Renewable energy, such as wind and solar, is expected to dominate power generation out to 2050 but there are still major challenges to its growth, according to the latest edition of bp’s Energy Outlook.

Renewables are set to increase substantially thanks to the continuing cost competitiveness and the adoption of these sources into the power systems. However, the significant acceleration in financing and building new capacity remains the challenge to continuing the growth, said bp.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

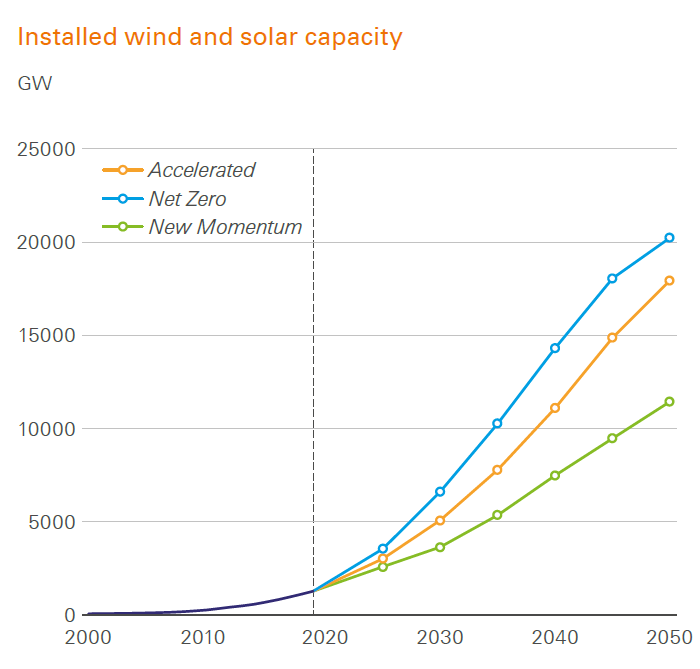

Its report outlined three main scenarios, namely Net Zero, Accelerated, and New Momentum, to explore the range of possible outcomes for the global energy system over the next 30 years. bp said that Accelerated and Net Zero explore how different energy system elements might change in pathways that achieve substantial reductions in carbon emissions by 2050 – by around 75% in Accelerated and over 95% in Net Zero. Net Zero also includes a shift in societal behaviour and preferences to support further gains in energy efficiency and adopting low-carbon energy.

Both scenarios assume a significant tightening in climate policies globally.

Meanwhile, New Momentum is designed to reflect the current broad trajectory of the world’s energy system. In this scenario, global carbon emissions peak in the 2020s and, by around 2050, are about 30% below 2019 levels.

Renewable energy project costs to fall again after short-term impacts

Up to 2050, bp said that wind and solar power would expand rapidly, driven by increasing cost competitiveness and policies supporting a shift to low-carbon electricity and green hydrogen. For example, falls in their costs will resume after recent short-term inflation pressures, especially over the first 10-15 years of the outlook.

Several reasons will contribute to the fall of solar and wind technology and production costs, including growing deployment, increased module efficiency, load factors and project scales for solar, and higher load factors of increasingly large turbines.

The pace of cost reductions will slow down and eventually plateau in the final two decades of the outlook as falling generation costs will be offset by the growing expense of balancing power systems with increasing shares of variable energy sources.

Two factors could impact the outlook for costs. First, the availability of the critical metals used in manufacturing PV modules and wind turbines needs to increase sufficiently to avoid a sustained increase in prices. Second, supply chains will develop and expand to avoid excessive dependence on individual countries or regions for key materials.

Challenges to growth

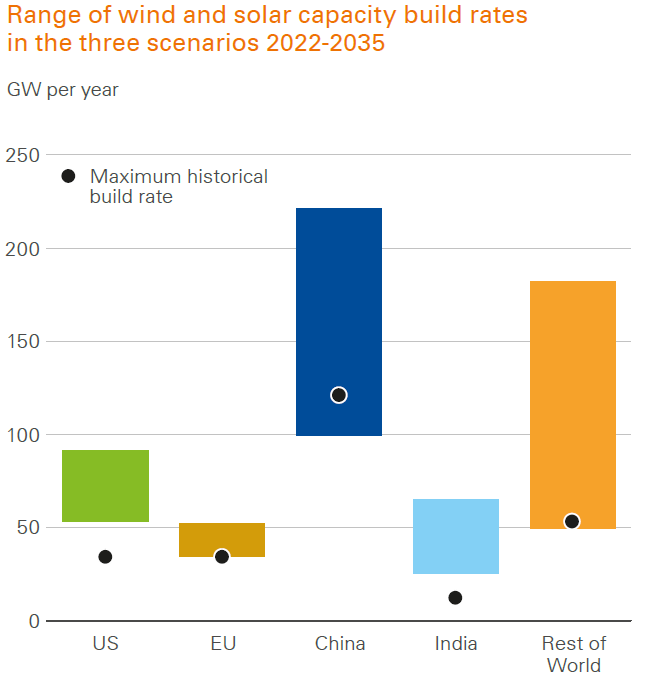

The current speed of the expansion of solar capacity is inadequate to achieve the goals of renewable energy adoption. The average rate of increase in installed capacity in Accelerated and Net Zero out to 2035 is 450-600GW per year, equivalent to about 1.9 to 2.5 times faster than the highest rate of increase seen in the past.

The rapid acceleration in the deployment of wind and solar capacity needed to get there depends on several enabling factors scaling at a corresponding pace. This includes the expansion of transmission and distribution capacity, development of market frameworks to manage intermittency, the speed of planning and permitting, and the availability of route-to-market mechanisms.

China and developed countries will account for about 30-40% of the overall increase in renewable energy capacity in all three scenarios out to 2035. But things will change after that year as emerging economies, excluding China, will account for about 75-90% of the growth in the 2040s in Accelerated and Net Zero.

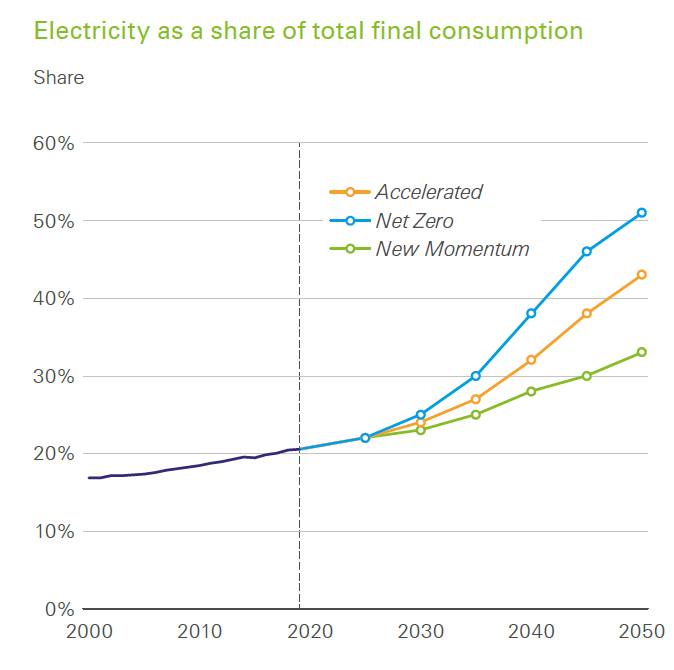

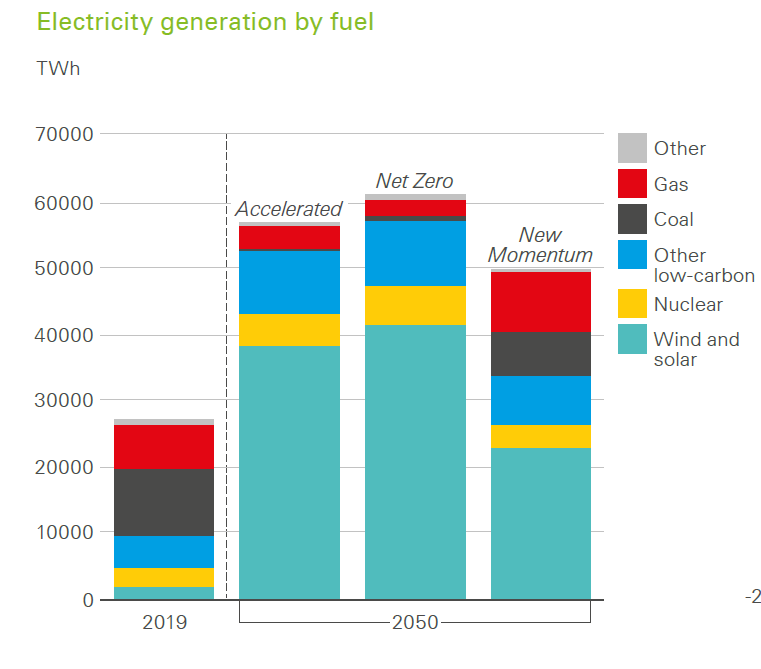

Apart from the expansion of wind and solar, the report also examined the increasing electricity demand and the decarbonisation led by the increasing dominance of wind and solar power.

The growth of electricity demand will mainly be driven by growing prosperity in emerging economies and increasing electrification of the global energy system. By 2050, the final electricity demand will increase by about 75% across all three scenarios.

Electricity demand in India grows by between 250-280% over the outlook across the three scenarios, compared with 10-30% in the EU. However, electricity consumption per capita in the EU in 2050 will still be about double that in India.

Regarding the decarbonisation of global power generation, wind and solar power will account for about two-thirds by 2050, or even closer to 75% in the Accelerated and Net Zero regions. That share will be around half by 2050 in New Momentum.