The China Photovoltaic Industry Association estimates that the total proportion of 182/210 silicon wafers will reach about 75% in 2022, which will become mainstream in the industry. As the proportion of large silicon wafers increases, the size and weight of the modules also increase rises. At present, the length of the 78-cell 182 modules has reached nearly 2.5 metres, while the frame weight of which reaches almost 3kg.

New module types put present higher demands for the performance of the frames. Aluminium frames are currently the mainstream solution in this field, with advantages such as lightweight, high corrosion resistance, high strength and easy processing and recyclability.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, although aluminium frames are relatively stable in performance, the gap between different aluminium frame manufacturers in product quality and cost control is widening, due to more strict standards of module companies on the frame strength, processing accuracy, manufacturing cost and other requirements.

Only leading aluminium frame manufacturers that have strong research and development (R&D) capabilities and an integrated industrial chain to finish the whole process from raw material to the final product will remain in a dominant position in the industry.

Earlier this month, PV Tech spoke with Wei Qingzhu, vice president of solar aluminium frame manufacturer Yonz Technology’s R&D platform.

Founded in 2009 and located in Changzhou, China, Yonz Technology has set up branches and production bases across the Chinese provinces of Liaoning, Jiangsu and Anhui, as well as in Singapore and Vietnam. At present, the company’s annual capacity of solar aluminium frame products is about 40GW, with 80GW of new capacity under construction.

In the past two years, the PV industry has experienced multiple price surges, which has brought the industry pressure to reduce costs. As a module auxiliary supplier, what do you think about this problem and how has the company been affected?

Wei Qingzhu: First of all, let’s take a look at the industry. In the past two years, polysilicon, glass, film and aluminium frames all experienced periodical price fluctuation. Now auxiliary materials are back to a reasonable level. Why did these prices go up? We can make an analysis of their costs. The main cost component of an aluminium frame, welding strips and silver paste, are depending largely on commodities prices. Silver, copper and aluminium commodity prices are all affected by changes in supply and demand relations in the global market.

For example, the peak price of aluminium alloy reached RMB25,000/ton (US$3,580/ton) last year, but in 2022 it has dropped to RMB17,000-19,000/ton with a reasonable level and relatively stable. Similarly, silver, copper and polymer materials, etc., also went through such a fluctuation process. But the overall trend for the prices of these industries went stable. Also, the relationship between supply and demand is another consideration factor. The supply of aluminium alloy is quite sufficient, so the price is not a thing to worry about.

Also, logistics costs have been affected to some extent this year by the pandemic. Especially in the first half of the year, logistics cost was relatively high. However, Yonz was actively taking responsibility of the supply chain, ensuring the supply of the frames and making every effort to send them to our customers’ sites.

Aluminium frames have been categorised as a no-cost-reduction PV component. What do you think? How does the company deal with cost reductions? What are your measures or solutions?

In fact, for more than ten years since Yonz first entered the PV industry, PV frame costs decreased from RMB0.3-0.35/W to the current level of RMB0.13-0.15/W, almost a 60% decline. Apart from the improvement of module efficiency, the PV frame cost also contributed by more than 50% through structural design, material development, process improvement and other methods. We have been doing “subtraction” for the products. In order to improve production capacity, and thus reduce manufacturing costs, we have carried out automation retrofit and intelligent upgrading of our production line, and finally achieved the purpose of cost reduction. On the other hand, we are also trying our best to improve the yield and create value for customers through technique and processing improvements.

In addition, in the past two years, although the purchasing price of some auxiliary materials has increased along with commodity prices, we didn’t transfer the cost pressure to our customers, which was recognised and appreciated by them. We have also been working on the structure modification of our frames. In 2018, we pioneered the introduction of a 55-degree angled frame, which achieved a great industrial cost reduction. Now 99% of the manufacturers in the industry have adopted a 55-degree angled frame.

In the 2022 annual meeting of the China Photovoltaic Industry Association, we proposed standardisation of the PV frame and cancelling the process of sandblasting both for the benefit of our customers. Why do we need standardisation? The cost of non-standardised PV frames is higher, and the delivery time is long. The increase in a customer’s frame storage will also affect the capital turnover. In addition, we analysed the influence of the frame appearance on the performance from the view of the customers, and the results showed that the sandblasting process had no impact on the long-time reliability and the mechanical performance, and also the accuracy of the frame, so we also put forward a series of standards including the frame structure, the appearance, the mechanical performance and the quality.

Through standardisation of performance and structure, cancelling sandblasting, appearance standardisation and other cost reduction approaches, the cost of each ton of frames can be reduced by more than RMB300. What does it mean? The cost per watt will be reduced by RMB0.3 cent, and the cost of 1GW will be reduced by about RMB3 million. Assuming annual module shipments of 300GW, the annual cost can be saved by RMB900 million, which will make a great contribution to the industry. That’s why we are actively promoting this work.

The energy consumption of aluminium production and processing, as well as stable supply in the long term, have been questioned. How do you think aluminium frames can meet the market demand for greener production, lower carbon emission and lower energy consumption?

Yonz Technology is also taking the initiative to reduce its carbon footprint to fulfil our corporate and social responsibility. Our aluminium frame products were assessed by third-party SGS for carbon footprint. Carbon footprint has to do with two factors. The first is the product manufacturing activity level and the second is the carbon emission factors, respectively. Through calculation, our product’s carbon footprint is very low during processing, about 1.3 tons of carbon footprint while producing each ton of aluminium frame, far lower than that of other materials.

Meanwhile, the Yonz Changzhou factory has installed a 6.5MW distributed rooftop PV plant on its roof and Yonz Chuzhou installed 12MW distributed rooftop PV plant. Green electricity production has also contributed to carbon reduction. On the other hand, aluminium alloy can be recycled infinite times, so the actual carbon footprint is very low from the perspective of the life cycle assessment (LCA). We have calculated that the carbon footprint is about an equivalence of 15kg of CO2 per kilowatt of the PV module from the aluminium frame part from the view of LCA.

From a long-term perspective, we focus on material recycling. We care about whether we will leave our grandchildren resources or garbage in the coming 25 years when the module is out of service. Aluminium alloy is completely renewable and can be recycled for infinite times in the industrial chain. In addition, the entire aluminium alloy industry pays lots of attention to the realisation of the double carbon goal. Many upstream enterprises are migrating to places with rich hydropower and solar power resources. And Yonz Technology is constructing a new manufacturing base in Wuhu, mainly focusing on recycling aluminium scrap as raw material to produce recycled aluminium frame products. We have also calculated the carbon footprint of the recycled aluminium frame with equivalent to 7-10kg CO2 per kilowatt of module frame, which is the lowest among all the frame materials.

With the development of large-size PV modules, they require stronger frames that can withstand higher loads. How does the company see this trend and what are your solutions?

From the view of module development, the PV industry realised that standardisation is very important for mass production. 182/210 type module has become a unified model with the same size for manufacturers. On this basis, the aluminium frame is being widely used and has been proven through the test in real applications. At the same time, we have also made some improvements for large-size modules, including upgrading the material from 6063 to 6005 in order to improve its strength. We have also made many technical improvements such as ageing and annealing.

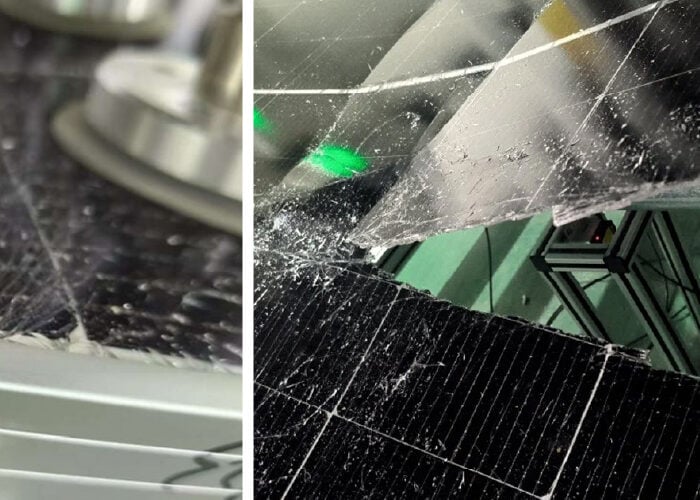

Large-size modules put forward higher requirements for aluminium frames, but this means not just higher strength and higher hardness, but also a better match between the frame and other auxiliary materials such as glass.

In the past two years, modules are more differentiated with more diversified forms and sizes to meet different market demands. As a packaging material supplier, how does Yonz respond to changing customer needs?

We have professional R&D, production and design teams to meet the differentiated needs of customers. At the same time, we have rich production experience in moulds, extrusion processing and other aspects, which can meet the demands of various application structures. Besides the standard frame product, we can also meet customised requirements, which is very competitive in the field.

In addition, we also noticed the diversification of module application scenarios, such as offshore PV plants, desert PV plants and other harsh and extreme environments. Harsh and extreme environments require better design and material of the modules, which can only be achieved by aluminium frames. We can say that the aluminium frame is the most suitable product for PV diversified applications.

There are also frame products made with different materials in the market, such as rubber clamps, steel frames, composite material frames, etc. What do you think about them?

Yonz is happy to see all the technological progress in the PV industry, but the application of new materials requires analysis and evaluation in terms of product quality. For example, steel is easy to corrode and relatively heavy, with its density three times that of aluminium alloy. Thus, the amount of steel used in the module frame is nearly twice as heavy as that of the aluminium alloy frame. In addition, the matching between the frame and other auxiliary materials as I mentioned just now, the product size accuracy, stability and other performances need to be considered.

Also, the steel frame is quite heavy, so its carbon footprint is significant. At the same time, evaluation from the LCA, its recyclability and recycling efficiency are not good, resulting in an unfavourable carbon footprint.

Another example is the composite material frame. It has some natural defects such as anisotropy, unstable coating, poor product accuracy and unsatisfying installation in the application, plus it uses glass fibre and polyurethane materials, which are unable to be recycled. This is exactly what I mentioned just now; it will leave behind garbage after the whole lifetime of about 25 years.

What is Yonz’s current market share?

At present, the company’s production capacity in Yingkou, Changzhou and Chuzhou bases exceeds 40GW in total, accounting for about 25% of the market share in the industry. By the end of 2023 and the beginning of 2024, when the Wuhu base and Vietnam base are put into production, our total frame capacity will reach 120GW, accounting for about 30% of the whole industry.

Besides aluminium frames, what other extensions in the product line does the company have and what are the plans for the future?

Besides aluminium frames, we are also developing both products and solutions for BIPV (building-integrated PV) and its application. We are also doing some research and development in the field of solar tracking and bracket, aiming to make a more ideal combination solution for module installation. This is our next step.