Shoals Technologies has become the latest solar manufacturer to adjust its guidance for the year, blaming an “increasingly challenging environment” caused by the US AD/CVD investigation.

Despite the adjustment, balance of system provider Shoals is not expecting the majority of its backlog to be at risk of being affected by the AD/CVD investigation, said Shoals CEO Jason Whitaker during a conference call.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“The outlook we provided earlier this year reflected our expectation of continued industry headwinds which is why we continue to be comfortable with the low end of our revenue outlook, but the uncertainty posed by the Commerce Department investigation in particular, has caused us to lower the high end of our outlook,” said Whitaker.

However, Whitaker added that the company expects new projects to be delayed until the investigation is resolved and could impact backlog growth in future quarters.

The revised revenue outlook for 2022 is expected to be in the range of US$300-325 million, lowering its high end from US$350 million, with an adjusted EBITDA reviewed to US$77-86 million, from US$79-97 million previously.

Furthermore, its net income has been lowered to US$45-53 million from US$54-69 million, due to higher expenses to support growth and staff hiring.

Nonetheless, Shoals saw its first quarter revenue increase 49% year-on-year.

Q1 2022 revenue stood at US$68 million compared to US$45.6 million in Q1 2021, primarily driven by a 73% increase in components revenue, itself attributed to a growth in battery storage shipments during the quarter and customer additions.

Moreover, system solutions represented 69% of total revenue for the quarter, a four percentage point decrease over Q1 2021, and its revenue increase due to the company’s ‘combine-as-you-go’ system and components sales growth.

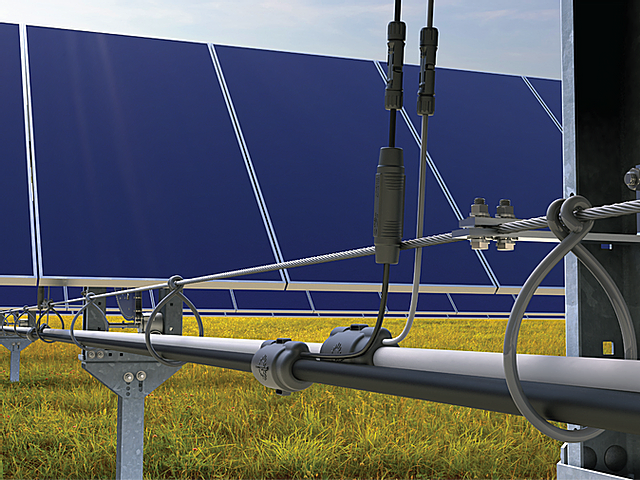

Whitaker said that during the first three months of the year, the business added seven customers to its Big Lead Assembly (BLA) solution – which combines cable assemblies, combiner boxes and fusing into a single product – which represents as much as 2GW of demand.

“Notably, three of the seven new customers are located in international markets demonstrating our ability to convert customers outside of the U.S. to BLA.”

Shoals ended Q1 with a backlog and awarded orders of US$302.3 million, a new record for the company and an increase of 67% and 1% compared to the same time last year and December 2021 respectively, reflecting continued robust demand for its products.

Q1 adjusted EBITDA increased 17% on the prior-year period to US$16.5 million, with a slower growth due to the company’s continued investment to support its growth initiatives, while gross profit increased 40% to US$26.3 million, compared to US$18.8 million in Q1 2021.

“We’re investing heavily in people to expand our new product development capabilities, grow our international sales presence, scale up our EV business and support our new 219,000 square foot manufacturing facility, which became operational a little over a month ago,” said Whitaker.

Conference call transcript from the Motley Fool.