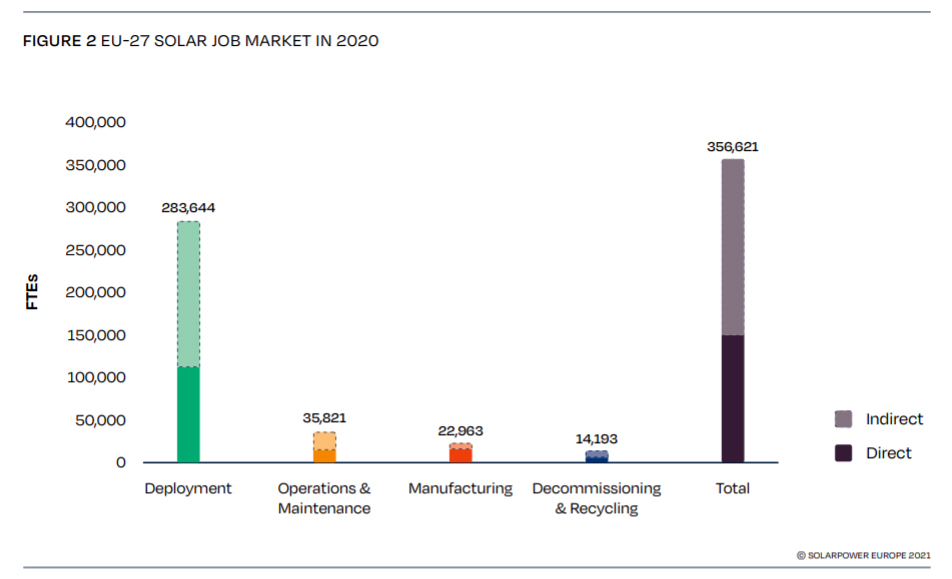

SolarPower Europe’s latest job report shows how O&M jobs in Europe account for 10% of the total, with deployment making up around 80%, which the report said, “is a consequence of the fact that solar PV has a rather high capex intensity and a low opex intensity”.

Mueller says that the maintenance side, composing of technicians and electricians, poses the biggest challenge in the O&M workforce. “Unemployment rate in this segment is zero and no new young people are visible,” he adds.

In order to combat this, contributors have urged the industry and companies to establish training centres and work programmes to support the development of skilled O&M workers, without which the industry risks greater than necessary levels of poor plant performance and module degradation.

A recurring theme when speaking with experts and companies was that O&M budgets were often far lower required for the effective maintenance of projects, with it increasingly being left as an afterthought. Given the capital investment into solar project and the importance of strong, consistent yields, O&M should not be overlooked. Drones, automated technologies and predictive software will change the industry significantly in the years to come but the need for highly skilled workers will persist.