Prices of products across various segments of China’s PV industry chain—polysilicon, wafers, cell and modules—have begun to rise recently.

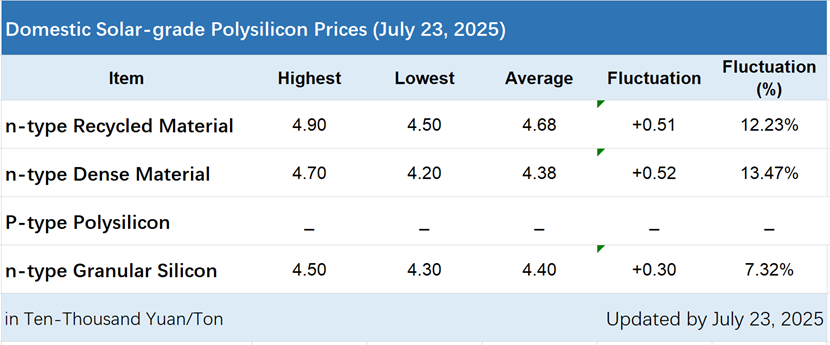

On July 23, the Silicon Industry Branch released the latest silicon material prices, which continued to rise this week. The highest increase reached 13.47%, making this the fourth consecutive week that prices have risen.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The latest price news follows the Sixth Meeting of the Central Financial and Economic Affairs Commission, which emphasised the orderly phase-out of outdated capacity. Subsequently, the Ministry of Industry and Information Technology held a symposium with PV manufacturing enterprises, proposing to regulate and tackle disorderly low-price competition in the PV industry in accordance with laws and regulations. Meanwhile, it guides enterprises to improve product quality and achieve healthy, sustainable development.

Against this backdrop, positive changes have emerged in the pricing of China’s PV industry chain. Third-party industry data from organisations, such as the Silicon Industry Branch of the China Nonferrous Metals Industry Association, show that, driven by the polysilicon segment, prices of major products across the industry supply chain have stabilised after a decline, market activity has picked up, new orders have started to climb and critical progress has been made in optimising the supply-demand dynamics of the PV industry.

Specifically, the transaction price range for n-type recycled material was RMB45,000-49,000 per ton (US$6,279-6,837 per ton), with an average transaction price of RMB46,800 per ton, up 12.23% week-on-week. The transaction price range for n-type granular silicon was RMB43,000-45,000 per ton, with an average transaction price of RMB44,000 per ton, up 7.32% week-on-week. The transaction price range for n-type dense material was RMB42,000-47,000 per ton, with an average transaction price of RMB43,800 per ton, up 13.47% week-on-week.

At the same time, market trading activity has also started to pick up. The Silicon Industry Branch stated that the upward trend in polysilicon prices has further strengthened. Compared to the previous scenario where price hikes were widespread but actual transactions remained scarce, last week saw a significant increase in trading activity, with around six companies securing new orders, as overall transaction volume recorded a substantial rise.

Based on production schedules from major polysilicon manufacturers, the upward trend in the market average price is expected to sustain its steady momentum. The Silicon Industry Branch estimates that domestic polysilicon production in July will be around 105,000 tons, with a slight increase to approximately 110,000 tons in August.

Meanwhile, downstream polysilicon demand remains stable at about 110,000 tons per month, meaning there is currently no additional inventory pressure in the market.

Wafer prices stop downward trend

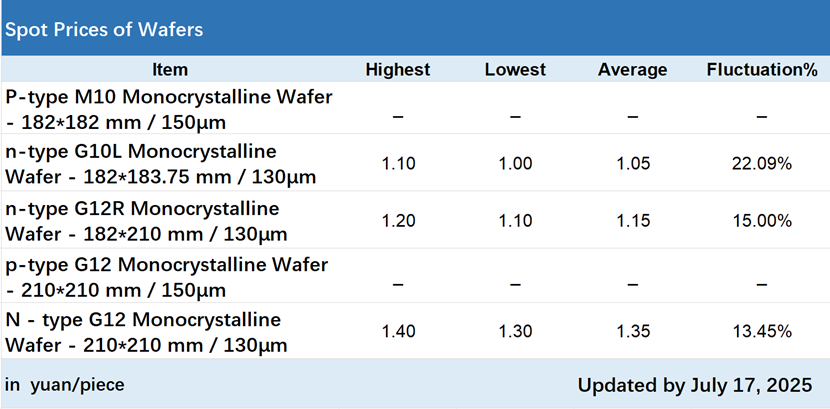

The sustained rise in polysilicon prices has effectively rippled through the midstream wafer segment, reversing its prolonged downward trend. Data from the Silicon Industry Branch shows that prices of mainstream wafer products saw broad-based gains, with notable increases across the board.

The average transaction price for n-type G10L monocrystalline wafers reached RMB1.05 per piece, surging 22.09% week-on-week; n-type G12R monocrystalline wafers averaged RMB1.15 per piece, up 15% from the previous week; and n-type G12 monocrystalline wafers averaged RMB1.35 per piece, posting a 13.45% week-on-week increase.

The Silicon Industry Branch attributes the rise in wafer prices to two main factors. First, the ongoing increase in polysilicon costs; second, wafer manufacturers have strictly implemented production cuts and load-reduction measures, leading to a significant contraction in industry supply, reduced inventory levels, and strong pricing momentum.

This upward trend has also extended to the cell segment. Mainstream cell prices edged up slightly to RMB0.24-0.25 per watt, up by about RMB0.01 per watt from the prior period.

InfoLink Consulting analysis indicates that, given the renewed rise in wafer prices, subsequent cell prices should logically increase to cover costs. In the long run, driven by policy support, the cell market is expected to break away from hovering at the bottom levels near cash cost, enabling manufacturers to return to sustainable profit levels.

Tier 1 manufacturers’ module price edges upward

In contrast to the broad-based price increases seen in upstream and midstream segments, the module sector—which directly supplies end-user power plants—has also experienced pricing shifts, with manufacturers showing significant divergence in their strategies.

Data from TrendForce’s New Energy Research Center shows that distributors of some Tier 1 manufacturers have actively responded to industry self-regulation initiatives by attempting to raise quotes by RMB0.01-0.02 per watt, while actual transaction prices for Tier 1 players are hovering around RMB0.65 per watt.

On the other hand, less competitive Tier 3 and smaller manufacturers continue to mainly adopt low-price strategies to attract orders, with quotes dropping as low as RMB0.59–0.63 per watt.

Looking ahead, InfoLink Consulting suggests that if high-priced polysilicon orders continue to emerge, they will provide upward support for wafer and downstream prices. While a full recovery in end-demand still requires time and the effectiveness of price transmission remains to be seen, the dual drivers—sustained industry-wide inventory draw-downs and proactive production cuts—have alleviated long-term downward pressure.

The future market development will hinge on whether polysilicon prices can stabilise and extend their upward trajectory, as well as whether actual transaction volumes can effectively sustain a new round of pricing adjustments.