PV-Tech has just released the Q2’20 PV ModuleTech Bankability Ratings report, compiled by our in-house market research team, based on our proprietary methodology developed during 2019.

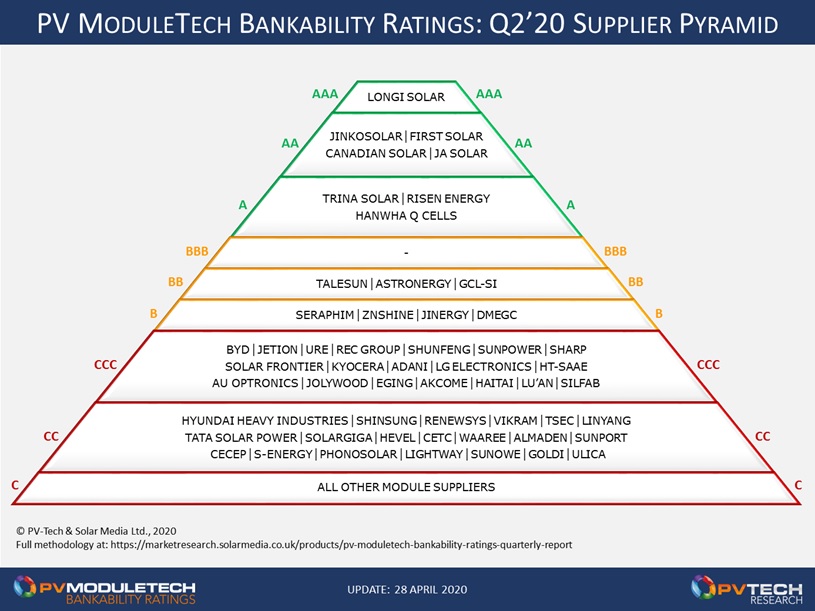

The report now includes bankability rankings for more than 50 PV module suppliers, qualifying across the AAA (highest) to CC (second from lowest) bands.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This article discusses the key findings of the new report release. To learn how to subscribe to the quarterly PV ModuleTech Bankability Ratings report, complete the information at the link here.

LONGi remains only AAA-Rated module supplier

There are currently eight PV module suppliers in the A graded bands of the Bankability ratings scale, as shown in the pyramid graphic below.

For the second consecutive quarter of releases this year, LONGi remains on the only AAA-Rated module supplier. This continues to be driven by the company’s strong operational performance, specifically the gross margins being achieved on wafer sales that are accounting for more than 50% of company revenues now. Combined with being a 10-GW-level global module supplier (not to mention the continued capex allocations to cell and module capacity levels this year), this is rather unchartered waters for a major PV module supplier.

The PV ModuleTech Bankability Ratings analysis now covers the top-50 PV module suppliers to the industry today, where weighting is placed on non-residential shipments globally.

The next category (AA-Rated) includes JinkoSolar, First Solar and Canadian Solar, in the same bands as the previous quarter. JA Solar has moved from A-Rated to AA-Rated now, largely based on the revaluation of the company following its back-door listing in China, compared to legacy market cap estimates from being US-listed.

Within the B grades, Talesun has moved up from B to BB, GCL-SI is still trending downwards with debt and declining market-share the key factors here, and Jinergy and ZNShine are now in the B-Rated band having grown in-house capacity and supply levels in the past few years.

There are still many companies in the CCC and CC Rating bands. Many of these companies are 500MW to 1GW module suppliers, and have a somewhat limited global reach for large utility-scale projects: compared for example to JinkoSolar shipping well above 10 GW outside China alone.

Companies in the CCC and CC Rating bands that have higher shipments than the GW-level are rated as such, mainly due to weak (loss-making) structures. Recall that the bankability rating for each company is based on manufacturing (including shipments) and financial health scores, with higher weightings assigned to financial strength.

The C band (unlisted in the pyramid above) contains several hundred module suppliers, many of whom are partial players within the sector, have very small capacities, and more than often serve to feed domestic rooftop installations only.

COVID-19 yet to show on Q1’20 results

Going forward in 2020, the bankability ratings of almost all companies are set to fall. The precise impact of this will not be known until the August-to-September 2020 period, when Q2’20 or 1H’20 results are audited and released. Only then will the impact of falling prices, shrinking margins and declining shipments be reflected in reported numbers.

Until then, it is somewhat anecdotal in nature, although there is no shortage of leading indicators of what is unfolding now in the supply chain.

The squeeze in margins is likely to focus on wafering this time. Poly pricing has collapsed in the past few years, and even if the industry sells at Daqo-referenced cash-costs, the decline in poly ASPs is not significant. Cell pricing is a break-even business already, and cell ASP declines are essentially on the back of buying in cheaper wafers.

Therefore the strongest correlation in module ASP declines will be with wafer price declines. The key thing is that wafer pricing can fall, as confirmed by LONGi’s wafer gross margins that were, at the start of 2020, out of synch with production margins across poly, cell and module stages.

The last industry downturn in 2012 resulting in a cell manufacturing squeeze, and saw cell production become a zero-margin part of the value-chain. It ushered out the Taiwan pure-play cell model and created the likes of Tongwei that would become 10-20GW pure-play cell makers with single-digit operating margins, on the back of sub 5c/W production costs.

To know where ASPs can get to, the best way is to wipe out gross-margin across the value-chain for a few months, then move that forward on rebound based on ASPs holding flat and costs then being worked on to restore 10-15% gross margins at all value-chain segments.

If this happens, then profitability will be hit, but company valuations will also see a second downward fall: there was a March 2020 fall in market-cap for all listed PV module suppliers (as there was in the global economy), and since then there has been a rebound of sorts. Fast-forward to August/September, when the full effect of 1H’20 is understood upon reporting, and valuations will likely then be reset down quickly.

The combination of declining company shipments, reduced operating margins, reductions in capex/R&D-spend, and share-price volatility, is enough to shift almost any PV module supplier down at least one band in the bankability rankings.

However, this is about the future, and is speculative for now. There are many things that will change unexpectedly in the next few months, for the good and the bad. Either way, the true impact of these will not be known for about 3-4 months.

This will overlap nicely with the next release of the PV ModuleTech Bankability Ratings report (Q3’20 edition), and as such the key thing will be looking at the 2-3 companies that are best shielded today, by virtue of technology (for example First Solar) or global diversification (most notably JinkoSolar). Having a sales pipeline in countries whose utility build segment may be less impacted by COVID-19 may well be the single most important factor in determining the levels to which the top-50 module suppliers are affected by regional-specific market contraction this year.