As solar PV proliferates and emerges as the dominant energy transition technology in much of the world, it is taking up a larger and larger portion of the world’s silver production. Solar manufacturing accounted for around 18% of global silver production in 2023, according to the International Technology Roadmap for Photovoltaics (ITRPV) from VDMA published earlier this month.

The 2024 World Silver Survey found that silver demand in 2023 massively outpaced supply, and the deficit is likely to remain “for the foreseeable future”. This high demand is underpinned by the “remarkable” rise in solar cell and module demand, the Survey said. As silver is a key component in the manufacturing of solar cells – particularly in new generation n-type cells – manufacturers are saddled with a new cost challenge and a finite resource to work with.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Published earlier this month, the ITRPV said the consumption of silver metallisation pastes in cell manufacturing “needs to be reduced” if the industry is to sustain its growth. The ITRPV shows that tunnel oxide passivated contact (TOPCon) cells use around 120mg of silver per cell; TOPCon has become the technology of choice for all of the biggest solar manufacturers. Each module contains 62 or 70 cells on average, which would put around 8,400mg of silver in each.

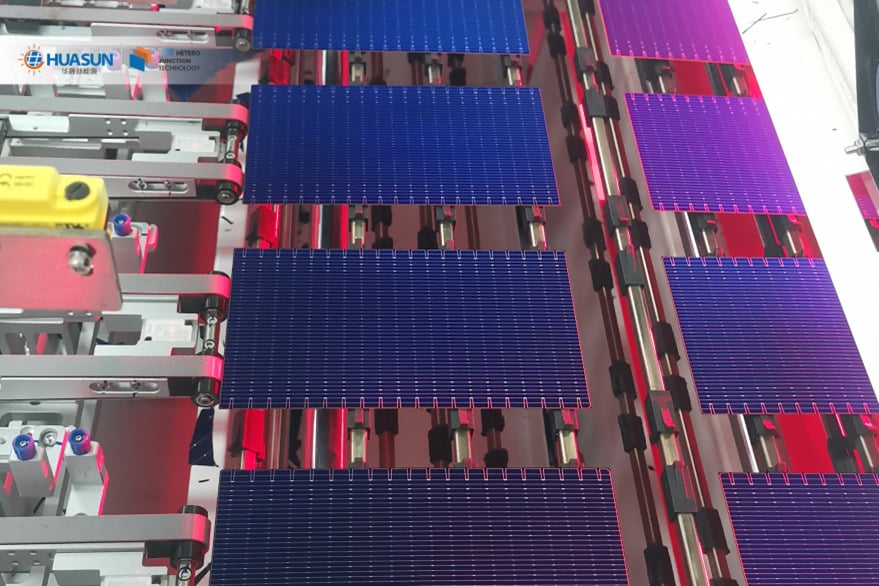

The ITRPV showed that heterojunction technology (HJT) cells and modules use even more silver than TOPCon, requiring 160mg per cell.

In comments to PV Tech Premium, Markus Fischer, vice president for R&D at Qcells and one of the writers of the ITRPV, says: “The need to reduce silver is extremely important. Especially as the switch to n-type technologies requires more silver per watt than the “old” PERC technology.

“TOPCon and HJT require silver on both sides, while PERC worked well with aluminium fingers on the rear side.”

Fischer says that the current price of silver is around US$1 per gram, which the ITRPV translated to around one US$ cent per watt for a solar cell. Simultaneously, the price of silver continues to fluctuate, and more and more solar supply is shifting towards more silver-intensive n-type production.

Silver reduction methods

The two-pronged attack of vastly growing solar capacity and the shift to n-type technologies has converged to make silver a real pressure point for future solar manufacturing.

The industry is aware of the problem silver poses, and innovations are emerging. German testing house Fraunhofer ISE announced a fine screen printing process last month designed to reduce the silver consumption for HJT cells. The researchers claimed that the “long-term cost-competitiveness” of mass-produced HJT cells – like those from Meyer Burger or REC in Europe – hinges on reducing silver use.

Thinner grid lines are one of the major methods of reducing silver in cell production. Shortly after Fraunhofer’s research, Korean-owned manufacturer Qcells announced a partnership with Lumet – an Israeli technology research firm – to reduce the silver in its predominantly TOPCon cell production. Lumet claims that its metallisation technology can produce grid fingers of “sub 10 microns” in width, which it said go beyond the “plateau” reached by screen printing technologies around 20 microns.

Fischer maintains that screen printing technologies – the most mature and proven method for metallisation – are capable of meeting the challenges of silver reduction. He says: “ITRPV contributors mainly see screen printing as still capable of meeting those challenges in mass production. New technologies have to compete with mature screen printing.”

Is copper an alternative?

The ITRPV looks into the alternatives to silver being pursued in parts of the industry. Chief among them is copper, which is less expensive and can be applied in plating techniques or in combination with silver.

Fischer tells PV Tech Premium that copper is more likely to be implemented in HJT cell production in the future than TOPCon.

He says: “As HJT requires lower-temperature technologies for cell contact formation and for interconnections, the introduction of copper is expected to be implemented there first.

“Copper for TOPCon in mass production appears to be much more challenging.”

The ITRPV forecasts that processes using copper in HJT cell production will gradually increase their market share from roughly 10% in 2024 to just over 50% in 2031. Simultaneously, it forecasts that HJT cells will increase their market share to around 20% by the same time, from around 5% in 2023. At the same time, ITRPV forecasts that TOPCon will take up over 50% of the market.