Polysilicon material prices have experienced a further decline recently, with the price of mono popcorn reaching a new low of RMB60/kg (US$8.3/kg).

During the week commencing on 19 June, the Silicon Industry Branch released the latest prices for solar-grade polysilicon on Wednesday 21 June with n-type, mono recharging chips, mono dense polysilicon, or popcorn materials all witnessing a general decline of over 8.2%, with some even experiencing a nearly 10% decrease.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

- The transaction price for n-type material ranges from RMB70,000-75,000/ton, with an average of RMB73,900/ton, an 8.2% decrease in average price compared to the previous week.

- The transaction price for mono recharging chips ranged from RMB65,000 to RMB70,000/ton, with an average of RMB68,100/ton, showing an 8.71% weekly decrease in average prices.

- The transaction price for mono-grade dense polysilicon ranged from RMB63,000 to RMB68,000/ton, with an average of RMB66,400/ton, indicating an 8.29% decline in average price compared to the previous week.

- The transaction price for mono popcorn material ranged from RMB60,000 to RMB65,000/ton, with an average of RMB62,700/ton, exhibiting a 9.78% weekly decrease in average price.

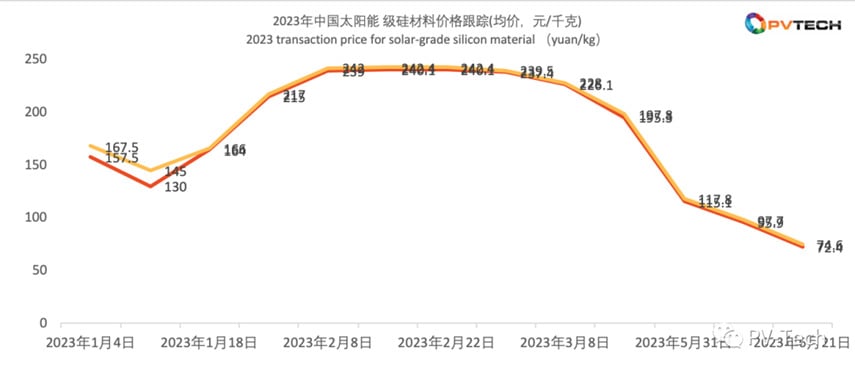

The average transaction price of mono-dense polysilicon outlined above has plummeted by nearly 80% compared to the same period in 2022, when prices reached RMB266,100/ton, while prices have more than halved (-60%) since the beginning of this year, when prices were at RMB176,200/ton.

Mono-dense polysilicon price average has dipped under the RMB72-80/kg average price range that was seen between 2019 and 2020, as it continued its descent since early March this year, when it reached highs of RMB235/kg, according to data from EnergyTrend.

It is reported that the oversupply situation in the polysilicon market has intensified, leading to continuous inventory accumulation and mounting pressure on silicon material companies. This may further drive downward price pressure on upstream grinding companies. In a surprising turn of events, industrial silicon futures on the Guangzhou Futures Exchange hit the daily trading limit for the first time since its listing half a year ago, opening at 9:18 AM on the 19th.

The Silicon Industry Branch of the China Nonferrous Metals Industry Association explained that the continuous decline in domestic industrial silicon market prices over the past six months could be attributed to factors such as unexpected oversupply, slower-than-expected growth in certain sectors’ demand, high inventory levels, and ongoing reduction in production costs.

Furthermore, industry experts believe that with the flood season approaching and the release of additional capacity, the domestic industrial silicon market will witness a significant increase in supply in the second half of the year. However, short-term demand is unlikely to experience noticeable growth, thereby resulting in a rapid decline of over 20% in futures prices after May. The Silicon Materials Branch also stated that given the anticipated improvement in market supply and demand, robust cost support, and various uncertain factors, there is limited downward space for industrial silicon market prices and a short-term stabilization and subsequent rebounds are expected.

As for polysilicon, the current price of mono dense polysilicon is essentially in line with the average production cost of the industry. Taking various factors into consideration, the potential for a further decline in polysilicon prices is limited, and the rate of decline may gradually decelerate.

With the downward transmission of prices, PV module prices have also experienced a decline. According to the data from InfoLink Consulting on June 15th, the overall average price of PV modules has fallen below RMB1.5/watt, with the lower price range plummeting to RMB1.4/watt and the lowest approaching RMB1.3/watt.

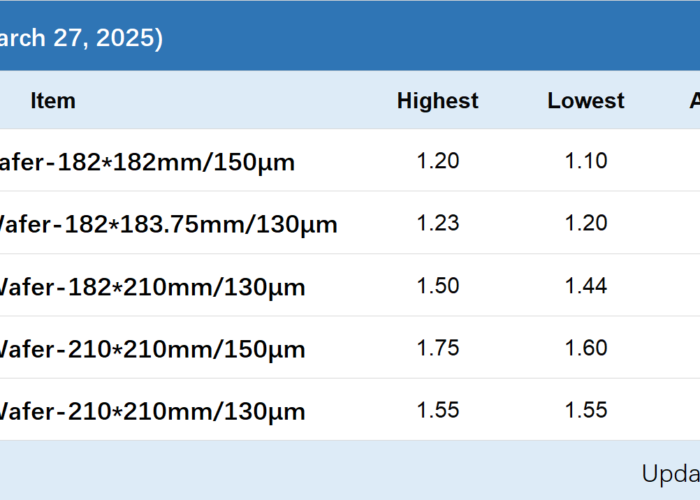

Similar to both polysilicon and PV module prices, wafers have also continued a steady decline over the past, with prices now lower than it used to be at the beginning of the year. For the week commencing on 19 June, average prices for 182mm wafers were in the range of RMB2.75-2.8, as shown in the chart below, while 210mm ranged between RMB4.2-4.15.