Renewable power purchase agreement (PPA) prices in Europe continue to climb, rising 7.8% quarter-on-quarter in response to the continent’s deepening energy crisis, according to new research from LevelTen Energy, a provider of renewable transaction infrastructure.

Macroeconomic and regulatory challenges, including the energy crisis, have been compounded by supply chain constraints, inflation, rising commodity costs and government auctions culminating in reduced PPA supplies and rising prices, the company said in its Q4 2021 PPA Price Index report.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As a result, Europe’s P25 Index – an aggregation of the lowest 25% of solar and wind PPA offers – now stands at €52.46/MWh (US$60.16/MWh), a 7.8% hike on Q3, which also saw an 8% jump in prices on the previous quarter.

Upward price pressure trends have now continued for the third consecutive quarter, representing a 17.4% increase in P25 price offers during the nine months.

With wholesale prices as high as they are, selling energy into wholesale electricity markets is an increasingly attractive option for renewable developers, said Fred Carita, manager of developer services, Europe, at LevelTen.

“Developers are raising their PPA prices to make up the revenue they could have otherwise made selling a greater percentage of their electricity on the day-ahead market,” he said.

While the P25 Index for solar offers rose 7.2% to €47.97/MWh in Q4, the index for wind offers increased 8.2%, now sitting at €56.96/MWh.

The report revealed that although Italy’s solar market has shown “remarkable price stability” over the last year, this trend broke in Q4, with Italian P25 solar prices soaring by 20.9%. Developers in the country may be padding PPA prices to account for increased uncertainty stemming from approval processes for permitting and interconnection rights seemingly unable to keep pace with the growing project pipeline, according to LevelTen.

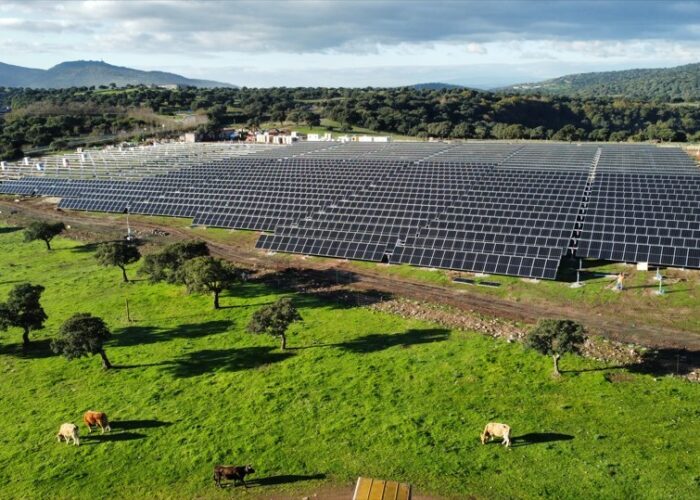

Solar PPA prices in Spain also rose by 11.5% during Q4 as measures introduced by the country’s government to limit windfall profits of renewable energy plants likely caused some upward price pressure, the report said.

Despite the headwinds, LevelTen said that developers and buyers are successfully navigating these uncertain waters, with non-standard contract structures paving the way.

“The good news is that PPA deals are still getting done,” said Rob Collier, VP of developer solutions at LevelTen Energy. “Contract innovations tailored to current market conditions are enabling successful PPA transactions. And second, buyers have so far remained undeterred by market conditions, meaning that demand is still high.”