Solar Balance of System (BOS) solutions provider Shoals Technologies has celebrated a “record year” in which revenues grew 21%, placing various post-IPO targets firmly in its crosshairs for 2021.

Earlier this week Shoals reported full year 2020 revenue of US$175.5 million, up 21.5% on the US$144.5 million revenue figure it reported in 2019. This growth was attributed by the company to “significantly higher sales volume” throughout the year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

While year-on-year revenue growth slowed in Q4 – the fourth quarter’s revenue of US$38.8 million was up just 2.3% on Q4 2019’s figure of US$37.9 million – this was laid squarely with downtime related to work being conducted to expand the solution provider’s capacity moving into 2021.

Shoals expects the forthcoming year to be one of considerable progress towards a series of growth initiatives outlined within its initial public offering (IPO), which was held earlier this year and saw the company raise US$2.2 billion after upsizing.

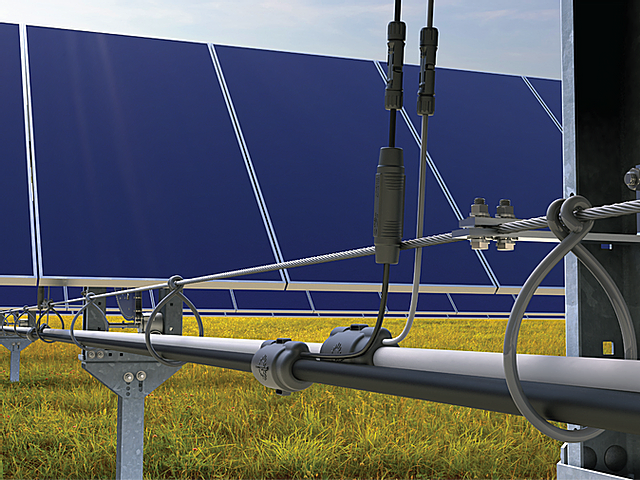

Gross proceeds from the IPO are now helping it pursue various growth strategies, including converting more customers to its Big Lead Assembly (BLA) solution, which combines cable assemblies, combiner boxes and fusing into a single product for utility-scale solar projects. Shoals is also boosting its product offering to incorporate more electrical BOS solutions, expand internationally and is also eyeing a move into electric vehicle charging infrastructure.

New wire management and IV curve benchmarking products are to be introduced in Q2 this year and the company expect them to begin generating revenue in Q4.

Jason Whitaker, chief executive officer at Shoals Technologies, praised the “tremendous efforts” of his team throughout the COVID-19 pandemic.

“The energy transition is a global megatrend that is in the very early innings. We see tremendous opportunity ahead for our employees and shareholders,” he added.

Shoals is forecasting for another strong year in 2021 and is guiding for revenues to grow by between 31 – 36.7%, reaching between US$230 – 240 million. Its adjusted earnings guidance is for between US$75 – 80 million, which would represent growth of between 23 – 31%.