PV Tech Power contributor John Lubbock examines the challenges of reforming the UK’s electricity market in the face of the increased rollout of renewables in the country.

Reforming an entire market structure is complex, let alone reforming one as complex as the electricity market, yet most stakeholders are in agreement: the UK’s electricity market needs reform.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The Review of Electricity Market Arrangements (REMA) reform has been on the cards since 2022, when the UK government decided to launch its consultation on the far-reaching reforms needed to cope with a market set up for a world with a small number of big energy sources, not a world with lots of small-scale renewable generation.

The intermittency of renewables on the grid is leading to increased costs. The Nuclear Industry Association (NIA) says: “The cost of balancing Britain’s power grid hit £4.19 billion last year [2022] according to Nuclear Industry Association analysis of National Grid Electricity Systems Operator (ESO) data… Costs have increased 250% since 2019, when the total was £1.2 billion. In those last four years, balancing the grid has cost British consumers £9.83 billion in total.”

The NIA says that without reform of the current market arrangements, “there is a risk of consumers having to pay spiralling costs to balance the electricity system. Currently, electricity generators can sell into the national market even if the power network cannot physically transmit the electricity to where there is consumer demand.”

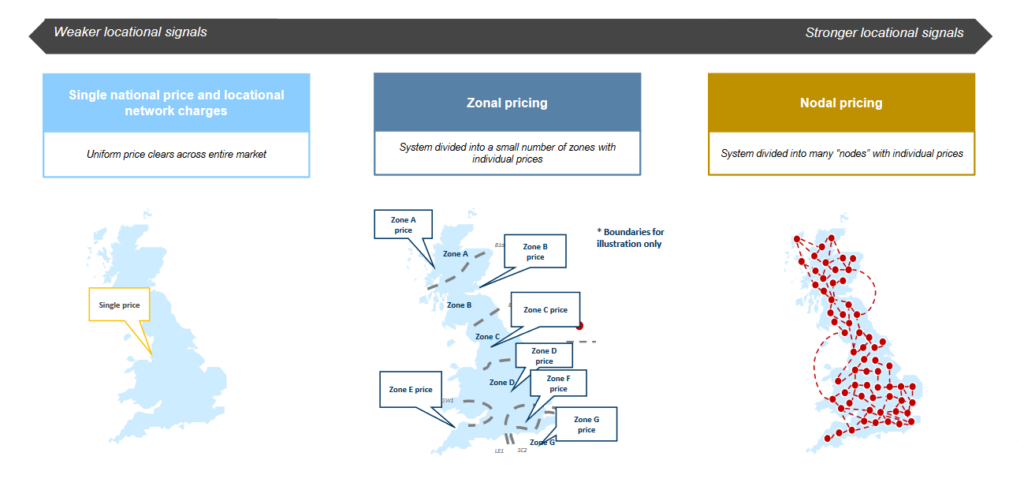

Over £1 billion is being spent a year on ‘balancing actions’ which are the result of wholesale markets too simplified to reflect real conditions on the grid. The Energy Systems Catapult – set up to accelerate the transition of the UK’s energy system – has looked at the reforms to do with locational pricing being considered by REMA, and concluded in a report that locational pricing could save consumers money.

National Grid ESO’s Net Zero Market Reform project, established in 2021, looked at what kind of market design would help to achieve net zero, and in March 2022, NGESO recommended the adoption of a nodal pricing system, which it said would achieve net zero at the lowest total cost.

However, there are potential drawbacks to a nodal pricing system which are causing concerns about attracting investment, as a prolonged period of transition and uncertainty could cause. As RenewableUK also noted, a nodal system” would lead to increased price volatility and complexity (indeed, this is the objective in order to incentivise behaviour).”

RenewableUK warns that this would “increase risk and adversely impact investor sentiment, which could slow the pace of deployment of renewable projects needed to reach net zero by 2050.”

However, there is also a concern that the continued lack of clarity around future market arrangements is hampering investment, with concerns being raised that the REMA consultation process has been going on too long. PV Tech talked to Tom Luff, senior advisor at the Energy Systems Catapult and Joe Perkins, senior vice president and head of research at Compass Lexecon, who has analysed nodal pricing for Ofgem, to understand the concerns and where REMA is heading.

“Fundamentally, change is needed,” says Tom Luff, because “we won’t get to net zero with the current arrangements.” The challenge is deciding the specific changes we need, Luff says, and how radical and fast they need to be.

The basic problem is that there’s not enough flexibility in the market to deal with the changing nature of energy production and the intermittency of renewables, Luff says. The way to achieve this is “to make sure that the value of energy is properly reflected so that the actual realities of the grid are properly reflected.” This means shorter trading windows and locational pricing to more accurately represent prices. Ofgem announced in June 2023 that the completion date for the market-wide half-hourly settlement (MHHS) programme would be pushed back from October 2025 to December 2026.

However, there is pushback to radical change from some parts of the industry, especially from companies that manage the grid and generate power in areas with high supply but low demand, like Scotland. Luff says that the government should set out a clear direction of travel if they decide to introduce locational pricing and stick to it to give investors confidence. Zonal pricing, rather than nodal, could be a halfway house on the road to nodal pricing which could cause less disruption, but would also give less flexibility.

Market reform is “not so much about giving more subsidy, it’s just giving a fair price,” Luff adds. In places where demand is high, like urban areas, reflecting the real electricity price would incentivise more rooftop solar, for example, which is something that community energy groups are enthusiastic about. Creating more supply where there is demand would also reduce the need for bigger transmission cables to take power from areas of production to where the demand is.

National Grid ESO is also in favour of locational pricing, because this would help reduce the problem of balancing costs we looked at earlier. This is important, because building out grid infrastructure is the biggest obstacle to the rollout of renewables, and locational pricing should help to incentivise the network upgrades needed.

Joe Perkins, who has been advising Ofgem on energy market reform, says that as far as the potential damage to investor confidence goes, “the status quo is not an option”, and there will need to be considerable reforms. There is already investor uncertainty around the transition period of reforms, and locational pricing would probably increase the riskiness of investments in the renewables sector.

Perkins looked at other jurisdictions which had moved to a locational pricing system over the past 10 or 20 years while expanding renewable generation, and “we didn’t really see any sign of a hiatus [in investment in the sector]”. Perkins added that “the broad sense was that what really mattered was the policy support mechanisms.”

Locational pricing is unlikely to impact on the cost of capital, Perkins said, and while it is possible that it could affect wind power generators in Scotland, it could also help to incentivise the rollout of battery storage to take advantage of locational price fluctuations. Perkins also thinks it would help incentivise community energy projects in urban areas, if these projects are allowed to sell their electricity locally and bring down consumer bills, and that it would also assist with vehicle to grid (V2G) interactions which create grid flexibility with electric vehicle battery storage.

“For me, it comes down to an empirical question, really: do you think that you get a better functioning energy system with locational prices or not?”, Perkins says. However, “if you were just doing the very head-down economist approach, you probably would say nodal pricing is the answer, because it just comes out with a much higher benefit cost ratio. For a more political perspective, I think there’s a case for zonal pricing.”

Fundamentally, the main bottleneck in rolling out renewable generation is increasing the capacity of the electricity grid by building out infrastructure. Arguably, the current energy market system in the UK doesn’t incentivise this, because there is one price for electricity all over the network, which means that there is no incentive to build capacity where demand is high.

Investors want certainty. They want the government to say what kind of energy market system they prefer, and lay out a roadmap to achieving it so that they can plan long term investments. There is already uncertainty about the direction of travel for the UK’s energy system, and the government can reduce this by speeding up the REMA process.

Energy UK has recently forecast that the UK will have the slowest growth in low-carbon electricity generation of the world’s largest eight economies, and some of the blame for this must lie in the slow pace of market reform and a lack of urgency by energy companies to upgrade their grid infrastructure. The only thing for certain in energy market reform is that doing nothing is not an option.